MAJOR DIVISIONS,DIVISIONS AND MAJOR GROUPS 1.1. List of

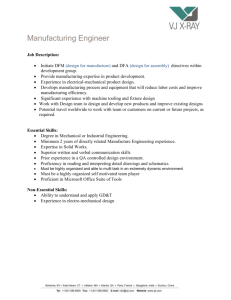

advertisement