FINANCIAL INVESTMENTS ANALYSIS AND EVALUATION. Corporate Finance Castellanza,

advertisement

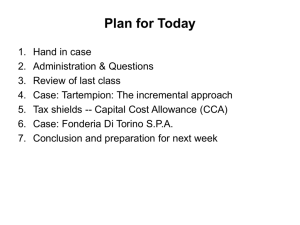

FINANCIAL INVESTMENTS ANALYSIS AND EVALUATION. Corporate Finance Castellanza, 20th October and 3rd November, 2010 2 Executive Summary The investment definition and financial value of the time The Cash-Flow Model The Present Value notion Capital Budget Techniques Present value A dollar tomorrow is worth less than a dollar today. Why? 1) Present consumption preferred to future consumption – to induce people to give up to present consumption you have to offer them more in the future 2) Monetary inflation – the value of currencies decreases over time 3) Uncertainty (risk) – if there is a risk associated with an investment in the future, the less the investment will be valued Discounting and compounding Discount rate: it is a rate at which present and future cash flows are traded off. It incorporates: preference for current consumption expected inflation the uncertainty in the future cash flows Discounting converts future cash flows into present cash flows. Cash flows at different points in time cannot be compared and aggregated. All cash flows have to be brought to the same point in time, before comparisons and aggregations are made. Compounding converts present cash flows into future cash flows. 5 A Definition: An Investment is a transfer of monetary resources over time, mainly characterized by net outflows in the first stage, and net inflows in the following periods. 6 An example of flows chart: F(t) t Implementation Useful life 7 Financial dynamics include… Current business decision-making; Capital budgeting; Investment decisions; Asset and liability management; In detail, about Capital budgeting: To increase productive capacity; To buy or improve plant and machinery (equipment investments decisions) / To rationalize processes (make or buy decisions); To develop and strengthen products and services range; Acquisition strategies. 8 Capital Budgeting: forces at play Investment Opportunities (real activities) ENTERPRISE Risk/Return Relationship Other aspects to focus on: Fiscal policy; Financial requirement. SHAREHOLDERS Investment Opportunities (financial activities) Risk/Return Relationship 9 How to finance investments: Self-Financing (A) Equity (E) Debt (D) on: The choice among the sources of fonts is based Capital supply; Enterprise conditions; Economic effects; Non-economic effects; Financial flexibility. 10 The investment analysis: key stages 1. Scouting among different alternative investments (strategic and commercial perspective); 2. Evaluation of alternative investments (technical perspective). 3. Evaluation of the projects according to financial criteria; 4. Selection of the most profitable projects. 11 Key information for a consistent evaluation In order to efficiently evaluate investments it is important to have clear information about: 1. Invested capital; 2. Investment duration; 3. Costs and revenues connected to the investment; 4. Cash flow generated by the investment; 5. Terminal value of invested capital at the end of the investment period; 6. Risk connected to the investment. 12 Investments financial analysis Key drivers: risk (connected to every investment) return (the “result” generated by the investment) time (the investment duration) Financial value of time Cost of capital (Fundraising) Return of capital (Investments) 13 Financial value of time Financial value of time is connected to: risk (it is proportional to the probability that future cash flows will be effectively collected) flexibility (possibility to reinvest present cash flow) Temporal distribution of value 14 Cash flow temporal distribution F(t) F(t) 0 1 2 3 4 Time 0 1 2 3 4 Time Both the investments are characterized by the same outflows; however, the temporal distribution of the inflows is clearly different. This feature implies the investments different value. 15 Executive Summary The investment definition and financial value of the time The Cash-Flow Model The Present Value notion Capital Budget Techniques 16 Key drivers for a consistent evaluation In order to efficiently evaluate investments it is important to focus on 3 key drivers: The cash flow amount; The temporal distribution of the cash flows; Financial value of time. 17 Relevant cash flows determination Revenues - Operating expenses - Depreciations = Operating income - Taxes = Net Earnings + Depreciations ± Change in Net Working Capital (NWC) = Cash flow from operations - Investments + Divestments = RELEVANT CASH FLOW 18 Guidelines for cash flow determination Do not confuse average and marginal returns (focusing only on marginal returns); To take into account “collateral” effects; Do not forget to cover the working capital requirement connected to the investment; Do not consider sunk costs; To analyze opportunity cost; To pay attention on common cost apportionment; To consider the present value of the fiscal benefit connected to amortization. 19 Executive Summary The investment definition and financial value of the time The Cash-Flow Model The Present Value notion Capital Budget Techniques 20 Present Value Present Value (PV) is the value on a given date of a future amount of money, discounted to reflect the financial value of time. PV = Ft (1 + k)t where, Ft = cash flow generated by the investment k = discount rate 1/(1 + k)t = discount factor 21 Investment Present Value PV is a means to compare cash flows at different times on a meaningful "like to like" basis F4 F(t) F3 n Ft PV t t 1 1 k F2 F1 Tempo F0 Discount dove: Ft n k 1/(1+k) = cash flow on a given date t = number of period = discount rate = discount factor 22 Executive Summary The investment definition and financial value of the time The Cash-Flow Model The Present Value notion Capital Budget Techniques 23 Methods for the investments evaluation There are different methods to evaluate and to compare alternative investments, such as: The Net Present Value (NPV) The Internal Rate of Return (IRR) The Pay-Back Period (PBP) 24 The Net Present Value (NPV) The Net Present Value is an indicator of how much value an investment adds to the enterprise. It takes into account not only cash inflows generated by the investment, but also cash outflows needed to develop the investment plan. The NPV is the sum of each cash inflow/outflow discounted back to its present value (PV). 25 How to estimate the Net Present Value 1. To estimate future cash flows of the investment for every year of the investment project. 2. To estimate discount rate. 3. To discount future cash flows for every year. 4. To sum discounted cash flows (= Present Value of the investment). 5. The NPV is simply the PV of future cash inflows minus the cash outflow needed to carry out the investment project. 26 The Net Present Value Supposing an investment plan characterized by five cash inflows and only a single cash outflow at the beginning, the NPV formula is: NPV F0 F3 F5 F1 F2 F4 1 k 1 1 k 2 1 k 3 1 k 4 1 k 5 where: Ft = cash inflows F0 = cash outflow k = discount rate n Ft NPV t t 0 1 k The Net Present Value F4 F(t) F3 F2 F1 Time F0 Discounting 28 The Net Present Value: properties The NPV allows to evaluate the added value generated by the investment plan. A project is profitable (in a financial point of view) only if its NPV has a positive value (NPV>0). Comparing alternative investments, the one yielding the higher NPV should be selected. A positive NPV points that the project is able to add value generating more cash inflows than cash outflows. 29 The NPV: PROS and CONS PROS: It takes into account financial value of time It considers both future cash flows and capital cost (troughout the discount rate) CONS: It is not directly connected to the initial investment It is based on the “perfect markets” assumption 30 The Internal Rate of Return (IRR) The Internal Rate of Return is the discount rate thanks to an investment has a zero Net Present Value. In other words, it represents the maximum cost of the fundraising activity, in order to maintain the project profitability. In general, an investment whose IRR exceeds its cost of capital adds value for the company. 31 The Internal Rate of Return: formula IRR: rate of return to project required to obtain an NPV = 0 If IRR > opportunity cost of capital, then accept the project. n Ft 0 t t 0 1 IRR The Payback Period (PBP) The Payback period requires that the initial outlay of a project should be recovered within a specified period. The PBP is the length of time required to recover the initial investment of the project. If PBP is less than the pre-determined cut-off, accept the project.