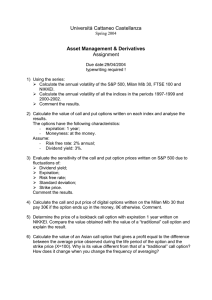

Nikkei S FactShe tock Ave eet rage Divi dend Po int Index

advertisement

Nikkei Stock Average Dividend Po int Index FactShe eet d Point Indeex is an indeex that accumulates diviidends receiv ved from thee The Nikkei Stock Average Dividend when investoors are suppossed to hold thhe constituen nts of the Nik kkei Stock Av Average (Nikk kei 225) on a companies w calendar yeaar basis, i.e. January to December D in a year. The index is calcculated by sub ubstituting thee each actuall dividend perr share into thhe formula of o the Nikkei 225 every tim me the each dividend d valuue is fixed. Itts final indexx value of the year is publiished at the beginning b of April in the subsequent year y after the all dividend payments off N Stockk Average Diividend Pointt the constitueents are fixedd. The index is expressedd with a year such as the Nikkei Index (2011) since the inndex is calculaated by accum mulating the dividends d eveery calendar yyear basis. ■(Dividend ds to cover) Gross cash dividends whose w ex-div vidend dates are between n January 1 and Decembber 31, inclu uding speciall dividends annd commemoorative dividends ■(Calculattion method)) The index iss calculated by b substitutin ng the receiveed dividends of the consttituents into tthe formula of o the Nikkeii 225. After aadjusting the each dividend by the prresumed par value, the ad djusted valuee shall be divided by thee divisor on iits ex-dividend date and accumulatedd. The index x value is ex xpressed with th two decim mal places inn Japanese yenn. ■(Timing tto include) Dividend paaid corresponnding to the annual a accouunting period shall be included on thee next dates of o the annuall regular sharreholder meeetings. Dividends paid onn the other dates d shall be b included oon the next dates of thee publication bby the compaanies ■(Base da ate etc) The commenncement datee of the calcullation was Appril 9th 2010,, which had been b retroactivvely calculated in the pastt to 1998. Thee index is calcculated and published p on tthe end-of-daay basis at aro ound 3pm on every busineess date. ■Graph (A Apr/1/2016) 350 300 250 200 150 100 50 0 2011/1 2012/1 2013/1 2014 4/1 2015/1 2016/1 ■Performa ance (Apr/1/22016) 20011 95.31 201 12 101.6 67 20133 103.900 2014 120.32 2015 148.53 104.59 179.41 192.03 123.2 23 193.1 17 207.9 92 117.411 208.811 226.733 135.04 240.53 265.12 168.16 299.42 326.72 June September December Final Value FS-DP0-E--20160401 Ranking of Final F Value No.1 No.2 No.3 2015 2014 2013 326.72 265.12 226.73 *Comparisonn of values startin ng in 1998 [1/2]] ■Ranking of contribution to Nikkei Stock Average Dividend Point Index (2015) 326.72 Rank Company 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Weight Dividend ParValue Nikkei Industry Contribution (%) (yen) (yen) Classification Technology Electric Machinery 30.38 9.30 773.79 50 Technology Communications 15.31 4.69 65 25/3 Consumer Goods Retail 13.74 4.21 350 50 Technology Automobiles & Auto parts 8.83 2.70 225 50 Technology Electric Machinery 8.83 2.70 150 100/3 Technology Electric Machinery 8.64 2.64 110 25 Technology Electric Machinery 7.58 2.32 193 50 Technology Pharmaceuticals 7.07 2.16 180 50 Technology Automobiles & Auto parts 6.91 2.11 88 25 Technology Pharmaceuticals 6.28 1.92 32 10 Technology Pharmaceuticals 5.89 1.80 150 50 Materials Chemicals 5.30 1.62 135 50 Consumer Goods Services 5.10 1.56 130 50 Materials Rubber 5.10 1.56 130 50 Technology Electric Machinery 4.83 1.48 123 50 Technology Communications 4.71 1.44 40 50/3 Consumer Goods Foods 4.63 1.42 118 50 Capital Goods/Others Machinery 4.51 1.38 115 50 Technology Electric Machinery 4.32 1.32 110 50 Consumer Goods Services 4.32 1.32 110 50 Code Sector Fanuc KDDI Fast Retailing Toyota Motor Canon Kyocera Tokyo Electron Takeda Pharmaceutical Honda Motor Astellas Pharma Eisai Nitto Denko Secom Bridgestone Denso Softbank Japan Tobacco Daikin Industries TDK Dentsu 6954 9433 9983 7203 7751 6971 8035 4502 7267 4503 4523 6988 9735 5108 6902 9984 2914 6367 6762 4324 ■Sector Weight, Industry Classification Weight (2015) Weight Top 10 Nikkei Industry Classification by weight Technology 49.19% Financials 4.51% Electric Machinery 23.83% Pharmaceuticals 8.61% Automobiles & Auto parts 7.74% Chemicals 7.40% Communications 7.18% Consumer Goods 15.56% Retail 6.43% Materials 18.16% Machinery 5.65% Services 4.63% Foods 4.40% Capital Goods/Others Transportation and Utilities 10.50% 2.08% Trading Companies The Others 3.61% 20.51% ■Vendor Code QUICK Bloomberg THOMSON REUTERS S225DIV.yy/NKNJ NKYDIV .N225D ■Reference Please refer to the "Index Guidebook" for the detail of the calculation method or constituents selection rules. →(URL) http://indexes.nikkei.co.jp/ <<Disclaimer>> The Nikkei Stock Average Dividend Point Index, which is calculated by a method independently developed by Nikkei Inc. (hereinafter "Nikkei"), is a copyrightable work. Nikkei owns the copyright and any other intellectual property rights in the Nikkei Stock Average Dividend Point Index itself, and the method for calculating the Nikkei Stock Average Dividend Point Index and the like. All ownership of trademarks and any other intellectual property rights with respect to marks representing "Nikkei Inc.," "Nikkei," and "Nikkei Stock Average Dividend Point Index" belongs to Nikkei. Nikkei is not obliged to continuously publish the Nikkei Stock Average Dividend Point Index, nor is it liable for any error or delay in, or discontinuation of the publication thereof. Nikkei owns the right to change the content of the Nikkei Stock Average Dividend Point Index, such as the calculation method thereof, and the right to suspend the publication thereof. Nikkei does not give any warranty, nor is it responsible for any and all financial instruments and the like, which are based on, or otherwise refer to, the Nikkei Stock Average Dividend Point Index. <<Regarding this material>> This material is a copyrightable work of Nikkei. It is prohibited to copy, reproduce, reprint, or circulate all or part of this material in any form without Nikkei's permission. This material was prepared for in-depth understanding of the Nikkei Stock Average Dividend Point Index, but is not for the purpose of soliciting any sale or purchase of financial instruments and the like, which are based on, or otherwise refer to, the Nikkei Stock Average Dividend Point Index. This material was prepared based on various types of information and data, which were deemed reliable as of the time of the preparation of this material. However, Nikkei is not liable for its accuracy, appropriateness, completeness, and the like. In addition, Nikkei assumes no liability for any costs or damages accrued from using information contained in this material. It is not guaranteed that this material will always be kept updated, and this material may change without any prior notice. Methods or the like different from this material may apply to the operation of indices subject to this material. In any event, the latest information disclosed by Nikkei prevails. FS-DP0-E-20160401 <<Contact>> Nikkei Inc. Index Business Office Tel: +813-6256-7341 index@nex.nikkei.co.jp [2/2]