Opening the black box

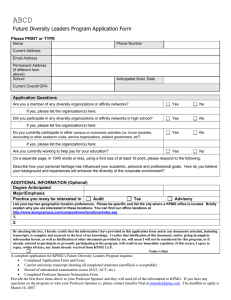

advertisement