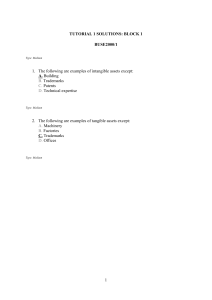

TUTORIAL 1: BLOCK 1 BUSE2000/1 1. The following are examples of intangible assets except: A. B. C. D. Building Trademarks Patents Technical expertise 2. The following are examples of tangible assets except: A. B. C. D. Machinery Factories Trademarks Offices 1 3. A firm's investment decision is also called the: A. B. C. D. Financing decision Liquidity decision Capital budgeting decision None of the above 4. The following are examples of financial assets except: A. B. C. D. Common stock Bank loan Preferred stock Buildings 2 5. Conflicts of interest between shareholders and managers of a firm result in: A. B. C. D. Principal-agent problem Increased agency costs Both A and B Managers owning the firm 6. The financial goal of a corporation is to: A. B. C. D. Maximize profits Maximize sales Maximize the value of the firm for the shareholders Maximize managers' benefits 3 7. The purchase of real assets is also referred to as the: A. B. C. D. Capital decision CFO decision Financing decision Investment decision 8. The following are some of the actions shareholders can take if the corporation is not performing well: A. B. C. D. Replace the board of directors in an election. Force the board of directors to change the management team. Sell their shares of stock in the corporation. Any of the above 9. If the five-year present value annuity factor is 3.60478 and four-year present value annuity factor is 3.03735, what is the present value at the $1 received at the end of five years? A. B. C. D. $0.63552 $1.76233 $0.56743 None of the above 10. What is the present value annuity factor at a discount rate of 11% for 8 years? A. 5.7122 B. 11.8594 C. 5.1461 D. None of the above 11. What is the present value of $1000 per year annuity for five years at an interest rate of 12%? A. B. C. D. $6,352.85 $3,604.78 $567.43 None of the above 12. For $10,000 you can purchase a 5-year annuity that will pay $2504.57 per year for five years. The payments are made at the end of each year. Calculate the effective annual interest rate implied by this arrangement: (approximately) A. B. C. D. 8% 9% 10% None of the above 4