E-Business Technology Adoption B2B and e-Procurement in Canada

advertisement

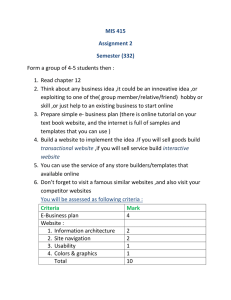

E-Business Technology Adoption Assessing B2B and e-Procurement in Canada Sandra Charles Raymond Lepage Presentation for the OECD Electronic Commerce Business Impacts Project (EBIP) Workshop October 29-30, 2001 Rome, Italy Industry Canada Industrie Canada E-Business Technology Adoption Assessing B2B and e-Procurement in Canada Outline 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Industry Canada Industrie Canada "SMEs are connected, but not yet leveraging Internet technology fully for real productivity improvement...” (Canadian E-Business Opportunities Roundtable) E-Business Adoption in Canada 2000 E-Business adoption is concentrated heavily in urban Canada, larger provinces and larger companies Canadian SMEs continue to fall behind their U.S. counterparts when it comes to embracing sophisticated e-business applications 60 Percentage of firms (%) Slow pace of e-commerce development, particularly the uneven pattern of growth regionally and within Canadian industry threatens to lead to digital divide 70 Internet Use Website Use E-procurement EDI Internet Sales 50 40 30 20 sad Canadian organizations will be under increasing pressure to convert at significant cost 10 0 Source: Survey on Electronic Commerce and Technology, Statistics Canada 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Industry Canada Industrie Canada Anecdotal and statistical evidence in e-business transformation are crucial to the development of appropriate policies Anecdotal evidence Case studies • OECD Case Studies (6 sectors) • Other Sectoral Case Studies (Academics) Statistical evidence Survey on Electronic Commerce and Technology 2000 (SECT) • Data on business transformation/Supply chain transformation – Business-to-Business sales – Purchasing online – Purpose for using the Internet Canadian Leaders Surveys • Data on e-procurement/Attitudes toward e-procurement – Drivers and barriers – Proportion of total purchasing Private sector’s surveys and reports Industry Canada Industrie Canada 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Fact #1 - Only 18% of Canadian firms are purchasing online Business-to-business transactions were the fastest growing segment of e-commerce in 2000. They accounted for 80% of total Internet sales or $5.8 billion; E-Procurement Adoption By Canadian Sectors 2000 18% Information & Cultural Industries 52.69 Educational Services 41.04 Professional Services Canada’s private sector is using ebusiness technology: 42% to access database of suppliers 32% to share or perform collaborative research 23% for training and education purposes 15% to access customer databases 35.8 Utilities 25.51 Wholesale 22.93 Manufacturing 21.3 Mining 20.41 Finance & Assurance 20.21 Entertainment 15.87 Transportation & Wharehousing 15.01 Health Care Almost half of Canadian public organizations are purchasing online (49.1%) 14.39 Retail 13.46 Accommodation & Foods Services 10.13 0 10 20 30 40 50 Percentage of firms (%) Online purchasing remains low in Canada Source: Survey on Electronic Commerce and Technology, Statistics Canada 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Industry Canada Industrie Canada 60 Fact #2 - Small firms are slow to adopt e-procurement technologies E-Procurement Adoption By Size of Firms 2000 More than half of Canada’s largest firms have implemented some e-procurement processes in their commercial activities. Leading sectors include : 18% Accommodation and Food Services (95%) Information and Cultural Industries (81%) 500 + FTE Transport and Warehousing (81%) 300-499 FTE Among the smaller firms, the percentage of firms purchasing online varies significantly between sectors. Leading sectors in 1-19 FTE category 100-299 FTE 50-99 FTE Information and Cultural Industries (55%) Educational Services (45%) Professional, Scientific and Technical Services (36%) 20-49 FTE 1-19 FTE 0 Most private sector Internet B2B transactions and online purchasing are conducted by large enterprises Industry Canada Industrie Canada 10 20 30 40 50 60 Percentage of firms (%) Source: Survey on Electronic Commerce and Technology, Statistics Canada 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Fact #3 - E-procurement is on the radar screen but fails to be implemented Top Leading Canadian CEOs Canadian Leader Survey on E-Procurement 53% will procure online in the next two years while only 6 percent said that they had no plans to procure online 42% said that online procurement was among top 7-10 strategic issues while 22% said that online procurement was not a strategic issue for their business Other Canadian CEOs 58% have an e-business strategy 67% of them have an e-procurement strategy 37% procure online, 34% will procure online in the next two year while 18% have no plans to procure online 84% of surveyed organizations have an ebusiness strategy 90% of them have an eprocurement strategy 38% of them procure online 47% said that e-procurement was not a strategic issue for their organizations There is a significant discrepancy between firms that have an eprocurement strategy and firms that are actually implementing it Industry Canada Industrie Canada Source: Industry Canada based on Canadian Leader Surveys 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research What have we learned from the surveys and EBIP case studies? Fact #1 - Online purchasing remains low in Canada Policy considerations Awareness Drivers of e-procurement Lack of skilled workers Availability of skilled workers Training opportunities Security and privacy considerations Others Jurisdiction Lack of Technology standards Local and sectoral constraints Industry Canada Industrie Canada Learning from EBIP Case Studies • Privacy issues e.g. General Merchandising and Pharmaceutical Retailing, Intelligent Manufacturing Technology • Skills e.g Consulting Engineering, ICT, Intelligent Manufacturing Technology, Plastic Industry • Jurisdiction e.g Consulting Engineering • Awareness/Standards e.g. ICT 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research What have we learned from the surveys and EBIP case studies? Fact #2 - Most private sector Internet B2B transactions and online purchasing are conducted by large enterprises Policy considerations Learning from EBIP Case Studies • Awareness e.g. ICT Awareness Drivers of e-procurement • Market structure Choice of technology e.g Retail Travel Service, General Merchandising and Pharmaceutical Retailing, Intelligent Manufacturing Technology Costs Financial cost/investment Time Market structure Vertical integration 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Industry Canada Industrie Canada What have we learned from the surveys and EBIP case studies? Fact #3 - There is a discrepancy between firms that have an e-procurement strategy and firms that actually purchase online Policy considerations Costs Transition from proprietary EDI to Internet-based EDI Industrial structure Learning from EBIP Case Studies • Privacy issues e.g. General Merchandising and Pharmaceutical Retailing, Intelligent Manufacturing Technology • Skills e.g Consulting Engineering, ICT, Intelligent Manufacturing Technology, Plastic Industry Lack of national and international standards Use of multiple technologies Infrastructure Intellectual properties Internal culture is slow to adapt to new technologies Reluctance from management Lack of skills Industry Canada Industrie Canada • Standards e.g. ICT Costs e.g. General Merchandising and Pharmaceutical Retailing, Consulting engineering, Retail Travel Services, ICT, Intelligent Manufacturing Technology, Plastic 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Statistical issues related to B2B activities in Canada Statistical Gap Drivers of e-business adoption Survey on 1. ROI Electronic Commerce 2. Government role as a model user and Technology 2001 Canadian SMEs New Questionnaire 1. micro enterprises I.e. 1-9 employees New category of size of firms Regional distribution of e-business adoption 1. Local environment Sectoral intelligence 1. Detailed sectoral intelligence New question of perceived benefits of e-business New questions on application of ICT Linking of databases 1. Establishments vs enterprises 2. Research Industry Canada Industrie Canada 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Emerging issues related to B2B activities in Canada S-Curve Research Gap Level of Electronic Commerce Activity E-business in value chains E-business and inter-industrial trade Impact Intensity E-marketplace Readiness E-business and innovation E-business and growth Source: Industry Canada Time 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Industry Canada Industrie Canada Food for thoughts - Potential policy research on e-business adoption Understanding the economic, social, cultural and technological dimensions of e-business E-business and economic growth; How does e-business influence the relative contributions to economic growth?; e-business and productivity; e-business and comparative advantage; e-business and innovation; impact of e-business on markets, investment, industrial structure, organizations and labor markets; Cost of e-business in rural and remote areas vs urban center; impact of e-business on SMEs and on SMEs on rural areas;etc… Understanding the major factors which influence productivity, growth and innovation in firms and organizations What are the features of innovative and leading firms in e-business and how do they develop?; Are these features consistent across all sectors and firms sizes?; e-business and firm’s productivity and innovation; How does e-marketplace evolve?What can differentiate the behavior of SMEs and large firms in terms of adopting e-business technologies; How does e-business provide competitive edge to self-employed and SMEs; etc... 1. Introduction 2. Findings related to B2B and e-procurement 3. Policy considerations 4. Issues to be addressed in future research Industry Canada Industrie Canada E-Business Technology Adoption Assessing B2B and e-Procurement in Canada For more information, Visit our Web site www.ecom.ic.gc.ca or contact us charles.sandra@ic.gc.ca lepage.raymond@ic.gc.ca