Chapter 9 Building the Aggregate Expenditures Model

advertisement

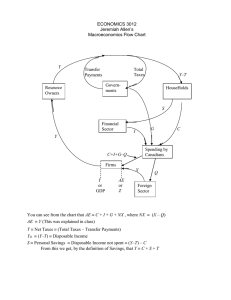

Chapter 9 Building the Aggregate Expenditures Model Two of most critical questions in macroeconomics are: 1. What determines the level of GDP given a nation’s production capacity? 2. What causes real GDP to rise in one period and to fall in another? To answers these questions, we construct the aggregate expenditures model. Assumptions: o Complications arising from government expenditures, taxes, exports, and imports will be deleted o Assume all savings consist of personal saving o Depreciation and net foreign factor is ZERO o Excess production capacity o Unemployed labor o Price level is constant Implications: o Aggregate spending initially consist of only consumption and investment o Gross domestic production, national income, personal income, and disposable income are equal Tools of Aggregate Expenditure Model o The basic premise of the aggregate expenditures model is that the amount of goods and services produced and therefore the level of employment depend directly on the level of aggregate expenditures o Business will produce only a level of output that they think that they can profitably sell o When aggregate expenditures fall, total output and employment decrease o When aggregate expenditures rise, total output and employment increase o An increase in aggregate expenditures will increase real output and employment but will not raise the price level Consumption and Savings o Savings = Disposable income – Consumption o Determinants of Consumption o Income or disposable income o As DI rises, savings increases o As DI falls, saving decrease o Households consume most of their disposable income o Consumption and savings are directly related to the income level o Consumption Schedule o Reflects the direct consumption –disposable income relationships suggested by the data o Households spend a larger proportion of a small disposable income than a large disposable income o Savings Schedule o S = DI – C o If households consume a smaller and smaller proportion of DI as DI increase, then they must be saving a larger and larger proportion o Households can consume more than their income by liquidating wealth o Break-even income is $390. The income level at which households plan to consume their entire incomes. Level of Output And Income GDP = DI $ 370.00 $ $ $ $ $ $ $ 390.00 410.00 430.00 450.00 470.00 490.00 510.00 C S $ 375.00 $ (5.00) $ 390.00 $ $ 405.00 $ 5.00 $ 420.00 $ 10.00 $ 435.00 $ 15.00 $ 450.00 $ 20.00 $ 465.00 $ 25.00 $ 480.00 $ 30.00 APC 1.01 1.00 0.99 0.98 0.97 0.96 0.95 0.94 APS (0.01) MPC MPS 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.75 0.25 0.00 0.01 0.02 0.03 0.04 0.05 0.06 $ $ 530.00 550.00 $ 495.00 $ 35.00 $ 510.00 $ 40.00 0.93 0.93 0.75 0.25 0.75 0.25 0.75 0.25 0.07 0.07 o At all higher income, households plan to save part of their incomes Average and Marginal Propensities Average Propensity to Consume (APC) o Fraction or percentage of total income that is consumed o Consumption/income Average Propensity to Save (APS) o Fraction of total income that is saved o Savings/income Note: APC + APS = 1 Therefore the percentage saved plus percentage consumed must equal one since DI = C + S Marginal Propensity to Consume (MPC) o Change in consumption/change in income o Slope of the consumption schedule Marginal Propensity to Save (MPS) o Change in saving/change in income o Slope of the savings schedule Note: MPC + MPS = 1 Nonincome determinants of consumption and savings o Wealth o Greater the wealth households have accumulated, the larger is their collective consumption at any level of current income o Wealth = real assets + financial assets o Households save to accumulate wealth o When some other factor boosts household wealth, households reduce their saving and increase their spending – Wealth effect – shifts the saving schedule downward and shifts the consumption schedule upward o Expectations o Taxation o Household debt Investment o Expenditures on new plants, capital equipment, machinery, inventories, and so on o The investment decision is a marginal benefit – marginal cost decision. o The marginal benefit from investment is the expected rate of return businesses hope to realize. o The marginal cost is the interest rate that must be paid for borrowing funds o Expected rate of return o Investment spending is guided by the profit motive o Real Interest Rate o Interest – financial cost of borrowing the money required to purchase the machinery o Interest cost = interest rate X amount borrowed o We invest when the expected rate of return = real interest rate o Investment Demand curve o Total demand for investment goods by the entire business sector o Inverse relationship between the interest rate and the dollar quantity of investment demanded conforms with the law of demand o Shifts Acquisition, maintenance, and operating costs Business taxes Technological change Stock of capital goods on hand Expectations Equilibrium GDP o Aggregate expenditures o Consist of consumption plus investment o Equilibrium output is that output whose production creates total spending just sufficient to purchase that output o The equilibrium level of GDP is the level at which the total quantity of goods produced (GDP) equals the total quantity of goods purchased (C + I). Diseqiulibrium GDP o No level of GDP other than the equilibrium level of GDP can be sustained o Levels below, the economy wants to spend at higher levels that the levels oaf GDP the economy is wiling to produce