The NAIC Risk-Based-Capital Formula Revisited

advertisement

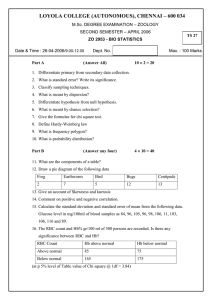

19 May 2004 The NAIC Risk-Based-Capital Formula Revisited Robert F. Wolf, FCAS, MAAA Principal, Mercer Oliver Wyman G. Chris Nyce, FCAS, MAAA Manager, KPMG LLP American Academy Committee Structure P/C RBC Committee – Reports to Joint AAA RBC Committee Reports to Risk Management and Solvency Committee - Reports to Risk management and Financial Reporting Council – Works with NAIC Capital Adequacy Task Force 2 Prescribed Goal of the NAIC US Risk Based Capital Formula Provide regulators with the authority to enforce compliance with more appropriate capital requirements. NAIC Endorsed Uses – Minimum Capital Requirements – Solvency Monitoring – Legal Authority NAIC Non-Endorsed Uses – Ratemaking – Marketing 3 US P&C RBC Ratio and Levels RBC Ratio = Adjusted Capital / Calculated Capital Supervisory intervention is required at the following RBC ratio levels: – company action level (RBC ratio 150-200%) - the insurer must file a comprehensive financial and business plan. – regulatory action level (RBC ratio 100-150%) - in addition to the above, the regulator must examine and require corrective action of an insurer. – authorized control level (RBC ratio 70-100%) - in addition to the above, the regulator may take control of an insurer. – mandatory control level (RBC ratio less than 70%) - the regulator is required to place the insurer under regulatory control unless it is reasonable to believe the situation will correct itself within 90 days. 4 Current and Recent Research Raising the Bar in ACL New Risk Charges and Considerations – Catastrophes – Terrorism Risk – DTAs/DTLs – Risk Charge for Credit/Unauthorized Reinsurance Updating Premium and Reserve Charges Trend Test 5 Subcommittee for Reserve and Premium Risk Factors Mission The mission of this subcommittee was to update the Risk Base Capital (RBC) charges for the reserving and premium and to also update the investment income offset factors. The committee was to achieve this by not “reinventing the wheel” but rather update using the same methodology as before. 6 Preliminary Directional Indications Most lines decreasing Medical malpractice and Products Increasing Current ResearchNot ready to provide recommendations Changing the Methodology? Not Changed in Over 10 Years -Soft to Hard Market Reserve Releases and Reserve Strengthening 7 Does NAIC RBC Properly Award Good Risk/Return Decisions? Incentive to Increase RBC Ratio offsets incentive to properly diversify assets and apply optimal investment strategies – Less incentive to invest in common stocks relative to treasuries and higher class bonds because of relatively higher risk charges – If an interest rate charge is included Asset/Liability Matching Strategy is favored to reduce RBC charges Contrary to recent research by CAS VFIC Committee that such an investment strategy may be sub-optimal Other Adverse Incentives – Reserve Charge Double Play Largest Risk Charge Lowest Rigor in RBC Calculation Incentive to underreport Reserves - Increases Statutory Surplus - lowers RBC charge - both effects increase RBC Ratio – Disincentive to Reinsure Doesn’t Differentiate between the quality of reinsurers Doesn’t differentiate between collateralization of reinsurance 8 Responsiveness – “...It's hard not to read news about property-casualty insurers whose financial strength ratings tumble from "A" to "B" in a heartbeat, only to have their hearts stop beating soon after, without wondering what's going on….” Suzanne Sclafane, National Underwriter Same Question have been raised for RBC Ratios ! 9 American Academy of Actuaries Committee on Risk Based Capital Working Group of the Committee on Trend Tests – Chair: G. Chris Nyce, KPMG LLP - Wendy Germani, Texas Department of Insurance - Jim Hurley, Tillinghast-Towers Perrin - Bob Wolf, Mercer Oliver Wyman Charge: “Provide recommendations regarding possible trend test(s) for P&C RBC and for Health RBC and provide recommendations regarding any changes to the Life RBC trend test. Any trend test should strive to provide regulatory action level reporting prior to a company entering an action level which may be based on a significant deterioration in RBC ratios. Considerations and support should be provided for recommendations made. Chris Nyce, Chair of the Subgroup will now provide his presentation……… 10 See Presentation Slides from Chris Nyce 11 Imagine That !!!! A trend Test based on the company’s reported calendar year profit Preliminary/ Not Final 12 Further Research Underway Lessons from past Failures – Micro Analysis Look at past insolvencies Back Test …….Stay Tuned 13 Thank You ! Q&A? Robert F Wolf, FCAS, MAAA 312-930-0648 Mercer Oliver Wyman Actuarial Consulting, Inc. Chicago, IL, US phone +1 312 930 0648 cell +1 312 560 5228 rwolf@mow.com 14