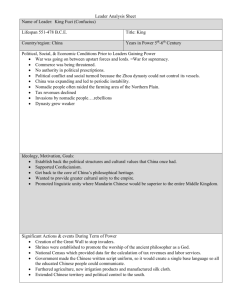

China #A1 Wanquanzhuang, Haidian Beijing 100089, China Tel: 86

advertisement