Presentation Slides

advertisement

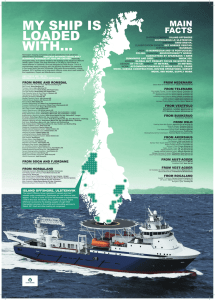

Disclaimer This presentation should be read in conjunction with Vard Holdings Limited’s results for the period ended 30 September 2014 in the SGXNet announcement. Financial figures are presented according to SFRS. This presentation may contain forward-looking statements that involve risks and uncertainties. Such forward-looking statements and financial information involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements and financial information. Such forward-looking statements and financial information are based on numerous assumptions regarding our present and future business strategies and the environment in which we will operate in the future. As these statements and financial information reflect our current views concerning future events, these statements and financial information necessarily involve risks, uncertainties and assumptions. Actual future performance could differ materially from these forward-looking statements and financial information. You are cautioned not to place undue reliance on these forward looking statements, which are based on the Company’s current view of future events. 29.11.2014 | Page 2 Vard Holdings Limited SIAS Corporate Profile & Investment Seminar – 29 November 2014 Holger Dilling – Executive Vice President, Investor Relations European network for Health Technology Assessment | JA2 2012-2015 | www.eunethta.eu About VARD VARD is one of the major global designers and shipbuilders of offshore and specialized vessels used in the offshore oil and gas exploration and production and oil services industries Headquartered in Ålesund, Norway Delivered more than 250 vessels since 2000 Listed on the Main Board of Singapore Exchange (SGX) in 2010 VARD’s majority shareholder is Italian shipbuilding group FINCANTIERI 11 631 employees worldwide 29.11.2014 | Page 4 Every 2nd week, a new VARD Vessel is delivered 10 shipyards located worldwide Four core market segments Vard 1-Series Platform Supply Vessels VARD 2-Series Anchor Handling Tug Supply Vessels VARD 3-Series Offshore Subsea Construction Vessels VARD 9-Series Other Specialized Vessels 29.11.2014 | Page 5 >100 vessels delivered during the last 5 years 51 Platform Supply Vessels 32 Anchor Handling Tug Supply Vessels 13 Offshore Subsea Construction Vessels 18 Other Specialized Vessels 29.11.2014 | Page 6 As of December 2013 2013 | Majority of shares acquired by FINCANTIERI of Italy; name changed to VARD 2012 | Established Seaonics (subsidiary for offshore handling equipment) 2011 | Commenced construction of second shipyard in Brazil, Vard Promar 2010 | Company listed in Singapore; name changed to STX OSV 2008 | Acquired by STX Group from Korea 2007 | Commenced construction of Vung Tau shipyard, Vietnam 2004 | Merged Brattvaag, Søviknes, Langsten and Aukra yards in Norway 2003 | Acquired Brevik (Norway) and Braila (Romania) yards 2001 | Acquired stake in Niterói shipyard, Brazil 2000 | Acquired Tulcea shipyard in Romania; established in-house design company 29.11.2014 | Page 7 STX Europe / STX OSV Acquired Vard Marine (design and engineering) in Canada and the US Aker / Aker Yards 2014 | VARD Historical highlights 11 631 employees worldwide 10 Shipyards worldwide Norway Vard Aukra Vard Brattvaag Vard Brevik Vard Langsten Vard Søviknes Brazil Vard Niterói Vard Promar Romania Vard Braila Vard Tulcea Vietnam Vard Vung Tau VARD is present in Norway, Romania, Vietnam, Brazil, Croatia, India, Poland, Canada, US and Singapore with various entities supporting the shipbuilding process. 29.11.2014 | Page 8 Norwegian Executive Management Team Roy Reite Jan Ivar Nielsen Stig Bjørkedal Excecutive Director and Chief Executive Officer Executive Vice President Chief Financial Officer Executive Vice President Business Development & Strategy 29.11.2014 | Page 9 Magne Bakke Magne Håberg Knut Ola Tverdal Holger Dilling Executive Vice President Chief Operating Officer Executive Vice President Sales & Marketing Executive Vice President Strategy Implementation Executive Vice President Investor Relations International Board of Directors Including two Singapore-based Independent Directors Giuseppe Bono Keen Whye Lee Pier Francesco Ragni Chairman of the Board and Non-Executive Director Independent Director Non-Executive Director Roy Reite Sung Hyon Sok Fabrizio Palermo Excecutive Director and Chief Executive Officer Independent Director Non-Executive Director 29.11.2014 | Page 10 Shareholding & corporate structure Vard RO Holding SRL (Romania) 55.63% Vard Marine Inc. (Canada) Vard Group AS (Norway) Vard Design AS (Norway) Vard Electro AS (Norway) 44.37% Other Shareholders (free float) 100% Fincantieri Oil & Gas S.p.A. Vard Holdings Limited (Singapore) 27.49% 1.5% Other Shareholders (free float) Vard Promar SA (Brazil) Vard Singapore Pte Ltd. (Singapore) 100% Fintecna S.p.A. 72.51% 50.5% 80.1% Cassa Depositi e Prestiti S.p.A. FINCANTIERI S.p.A. Treasury Shares Vard Piping AS (Norway) Milan listed Singapore listed 51% Vard Accommodation AS (Norway) Seaonics AS (Norway) Vard Brevik Holding AS (Norway) Note: Corporate structure simplified for illustration 29.11.2014 | Page 11 Vard Braila SA (Romania) Vard Niterói SA (Brazil) 100% Italian Bank Foundations 18.4% Ministry of the Economy and Finance of the Republic of Italy Vard Tulcea SA (Romania) Vard Vung Tau Ltd (Vietnam) About our largest shareholder, FINCANTIERI One of the world’s largest shipbuilding groups Over 200 years of maritime history Built more than 7,000 vessels A world leader in cruise ship construction, and a reference player in other sectors, such as naval vessels, mega yachts, offshore and marine systems Eight shipyards in Italy and three in the US Headquartered in Trieste, Italy Listed on the Borsa Italiana (Milan, Italy) 29.11.2014 | Page 12 Vard Holdings: Key investment highlights Leading market position in design and construction of high-end offshore support vessels Global manufacturing footprint Large portfolio of own designs, technologies and solutions Diversified international client base High order book visibility Positioned for growth through new shipyard development in Brazil Strong balance sheet Recognized commitment to corporate governance and transparency 29.11.2014 | Page 13 Leading market position in key high-end OSV markets, both geographically and by vessel type North Sea built OSCVs 15.2 % 22.9 % 10.6 % 42.9 % 51.5 % 9.1 % 18.6 % 7.6 % 7.1 % VARD Note: Kleven 6.1 % 8.6 % IHC Ulstein Other Based on number of vessels in the order book, as of 30 September 2014 OSCVs include ROVSV, DSV, LAYSV incl. DP Source: RS Platou 29.11.2014 | Page 14 VARD Eastern Shipuilding IHC Kleven Cosco Other High-end means… High specifications, sophisticated vessels suitable for deep water operations and harsh environments Complex project execution including integration of specialized top-side equipment Own design, R&D and innovation as key success factors Ability and willingness to adapt vessels to customer needs Track record of vessel delivery according to agreed quality, price and delivery date Highest standards for health, safety and the environment, and quality management (HSEQ) 29.11.2014 | Page 15 Examples Skandi Iceman | AHTS | VARD 2 12 Delivered October 2013 | Vard Søviknes, Norway Deep Explorer | Diving Support Vessel | VARD 3 06 Contracted January 2014 | Vard Langsten, Norway Normand tbn | OSCV | VARD 3 19 Contracted March 2014 | Vard Brattvaag, Norway REM tbn | AHTS | VARD 2 06 Contracted June 2014 | Vard Brattvaag, Norway 29.11.2014 | Page 16 Global manufacturing footprint Integrated value chain across countries and regions 29.11.2014 | Page 17 Ten shipyards in four countries Vard Aukra Vard Brattvaag Vard Brevik Vard Langsten Vard Søviknes Vard Braila Vard Tulcea Vard Vung Tau Vard Niterói Vard Promar 29.11.2014 | Page 18 Major investments in yard upgrades during the last 18 months (Example: Vard Tulcea, Romania) New blasting and painting facilities 29.11.2014 | Page 19 Robots in the production line New piping prefabrication facilities Large portfolio of own designs, technologies and solutions Main Switchboards Emergency Switchboards Propulsion Systems Converters El Motors Generators Integrated Automation System Transformers Power Management System Energy Management System Blackout Prevention System Bridge and ECR Consoles 29.11.2014 | Page 20 Cabin Concept Navigation Systems Bridge Alert Management System Manoeuvring Chairs Communication Systems Infotainment Module Handling & Well Intervention Systems Deck Cranes & AHC Subsea Construction Cranes Launch & Recovery Systems Active Heave Compensated Winches Deck Machinery Drilling and Tensioning systems Diversified international client base Bugsér & Berging 1 N.N. 1 Rem Offshore 1 Simon Møkster 1 Solstad 1 Transpetro 8 Harkand 1 Orange Marine 1 Bourbon 1 Technip 1 E.R. Offshore 2 Island Offshore 6 Mermaid Marine Australia 2 Nordic American Offshore 2 Tidewater 2 Farstad Shipping 2 Note: Based on 40 vessels in the order book as of 30 September 2014 Numbers indicate vessels on order per client 29.11.2014 | Page 21 DOF and Technip 4 DOF 3 High order book visibility due to strongest order book in over five years Order book (MNOK) Order intake (MNOK) 25000 25000 20000 20000 +50% 15000 15000 10000 10000 5000 5000 0 0 3Q 4Q 2010 29.11.2014 | Page 22 1Q 2Q 3Q 2011 4Q 1Q 2Q 3Q 2012 4Q 1Q 2Q 3Q 2013 4Q 1Q 2Q 2014 3Q Increased share of large, high-value OSCVs in the order book 60 Number of vessels in order book 50 40 OSCV 30 PSV 20 AHTS 10 Other 0 3Q 4Q 1Q 2Q 2010 3Q 4Q 1Q 2Q 2011 3Q 4Q 1Q 2Q 2012 3Q 4Q 1Q 2013 2Q 3Q 2014 OSCV 4 4 2 2 2 1 3 5 5 7 10 9 13 13 15 13 11 PSV 21 26 27 32 31 30 26 26 21 18 14 11 11 10 13 14 14 AHTS 15 12 10 11 9 7 8 9 8 8 7 6 6 5 5 4 4 Other 8 7 7 6 8 16 16 15 15 15 15 15 13 13 12 12 11 29.11.2014 | Page 23 Positioned for growth through new shipyard development in Brazil: Vard Promar Key milestones March 2011: Environmental license granted for new shipyard development November 2011: Start of yard construction; contracts for eight LPG carriers for Transpetro effective June 2013: Shipyard construction largely complete; operations start with first cutting of steel August 2014: Launch of first vessel November 2014: Ramp-up ongoing; four vessels currently under construction Mid-2015: Target production volume expected to be reached Current order book Eight LPG carriers for Transpetro (of which two outsourced and currently undergoing outfitting at Vard Niterói) Two Pipelayers (PLSVs) for JV of DOF and Technip 29.11.2014 | Page 24 Positioned for growth through new shipyard development in Brazil: Vard Promar November, 2011 29.11.2014 | Page 25 Greenfield development in less than 18 months March 2013 29.11.2014 | Page 26 First vessel launched at the new shiypard 14 months after start-up of operations 29.11.2014 | Page 27 Revenues stable; margins since 2Q 2013 impacted primarily by Brazil operations (MNOK) 4 000 30% 3 600 27% 3 200 24% 2 800 21% 2 400 18% 2 000 15% 1 600 12% 1 200 9% 800 6% 400 3% 0 0% 3Q -400 4Q 2010 29.11.2014 | Page 28 1Q 2Q 3Q 2011 4Q 1Q 2Q 3Q 2012 4Q 1Q 2Q 3Q 2013 4Q 1Q 2Q 2014 3Q -3% Revenue EBITDA % Strong balance sheet with low long-term loans and borrowings As at (NOK million) 30 September 2014 31 December 2013 Non-current assets 3 577 3 281 Current assets 9 920 10 390 Total assets 13 497 13 671 Total equity 3 714 3 708 Loans and borrowings and construction loans 4 982 5 012 Trade and other payables and construction work in progress 3 507 3 616 Other current liabilities 355 452 Long-term loans and borrowings 753 673 Other non-current liabilities 186 210 9 783 9 963 13 497 13 671 Total liabilities Total equity and liabilities 29.11.2014 | Page 29 Solid cash position Net Cash (NOK million)1 Construction Loans (NOK million) 1 000 6 000 5 000 767 800 668 4 707 4 745 31 Dec 2013 30 Sep 2014 4 000 600 3 000 400 2 000 200 1 000 0 0 31 Dec 2013 (1) Cash and cash equivalents less sum of short-term and long-term interest bearing liabilities, excluding construction financing 30 Sep 2014 Cash and Cash Equivalents (NOK million) 2 400 2 000 1 803 1 745 1 658 30 Sep 2013 31 Dec 2013 30 Sep 2014 1 600 1 200 800 400 0 29.11.2014 | Page 30 Restricted Cash Non-restricted Cash Outlook Softer industry outlook on the back of reduced oil price and more cautious investment climate Continued demand for certain vessel types, in particular in the subsea support and construction vessel market VARD well positioned with long and solid orderbook Ongoing contract negotiations for several projects, but below-average new order intake expected in the near to medium term Stable operations expected going forward in Europe, but strong focus on efficiency and change required to meet demands of a challenging market Vard Promar showing clear signs of operational improvement and better visibility Impact of legacy projects in Niterói and vessels outsourced from Promar gradually decreasing Positive EBITDA margin expected in Q4, and further improvements in 2015 29.11.2014 | Page 31 Recognized commitment to corporate governance and transparency 2011 Singapore Corporate Awards Best Annual Report Award (Gold) 1) Best Investor Relations Award (Merit) 1) 2014 Singapore Corporate Awards Best Annual Report Award (Silver Winner) 2) 2014 SIAS Investors’ Choice Awards Most Transparent Company Award (Runner Up) 3) 1) New listings category 2) $300 million to $1 billion category 3) Foreign listings category 29.11.2014 | Page 32 Our name is VARD™ Reflecting the company’s values, tradition, culture and maritime heritage The name is derived from the Norwegian word «varde» - a small tower made of stone These were the first navigation marks along the coast, and the first one was likely raised at the time of the Vikings Marking out the shipping lanes and guiding vessels in the right direction 29.11.2014 | Page 33 Q&A Q&A