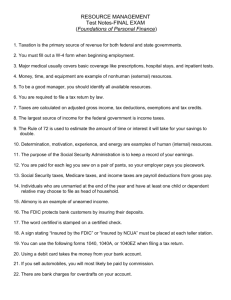

Blanket Physical Damage Coverage

advertisement

collateral protection Blanket Physical Damage Coverage Blanket Physical Damage Coverage is the easy, convenient way Loss scenarios to protect your loan portfolio and avoid the risk of unpredictable loan losses. The following are examples of typical loss scenarios where Blanket Physical Damage Coverage will safeguard your interest in collateral. If you’re subject to losses due to comprehensive or collision damage to property pledged as collateral on a loan, Blanket Physical Damage Coverage protects your interest in that collateral. What’s Covered This coverage protects your interest (not your borrower’s equity) in collateral that is repossessed, found to be damaged, and no valid/collectible physical damage insurance is in force at the time of damage. Blanket Physical Damage covers motorized vehicles and transportable trailers, such as autos, semi trucks, trailers, ATVs, snowmobiles, watercraft and their trailers, mobile homes, and farm vehicles and their trailing implements. Available Supporting Coverages* • Mechanic’s Lien • Repossession Fee & Disposal Expense • Storage Expense • Blanket Confiscation, Conversion & Embezzlement • Blanket Confiscation, Conversion & Secretion • Loss Settlement without Actual Cash Value • Non-Filing of Instruments • Repossessed Property *Subject to underwriting approval. • A borrower whose personal auto policy has recently expired is hit by another uninsured driver, and the car is a total loss. As a result, the borrower defaults on the loan. • You discover that a vehicle you’re trying to repossess from a borrower who never obtained physical damage insurance was actually stolen. collateral protection Benefits • No notices sent to borrowers • No force-placed insurance on members’ loans • No insurance tracking (appropriate risk management measures are recommended to control losses) • No individual certificate placement • Minimal investment in staff time and systems management Payment Options • Annual-Premium Option calculates premiums annually based on your loan portfolio. You pay either monthly or annually. • Single-Pay Option changes the rating basis to a rate per new loan. If your state allows, you may consider passing along the premium to the borrower or increasing the interest rate on the loan. If you desire to pass on the cost of the blanket single-pay premium to your borrower through insurance or application fees, etc., it is required that you consult with your legal counsel to ensure your state allows this practice as well as to get the proper disclosure language. Customized Coverage • Fully customizable to meet your needs • Hundreds of options let you tailor your program to your risk exposure • Many limits and deductibles to choose from • Risk management guidelines help you manage your premium cost. Frequently Asked Questions Q.What conditions must be met before a potential loss is covered under this policy? A.There must be comprehensive or collision damage to the vehicle with no valid or collectible insurance in force. The loan must be in default (no payment to principal for at least 90 days) and you must repossess the collateral. Q.Can I still file a claim if the collateral is damaged, but it has not been 90 days since the last principal payment? A.Yes. You may file a claim. We will set up the claim and start adjusting the loss. However, any claim payment due cannot be made until after 90 days with no payment to principal. For more information about Blanket Physical Damage Coverage, or to request additional information about our comprehensive suite of Collateral Protection products, contact your CUNA Mutual Group Sales Executive at 800.356.2644. CUNA Mutual Group is a leading provider of financial services to credit unions, their members, and valued customers worldwide. With more than 75 years of market commitment, CUNA Mutual Group’s vision is unwavering: to be a trusted business partner who delivers service excellence with customer-focused, best-in-class products and market-driven innovation. Visit www.cunamutual.com or call 800.356.2644 for more information. P.O. Box 391 5910 Mineral Point Road Madison, WI 53701-0391 800.356.2644 www.cunamutual.com CUMIS Insurance Society, Inc. underwrites all coverages and endorsements available through the Collateral Protection Blanket Physical Damage program. Product availability and features may vary by jurisdiction and are subject to actual policy language. CP-1111-A129 ©CUNA Mutual Group