Protected Equity Notes

advertisement

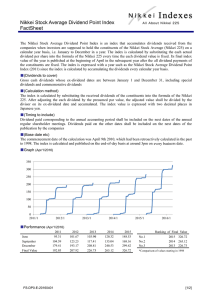

Protected Equity Notes Suppose you are an analyst working for the Sacramento County Public Employees’ Pension Fund (SCPEP). The fund has $10 million invested in a Japanese stock market index mutual fund. Currently the dividend yield on the stocks in the Japanese index is 0.5% annually. SCPEP has been approached by Bankers Trust with an offer to arrange a bond issue with principal of $5 million, a 1% annual coupon, and a maturity payment at the end of five years that will be determined by the appreciation in the Nikkei Dow Index of 225 Japanese stocks. The formula for calculating the maturity payment is as follows: Maturity payment = Principal * (IT/I0 ) if the index increases, with guaranteed return of principal if the index declines. • IT = the Nikkei index at maturity and • I0 = the Nikkei index at origination The bond will be issued by Private Export Funding Corporation, whose debt is guaranteed by the Import/Export Bank of the United States. PEFCO has AAA bond rating, and would arrange a swap through Bankers Trust that would allow it to pay a fixed annual interest rate over the five-year period and receive a variable amount equal to the notional principal times (IT/I0 – 1). Thus there is virtually no risk of default. So, it appears that this so-called “Protected Equity Note” (PEN for short) is a better investment than the Japanese index mutual fund. Your boss wants you to analyze this PEN and report back with a recommendation and an explanation of how it works. Prof. Kensinger Practice Problem