PRINCIPAL PROTECTED NOTES Ping Hu Matt Neeve Olena Olenchuk

advertisement

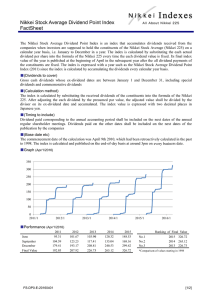

PRINCIPAL PROTECTED NOTES Ping Hu Matt Neeve Olena Olenchuk Principal Protected Notes - what are they? • An investment that guarantees a percentage of the principle at maturity i.e. the minimum return will equal the initial investment • Payoff at maturity - no coupons, principal + appreciation Principal Protected Notes - what are they? • • • • • • • • Principal protection High growth potential Enhanced income potential Weekly liquidity The opportunity to invest in a broad range of investments Potential for leveraged returns Capital protection regardless of what happens in the markets Maturity 6-8 years Principal Protected Notes - what are they? Benefits to the Issuer: • Liquidity • Financial leverage • “Callability” strategy – reduced debt when needed Global Equity Index Linked Note • Issued by the Business Development Bank of Canada • Variable interest promissory • Equally weighted in three indexes: S&P 500 Dow Jones ERUO STOXX 50 Nikkei 225 Global Equity Index Linked Note • Dec 2000 issues – minimum issue of 10 million dollars with a 7- year maturity. • Each note is valued at 10 dollars (at the time of issue) Risks: • Market Risk • Inflation Risk Global Blue-Chip Rainbow Deposit Notes, Series 1 • A portfolio of 5 Baskets of shares • Each Basket consists of 3 shares, equally-weighted within the Basket. • Note term is 7 years Global Blue-Chip Rainbow Deposit Notes, Series 1 • The return is linked to the performance of the portfolio • Amounts payable at the maturity consist of 1. The principal amount - $100/note regardless of the portfolio performance 2. Variable interest – 100 * portfolio return • The Deposit Notes will not be listed on any exchange • Tax consideration Global Blue-Chip Rainbow Deposit Notes, Series 1 Nikkei 225 Index Note, Series 1 • • • • • • • Linked to Nikkei 255 Index – Tokyo Stock Exchange, Japan Note term - 7 years $100 denominated Minimum subscription - 50 Not listed - trade on secondary markets Callable if Index Return equals or exceeds applicable Call Trigger Call feature – risk • 2006 – 2007 Index Return 3.06% Nikkei 225 Index Note, Series 1 Nikkei 225 Index Note, Series 1 Index Performance Nikkei 225 Index Note, Series 1 Nikkei 225 vs. S&P 500, Dow and NASDAQ Principal Protected Notes Risks: • • • • • • • • • Suitability of Deposit Notes for Investment Non-Conventional Investment No Interest May Be Payable No Ownership of, or Recourse to, Shares Equity Risk Secondary Market Market Disruption or Extraordinary Event Special Circumstances – Market disruption Economic and Regulatory Issues PPNs - Who would use them? • Risk adverse investors that want to protect their investment, but still capitalize on positive changes in the market. • Investors that are confident in the market, but still believe that there is speculation Questions?