CHAPTER 6 OTHER POTENTIALLY DIRECT AND MATERIAL LAWS AND REGULATIONS

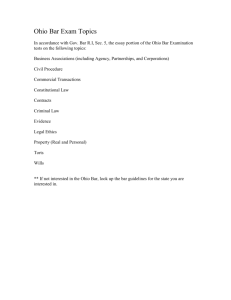

advertisement