CHAPTER 5 DEPOSITS AND INVESTMENTS

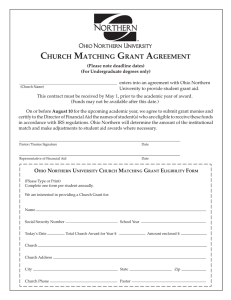

advertisement