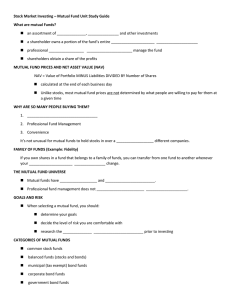

How to Read a Mutual Fund Prospectus

advertisement

How to Read a Mutual Fund Prospectus What is a Prospectus? A legal document required to be given to mutual fund investors Potential time and money saver Written in “legalese” A mutual fund screening tool A reference tool– Start a “fund file” Class Objective To review the important sections of a mutual fund prospectus To learn how to use the information in a prospectus to make fund decisions Name of the Mutual Fund Prospectus must be updated at least annually May be a “consolidated” prospectus for several funds from the same fund family – Example: Vanguard U.S. Stock Index Funds Required Cover Statements Standardized “CYA” language – Clearly states in bold print that there is no government approval of the fund – To state that there is approval is a crime Tells investor about the availability of – Statement of Additional Information (SAI) – Annual and semi-annual reports to shareholders Statement of Fund Investment Objective Varies with the type of mutual fund Almost 30 different objectives (ICI) Three PRIMARY Objectives: – Stability (preservation of principal) • Example: Money market mutual funds – Growth (increased value of principal over time) • Examples: Stock mutual funds, stock index funds – Income (generating a stream of payments) • Example: Bond mutual funds Example of a Mutual Fund Objective The fund invests with the objective of capital growth. Although income is considered in the selection of securities, the Fund is not designed for investors seeking primarily income rather than capital appreciation. Fees and Expenses Shareholder Fees – Charged to an individual investor’s account – Examples: sales load, redemption fee, account maintenance fee, exchange fee Annual Fund Operating Expenses – Paid by mutual fund as a % of assets – Examples: management fee, 12b-1 fee, other expenses Standardized hypothetical example – 1, 3, 5, and 10 years of fees on $10,000 Financial Highlights Table NAV, beginning of period NAV, end of period Net assets, end of period Ratio: total expenses & average net assets Number of outstanding shares Total return for period Turnover rate Investment Policies The “personality” of a fund – What it will do and won’t do – Securities purchased to meet fund objective – Investment quality of securities – Use of speculative practices (e.g., selling on margin, futures contracts, derivatives) – Limits on % of fund assets in one industry Investment Risks Describes principal risks associated with investing in a particular fund – Example: currency risk (global fund) Describes risks associated with a type of investment – Example: interest rate risk on bond funds Describes range of quality ratings allowed – Example: low rated bonds in junk bond funds Investment Advisor Information Name of advisor (e.g., The Vanguard Group) Beginning of operations (e.g., since 1975) Amount of assets under management (e.g., $592 billion in assets) Services provided by investment advisor compensation to investment advisor as a % of assets Special arrangements such as bonuses Fund Distributions and Taxes Frequency of fund distributions – Dividends – Capital gains Sale or exchange of shares is a “taxable event” Procedure for reinvesting distributions How to Purchase Shares Method(s) of Purchase – Online, by check, by exchange, through a broker/sales agent Price of Purchase – NAV or NAV plus a sales load – Price breaks for large purchases Minimum Purchase Amounts – Minimum initial deposit and later deposits – Minimums for IRAs and automatic purchase plans How to Redeem Shares Methods by which shares can be redeemed (e.g., check-writing, telephone request, written request, wire transfers) Description of redemption price – Example: “You redeem shares at the fund’s next-determined NAV after [company] receives your redemption request.” Process to exchange fund shares Profile Prospectuses Short and sweet – One double-sided page Key pieces of information only – Short paragraphs – Sometimes in “Q&A” format Should still request full prospectus Five Key Factors to Scrutinize Fund objective Fees and expenses (for type of fund) Historical performance Investment policies relative to personal risk tolerance Minimum initial and subsequent deposits Wall Street Journal “Screening Factors” Sector funds Load funds High-cost funds High minimum deposit funds Newcomers Poor performers (relative to indexes) Follow “The Rule of Three” Start a File For Every Fund That You Own Most recent prospectus Copy of original application form Annual account statements Periodic statements Articles about the fund, manager, etc