MSCI North America Index

MSCI NORTH AMERICA INDEX (USD)

The MSCI North America Index is designed to measure the performance of the large and mid cap segments of the US and Canada markets. With 713 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US and Canada.

CUMULATIVE INDEX PERFORMANCE - GROSS RETURNS

300

200

100

MSCI North America

MSCI World

MSCI ACWI IMI

(USD) (AUG 2001 – AUG 2016)

268.68

260.93

245.04

50

Aug 01 Nov 02 Feb 04 May 05 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16

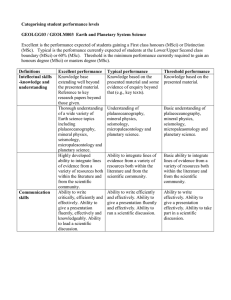

ANNUAL PERFORMANCE

(%)

Year

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

MSCI North

America

-0.27

12.57

30.39

15.57

0.55

15.98

29.35

-37.80

7.67

15.48

6.93

11.29

30.13

-22.34

MSCI World MSCI ACWI IMI

-0.32

5.50

27.37

16.54

-5.02

12.34

30.79

-40.33

9.57

20.65

10.02

15.25

33.76

-19.54

-1.68

4.36

24.17

17.04

-7.43

14.87

37.18

-42.01

11.66

21.49

12.06

16.93

36.18

-17.26

INDEX PERFORMANCE — GROSS RETURNS

(%) ( AUG 31, 2016 )

MSCI North America

MSCI World

MSCI ACWI IMI

1 Mo

0.16

0.13

0.38

3 Mo 1 Yr YTD 3 Yr

ANNUALIZED

5 Yr 10 Yr

4.22

11.78

8.28

11.34

13.40

7.28

3.27

7.32

5.45

7.99

10.14

5.13

4.18

7.97

6.66

7.39

9.03

5.21

Since

May 31, 1994

9.37

7.07

6.88

FUNDAMENTALS

( AUG 31, 2016 )

Div Yld (%)

2.13

2.56

2.48

P/E

23.13

21.30

21.21

P/E Fwd

17.31

16.24

16.00

P/BV

2.81

2.17

2.03

INDEX RISK AND RETURN CHARACTERISTICS

( AUG 31, 2016 )

MSCI North America

MSCI World

MSCI ACWI IMI

ANNUALIZED STD DEV (%) 2

Turnover

(%) 1

3 Yr

2.48

2.51

10.97

11.48

3.17

11.66

1

Last 12 months

5 Yr

11.94

12.74

10 Yr

15.54

16.54

3 Yr

1.02

0.71

13.21

17.23

0.65

2

Based on monthly gross returns data

SHARPE RATIO 2 , 3

5 Yr

1.10

0.81

0.70

10 Yr

Since

May 31, 1994

0.45

0.31

na na

0.31

0.32

3

Based on BBA LIBOR 1M

(%)

55.08

57.46

58.28

MAXIMUM DRAWDOWN

Period YYYY-MM-DD

2007-10-09—2009-03-09

2007-10-31—2009-03-09

2007-10-31—2009-03-09

The MSCI North America Index was launched on Mar 31, 1986. Data prior to the launch date is back-tested data (i.e. calculations of how the index might have performed over that time period had the index existed).

There are frequently material differences between back-tested performance and actual results. Past performance -- whether actual or back-tested -- is no indication or guarantee of future performance.

MSCI NORTH AMERICA INDEX

AUG 31, 2016

INDEX CHARACTERISTICS

Number of

Constituents

Index

Largest

Smallest

Average

Median

MSCI North America

713

Mkt Cap ( USD Millions)

20,979,628.71

588,280.26

1,236.24

29,424.44

12,782.01

TOP 10 CONSTITUENTS

APPLE

MICROSOFT CORP

EXXON MOBIL CORP

JOHNSON & JOHNSON

AMAZON.COM

GENERAL ELECTRIC CO

FACEBOOK A

AT&T

JPMORGAN CHASE & CO

WELLS FARGO & CO

Total

Mkt Cap

( USD Billions)

588.28

431.75

361.87

329.30

307.83

291.49

289.44

251.46

247.74

245.00

3,344.16

Index

Wt. (%)

2.80

2.06

1.72

1.57

1.47

1.39

1.38

1.20

1.18

1.17

15.94

SECTOR WEIGHTS

9.63%

12.65%

9.28%

7.61%

3.49%

3.13%

2.68%

13.87%

20.11%

17.55%

Information Technology 20.11%

Consumer Discretionary 12.65%

Energy 7.61% Materials 3.49%

Financials 17.55% Health Care 13.87%

Consumer Staples 9.63% Industrials 9.28%

Utilities 3.13% Telecommunication Services 2.68%

COUNTRY WEIGHTS

94.43%

United States 94.43% Canada 5.57%

Sector

Info Tech

Info Tech

Energy

Health Care

Cons Discr

Industrials

Info Tech

Telecom Srvcs

Financials

Financials

5.57%

INDEX METHODOLOGY

The index is based on the MSCI Global Investable Market Indexes (GIMI) Methodology —a comprehensive and consistent approach to index construction that allows for meaningful global views and cross regional comparisons across all market capitalization size, sector and style segments and combinations. This methodology aims to provide exhaustive coverage of the relevant investment opportunity set with a strong emphasis on index liquidity, investability and replicability. The index is reviewed quarterly—in February, May, August and November—with the objective of reflecting change in the underlying equity markets in a timely manner, while limiting undue index turnover. During the May and November semi-annual index reviews, the index is rebalanced and the large and mid capitalization cutoff points are recalculated.

ABOUT MSCI

For more than 40 years, MSCI' research-based indexes and analytics have helped the world' leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative research. Our line of products and services includes indexes, analytical models, data, real estate benchmarks and ESG research. MSCI serves 98 of the top 100 largest money managers, according to the most recent P&I ranking. For more information, visit us at www.msci.com

.

The information contained herein (the "Information") may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI. The Information may not be used to verify or correct other data, to create indexes, risk models, or analytics, or in connection with issuing, offering, sponsoring, managing or marketing any securities, portfolios, financial products or other investment vehicles.

Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the Information or MSCI index or other product or service constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy. Further, none of the Information or any MSCI index is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. The Information is provided "as is" and the user of the

Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF MSCI INC. OR ANY OF ITS SUBSIDIARIES OR ITS OR THEIR DIRECT OR INDIRECT SUPPLIERS OR

ANY THIRD PARTY INVOLVED IN THE MAKING OR COMPILING OF THE INFORMATION (EACH, AN "MSCI PARTY") MAKES ANY WARRANTIES OR REPRESENTATIONS AND, TO THE MAXIMUM EXTENT PERMITTED BY

LAW, EACH MSCI PARTY HEREBY EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES, INCLUDING WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. WITHOUT LIMITING ANY OF

THE FOREGOING AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, IN NO EVENT SHALL ANY OF THE MSCI PARTIES HAVE ANY LIABILITY REGARDING ANY OF THE INFORMATION FOR ANY DIRECT, INDIRECT,

SPECIAL, PUNITIVE, CONSEQUENTIAL (INCLUDING LOST PROFITS) OR ANY OTHER DAMAGES EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

© 2016 MSCI Inc. All rights reserved.

MSCI NORTH AMERICA INDEX