K Oil Fund : K-OIL

advertisement

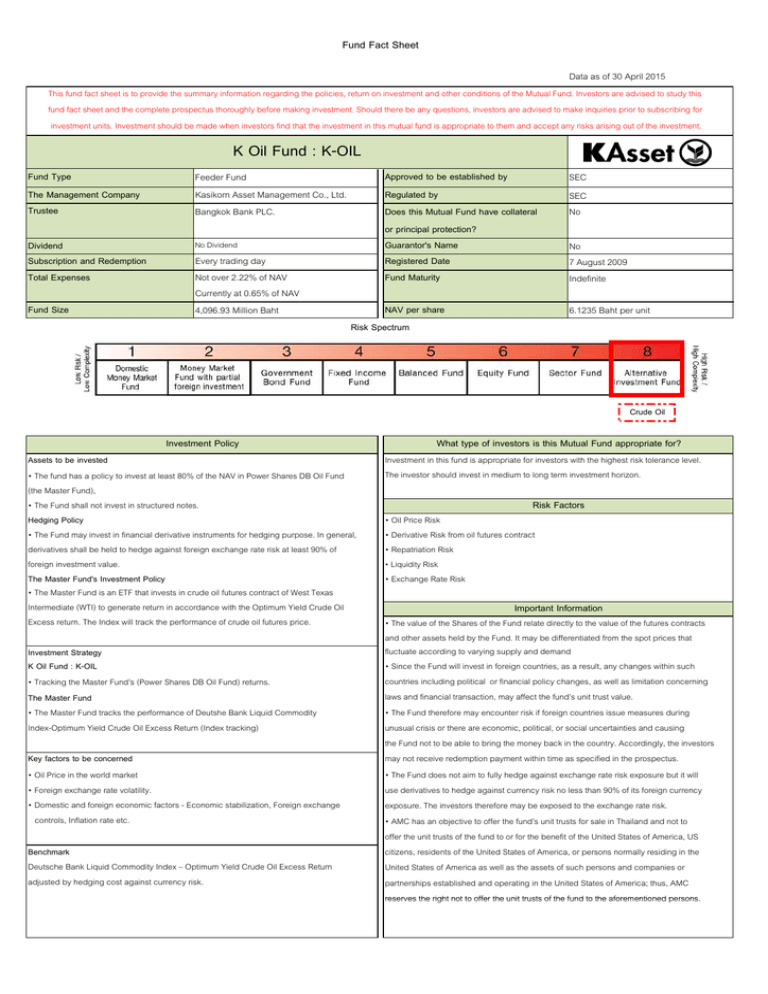

Fund Fact Sheet Data as of 30 April 2015 This fund fact sheet is to provide the summary information regarding the policies, return on investment and other conditions of the Mutual Fund. Investors are advised to study this fund fact sheet and the complete prospectus thoroughly before making investment. Should there be any questions, investors are advised to make inquiries prior to subscribing for investment units. Investment should be made when investors find that the investment in this mutual fund is appropriate to them and accept any risks arising out of the investment. K Oil Fund : K-OIL Fund Type The Management Company Trustee Feeder Fund Kasikorn Asset Management Co., Ltd. Bangkok Bank PLC. Dividend Subscription and Redemption Total Expenses No Dividend Fund Size Every trading day Not over 2.22% of NAV Currently at 0.65% of NAV 4,096.93 Million Baht Approved to be established by Regulated by Does this Mutual Fund have collateral or principal protection? Guarantor's Name Registered Date Fund Maturity NAV per share Risk Spectrum SEC SEC No No 7 August 2009 Indefinite 6.1235 Baht per unit Crude Oil Investment Policy Assets to be invested 4 The fund has a policy to invest at least 80% of the NAV in Power Shares DB Oil Fund (the Master Fund), 4 The Fund shall not invest in structured notes. Hedging Policy 4 The Fund may invest in financial derivative instruments for hedging purpose. In general, derivatives shall be held to hedge against foreign exchange rate risk at least 90% of foreign investment value. The Master Fund's Investment Policy 4 The Master Fund is an ETF that invests in crude oil futures contract of West Texas Intermediate (WTI) to generate return in accordance with the Optimum Yield Crude Oil Excess return. The Index will track the performance of crude oil futures price. Investment Strategy K Oil Fund : K-OIL 4 Tracking the Master Fund>s (Power Shares DB Oil Fund) returns. The Master Fund 4 The Master Fund tracks the performance of Deutshe Bank Liquid Commodity Index-Optimum Yield Crude Oil Excess Return (Index tracking) Key factors to be concerned 4 Oil Price in the world market 4 Foreign exchange rate volatility. 4 Domestic and foreign economic factors - Economic stabilization, Foreign exchange controls, Inflation rate etc. Benchmark Deutsche Bank Liquid Commodity Index B Optimum Yield Crude Oil Excess Return adjusted by hedging cost against currency risk. What type of investors is this Mutual Fund appropriate for? Investment in this fund is appropriate for investors with the highest risk tolerance level. The investor should invest in medium to long term investment horizon. Risk Factors 4 Oil Price Risk 4 Derivative Risk from oil futures contract 4 Repatriation Risk 4 Liquidity Risk 4 Exchange Rate Risk Important Information 4 The value of the Shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund. It may be differentiated from the spot prices that fluctuate according to varying supply and demand 4 Since the Fund will invest in foreign countries, as a result, any changes within such countries including political or financial policy changes, as well as limitation concerning laws and financial transaction, may affect the fund>s unit trust value. 4 The Fund therefore may encounter risk if foreign countries issue measures during unusual crisis or there are economic, political, or social uncertainties and causing the Fund not to be able to bring the money back in the country. Accordingly, the investors may not receive redemption payment within time as specified in the prospectus. 4 The Fund does not aim to fully hedge against exchange rate risk exposure but it will use derivatives to hedge against currency risk no less than 90% of its foreign currency exposure. The investors therefore may be exposed to the exchange rate risk. 4 AMC has an objective to offer the fund>s unit trusts for sale in Thailand and not to offer the unit trusts of the fund to or for the benefit of the United States of America, US citizens, residents of the United States of America, or persons normally residing in the United States of America as well as the assets of such persons and companies or partnerships established and operating in the United States of America; thus, AMC reserves the right not to offer the unit trusts of the fund to the aforementioned persons. Portfolio Breakdown Fund Performance (%) (1) Asset Allocation (% of NAV) Unit Trust : 95.35% Deposits,P/N,B/E,Debt Instrument Bank&Finance : 4.65% (2) Portfolio Holdings Currency Exposure USD THB 8.11% 91.89% 3 years 3 months 6 months 1 year Since As of 24 Apr 15 inception 69.53333333 Fund 15.54% -37.83% -47.30% -46.99% -39.63% Benchmark 15.50% -35.46% -45.43% -44.38% -36.78% 1 -0.15 -0.81 -0.51 -0.29 -0.05 Information Ratio Standard 39.52% 44.12% 32.81% 24.08% 24.86% Deviation 1 Information Ratio (IR) measures a portfolio manager's ability to generate excess returns relative to a benchmark. The fund performance document is prepared in accordance with AIMC standards. Calendar Year Performance (%) 20.00% Fund Benchmark 10.00% Note : Data as of 30 April 2015 0.00% Updated information is available on website www.kasikornasset.com. -10.00% Fees -20.00% = Fees charged to the Fund (% p.a. of NAV) Management fee Not over 1.50 Currently 0.50 Trustee fee Not over 0.07 Currently 0.04 Registrar fee Not over 0.15 Currently 0.05 1 Other expenses Not over Actual Currently 0.07 Total expenses Not over 2.22 Currently 0.65 1 Data from the latest accounting period. = Fees charged to Unitholders (% subscription / redemption price) price) Front-end fee Not over 1.50 Currently Exempted Back-end fee Not over 1.50 Currently Exempted Switching fee Either the redemption price of the switch-out fund or the subscription price of the switch-in fund. Brokerage fee Not over 0.75 Currently 0.08 (Being charged when the unitholder subscribe or redeem units) *Investors are advised to consider fees and expenses before making any investment decision since they affects the fund's performance. * All fees exclude VAT. -30.00% For more information 4 Kasikorn Asset Management Co.,Ltd. Address: KASIKORNBANK Building, 6th Floor, 400/22 Phahon Yothin Avenue, Phaya Thai, Bangkok 10400 Tel: 0 2673 3888 Fax: 0 2673 3988 Website : www.kasikornasset.com Email : ka.customer@kasikornasset.com 4 For more information about the Fund or request the fund prospectus, please contact the Management company or other selling agents. Other Information Investment Channels & Additional Services Kasikorn Bank Branches Electronic Channels K-Cyber Invest Other Services KAsset mutual Funds Internal Switching K-Saving Plan 2010 2011 2012 2013 2014 -40.00% -50.00% *Past performance is not indicative of future results.* Subscription / Redemption = Registered Fund Size 10,000 Million Baht = Subscription : Subscription Every trading day before 3.30 p.m. Initial subscription / Subsequent subscription 5,000 Baht K-Saving plan 500 Baht = Redemption : Redemptionv cut-off time Every trading day before 3.30 p.m. Minimum redemption 5,000 Baht Minimum balance 5,000 Baht Redemption settlement date : 4 business days after the redemption date (T+4, 10 a.m.) (Effective on 2 March 2015) (Deposited into KBank Account) 4 NAV is available on Website: www.kasikornasset.com or call 0 2673 3888 or Kbank branches or call 0 2888 8888. Power Shares DB Oil Fund Name: PowerShares DB Oil Fund Fund type: Exchange Trade Fund registered at New York Stock Exchange : NYSE Arca Date registered for trades in stock exchange: 5-Jan-07 Reference Index: Deutsche Bank Liquid Commodity Index B Optimum Yield Management Company: Crude Oil Excess Return DB Commodity Services, LLC 4 Investment in investment units is neither money deposit nor under the protection of Deposit Protection Agency. Investor may have investment risk of not receiving return of investment funds in full. 4 In the event of unusual circumstances, investors may not receive the redemption payment within the period of time as specified in the prospectus. 4 Fund Performance is not subject to financial status or performance of the Management Company or the appointed selling agents. The draft prospectus for offering of investment units of the Mutual Fund does not mean that the SEC has certified the correctness of the information in the prospectus or guaranteed the price or return of the offered investment units. As the person responsible for managing the Mutual Fund, The Management Company carefully reviewed the information in the summary prospectus as of 30 April 2015 and hereby certifies that the information is correct, not fault and does not mislead.