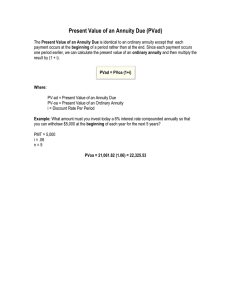

TIME VALUE OF MONEY The chief value of money lies in the fact that one lives in a world in which it is overestimated. —H. L. MENCKEN OUTLINE/ CONTENTS ⚫ The Interest Rate ⚫ Simple Interest ⚫ Compound Interest ⚫ ⚫ ⚫ ⚫ Compounding More Than Once per Year ⚫ ⚫ ⚫ ⚫ Single amount Annuities Mixed cash flows Semiannual or other compounding periods Effective annual interest rate Continuous compounding Amortizing a Loan Time value of money ⚫ Basic Problem: ⚫ How to determine value today of cash flows that are expected in the future? ⚫ Time value of money refers to the fact that a dollar in ⚫ ⚫ ⚫ ⚫ hand today is worth more than a dollar promised at some time in the future Which would you rather have -- $1,000 today or $1,000 in 5 years? Obviously, $1,000 today. Money received sooner rather than later allows one to use the funds for investment or consumption purposes. This concept is referred to as the TIME VALUE OF MONEY!! TIME allows one the opportunity to postpone consumption and earn INTEREST. Types of Interest ⚫ Money paid (earned) for the use of money is called ❖ interest Simple Interest ⚫ Interest paid (earned) on only the original amount, or principal, borrowed (lent). ❖ Compound Interest Interest paid (earned) on any previous interest earned, as well as on the principal borrowed (lent). SIMPLE INTEREST SI = P0(i)(n) SI: Simple Interest P0: Deposit today (t=0) i: Interest Rate per Period n: Number of Time Periods ⚫ Future value of Simple Interest is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate. FV = P0 + SI FV = P0 (1+in) COMPOUND INTEREST - single amount ⚫ The amount calculated on the compounded value is called Compound Interest ⚫ Future value refers to the amount of money an investment will grow to over some length of time at some given interest rate ⚫ To determine the future value of a single cash flows, we need: ⚫ present value of the cash flow (PV) ⚫ interest rate (i), and ⚫ time period (n) FVn = P0 (FVIFi,n) or FVn = P0 (1+i)n Example Julie Miller wants to know how large her deposit of $10,000 today will become at a compound annual interest rate of 10% for 5 years. 0 1 2 3 4 5 10% $10,000 FV5 Problem Solution ● Calculation based on general formula: FVn = P0 (1+i)n $10,000 (1+ 0.10) 5 FV5 = = $16,105.10 ⚫ Calculation based on Table I: ⚫ FV5 = $10,000 (FVIF10%, 5) (1.611) = $16,110 (from book) = $10,000 [Due to Rounding] Present Value Single Deposit (Graphic) Assume that you need $1,000 in 2 years. Let’s examine the process to determine how much you need to deposit today at a discount rate of 7% compounded annually. 0 1 2 7% $1,000 PV0 PV1 Present Value Single Deposit (Formula) PV0 = FV2 / (1+i)2 = $1,000 / (1.07)2 = FV2 / (1+i)2 \ = $873.44 0 1 2 7% $1,000 PV0 COMPOUND INTEREST - Annuities ⚫ A series of level/even/equal sized cash flows that occurs for a fixed time period Examples of Annuities: ⚫ Car Loans ⚫ House Mortgages ⚫ Insurance Policies ⚫ Some Lotteries ⚫ Ordinary Annuity: Payments or receipts occur at the end of each period. ⚫ Annuity Due: Payments or receipts occur at the beginning of each period Parts of an Annuity (Ordinary Annuity) End of Period 1 0 Today End of Period 2 End of Period 3 1 2 3 $100 $100 $100 Equal Cash Flows Each 1 Period Apart Parts of an Annuity (Annuity Due) Beginning of Period 1 Beginning of Period 2 0 1 2 $100 $100 $100 Today Beginning of Period 3 3 Equal Cash Flows Each 1 Period Apart Example of an Ordinary Annuity -- FVA Cash flows occur at the end of the period 0 1 2 3 4 7% $1,000 $1,000 $1,000 $1,070 $1,145 FVA3 = $1,000(1.07)2 + $1,000(1.07)1 + $1,000(1.07)0 = $1,145 + $1,070 + $1,000 = $3,215 $3,215 = FVA3 Future value of an ordinary annuity ⚫ FVAn = R (FVIFAi%,n) ⚫ FVAn = R [(1+i)n-1/i ] ⚫ FVA3 = $1,000 (FVIFA7%,3) $1,000 (3.215) = $3,215 = Example of an Annuity Due -- FVAD Cash flows occur at the beginning of the period 0 1 2 3 4 $1,000 $1,070 7% $1,000 $1,000 $1,145 $1,225 FVAD3 = $1,000(1.07)3 + $1,000(1.07)2 + $1,000(1.07)1 = $1,225 + $1,145 + $1,070 = $3,440 $3,440 = FVAD3 Annuity formula ⚫ FVADn = R (FVIFAi%,n)(1+i) ⚫ FVADn = R [(1+i)n-1/i ] (1+i) ⚫ FVAD3 = $1,000 (FVIFA7%,3)(1.07) = $1,000 (3.215)(1.07) = $3,440 Example of an Ordinary Annuity -- PVA Cash flows occur at the end of the period 0 1 2 3 4 7% $1,000 $1,000 $1,000 $934.58 $873.44 $816.30 $2,624.32 = PVA3 PVA3 = $1,000/(1.07)1 + $1,000/(1.07)2 + $1,000/(1.07)3 = $934.58 + $873.44 + $816.30 = $2,624.32 ORDINARY ANNUITY FORMULA ⚫ PVAn = R (PVIFAi%,n) ⚫ PVAn = R [1-[1/(1+i)n]/i] ⚫ PVA3 = $1,000 (PVIFA7%,3) = $1,000 (2.624) = $2,624 Example of an Annuity Due -- PVAD Cash flows occur at the beginning of the period 0 1 2 3 7% $1,000.00 $ 934.58 $ 873.44 $1,000 $1,000 $2,808.02 = PVADn PVADn = $1,000/(1.07)0 + $1,000/(1.07)1 + $1,000/(1.07)2 = $2,808.02 4 Annuity Due formula ⚫ PVADn = R (PVIFAi%,n)(1+i) ⚫ PVAD = R [1-[1/(1+i)n]/i] (1+i) ⚫ PVAD3 = $1,000 (PVIFA7%,3)(1.07) = $1,000 (2.624)(1.07) = $2,808 NUMERICALS ⚫ SELF CORRECTION 1 ⚫ SELF CORRECTION 2 ⚫ SELF CORRECTION 4 ⚫ PROBLEM 1 (PART a, b, c) ⚫ PROBLEM 2 ( part a, b, c, d) ⚫ PROBLEM 3 ⚫ PROBLEM 4 ⚫ PROBLEM 5 ⚫ PROBLEM 6