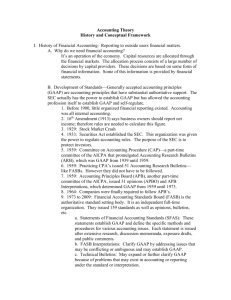

Accounting Theory History and Conceptual Framework

advertisement

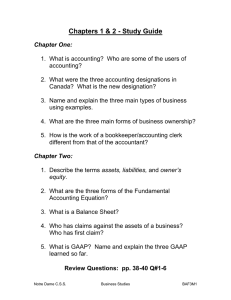

Accounting Theory History and Conceptual Framework I. History of Financial Accounting: Reporting to outside users financial matters. A. Why do we need financial accounting? It’s an operation of the economy. Capital resources are allocated through the financial markets. The allocation process consists of a large number of decisions by capital providers. These decisions are based on some form of financial information. Some of this information is provided by financial statements. B. Development of Standards—Generally accepted accounting principles (GAAP) are accounting principles that have substantial authoritative support. The SEC actually has the power to establish GAAP but has allowed the accounting profession itself to establish GAAP and self-regulate. 1. Before 1900, little organized financial reporting existed. Accounting was all internal accounting. 2. 16th Amendment (1913) says business owners should report net income; therefore rules are needed to calculate this figure. 3. 1929: Stock Market Crash 4. 1933: Securities Act established the SEC. This organization was given the power to regulate accounting rules. The purpose of the SEC is to protect investors. 5. 1939: Committee on Accounting Procedure (CAP)—a part-time committee of the AICPA that promulgated Accounting Research Bulletins (ARB), which was GAAP from 1939 until 1959. 6. 1959: Practicing CPA’s issued 51 Accounting Research Bulletins— like FASBs. However they did not have to be followed. 7. 1959: Accounting Principles Board (APB), another part-time committee of the AICPA, issued 31 opinions (APBO) and APB Interpretations, which determined GAAP from 1959 until 1973. 8. 1964: Companies were finally required to follow APB’s. 9. 1973 to 2009: Financial Accounting Standards Board (FASB) is the authoritative standard setting body. It is an independent full-time organization. They issued 168 standards as well as opinions, bulletins, etc. a. Statements of Financial Accounting Standards (SFAS): These statements establish GAAP and define the specific methods and procedures for various accounting issues. Each statement is issued after extensive research, discussion memoranda, exposure drafts, and public comments. b. FASB Interpretations: Clarify GAAP by addressing issues that may be conflicting or ambiguous and may establish GAAP. c. Technical Bulletins: May expand or further clarify GAAP because of problems that may exist in accounting or reporting under the standard or interpretation. d. Statements of Financial Accounting Concepts (SFAC): Intended to establish the objectives and concepts in developing accounting and reporting standards. They do not establish GAAP. 10. 2002: Sarbanes-Oxley Act of 2002 was enacted as a reaction to a number of major corporate accounting scandals including Enron and WorldCom. The act creates a government regulated Public Company Oversight Board (PCAOB) charged with overseeing, regulating, inspecting, and disciplining accounting firms in their roles as auditors of public companies. Stress the independence of auditors. 11. July 1, 2009: FASB Accounting Standards Codification is the single official source of authoritative, nongovernmental U.S. generally accepted accounting principles. Accounting and financial reporting practices not included in the Codification are not GAAP. Modifications to the Codification are issued by FASB via Accounting Standards Updates (not authoritative). All new GAAP and SEC amendments are fully integrated into the existing structure of the Codification. *Under IFRS, entities are directed to refer to and consider the applicability of the concepts in the Framework when developing accounting policies in the absence of a standard or interpretation that specifically applies to an item. Under U.S. GAAP, the Conceptual Framework cannot be applied to specific accounting issues. C. Hierarchy of Sources of GAAP—The sole source is currently the FASB Codification. Accounting and financial reporting practices not included in the Codification are not GAAP. FASB updates the Accounting Standards Codification for new U.S. GAAP issued by the FASB and for amendments to the SEC content with Accounting Standards Updates. These Updates are not authoritative literature. All new GAAP and SEC amendments are fully integrated into the existing structure of the Codification. II. International Accounting Standards Board (IASB) A. Established in 2001 to develop a single set of high-quality, global accounting standards. B. Issues International Financial Reporting Standards (IFRS)—“International GAAP.” At least 9/12 IASB members must approve an IFRS for issuance. C. Framework for the Preparation and Presentation of Financial Statements (Framework)—developed by the IASB to assist in developing future IFRSs and evaluating existing IFRSs. D. International Convergence—the IASB and FASB have been working together towards international convergence of accounting standards since 2002. The goal of the convergence project is a single set of high-quality, international accounting standards that companies can use from both domestic and crossborder financial reporting. III. Conceptual Framework of Financial Accounting: A coherent set of interrelated objectives and fundamental concepts; define accounting rules and boundaries. Guide the FASB in establishing accounting standards Provide a frame of reference for resolving accounting questions for which no standard exists Determine the bounds for judgment in the preparation of financial statements. Increase users’ understanding of and confidence in financial reporting. Enhance comparability A. SFAC 1: Objectives of Financial Reporting—Disclosing the entity’s performance with the focus being on the information needs of external users. 1. Users of Financial Information a. Present and potential investors/creditors b. Assumes users have reasonable understanding of economic and business situations. 2. Information a. Useful for decision making b. Helpful in assessing future cash flows c. Relates to economic resources (assets), claims against resources (liabilities), and inflows and outflows of resources. 3. The objectives are stated with the understanding that the financial information is: a. Reported at the entity level (not industry or economy) b. Full of estimates c. Reflects financial effects of transactions d. Only 1 of many sources B. SFAC 2: Qualitative Characteristics of Useful Accounting Information 1. Characteristics that make financial information useful a. Relevance—makes a difference; has predictive or feedback value and is timely b. Reliable—free from error and bias and represents what it intends to represent. It’s verifiable, neutral, and has representational faithfulness. i. Verifiable—when measures can form a consensus that the selected method has been used w/o error or bias. ii. Neutral—an absence of bias intended to attain a predetermined result or to influence behavior in a particular direction. iii. Representational Faithfulness: A relationship exists btwn the reported accounting measurements or descriptions and the economic resources, the obligations, and the transactions and events causing changes in these items. c. Tradeoff between the 2: liquidation value vs. fair value (give up reliability for relevance). d. Comparability vs. Consistency: i. Comparability—enables users to identify and explain similarities and differences between 2+ sets of economic fact. ii. Consistency—conformity from period to period with accounting policies and procedures remaining unchanged. iii. Constraints are materiality—threshold of measurement—and cost vs. benefit C. SFAC 5: Recognition and Measurement in the Financial Statements—what and when information should be incorporated in the financial statements 1. Financial Statements a. Statement of Financial Position (Balance Sheet) b. Statement of Earnings (Income Statement) c. Statement of Comprehensive Income d. Statement of Cash Flows e. Statement of Changes in Owners’ Equity 2. Measurement Bases a. Historical Cost (historical proceeds)—PP&E and most inventory b. Current Cost (Replacement Costs)—some inventory c. Fair Value (Current Market Value) d. Net Realizable Value (Settlement Value)—Sales e. Present Value of Future Cash Flows—LT receivables and payables 3. Assumptions a. Entity—personal transactions are separate from those of business. b. Going Concern—the entity will continue to operate c. Monetary Unit d. Periodicity e. Historical Cost f. Revenue Recognition—recognize revenue when it is earned and realized or realizable. g. Matching Principle—why do we incur expenses? To generate revenue. h. Accrual Accounting—revenues are recognized when they are earned and expenses are recognized in the same period as the related revenue i. Full Disclosure Principle—users are given information that would make a difference in the decision process but not too much that it impedes analyzing what is important. j. Conservatism Principle—when selecting GAAP methods, the method that is least likely to overstate assets, revenues, and gains and understate liabilities, expenses and losses should be selected. i. Recognize revenues/gains when the earrings process is complete. ii. Recognize expenses/losses immediately. *IASB Framework outlines only 2 assumptions—accrual basis accounting and going concern. D. SFAC 6: Elements of Financial Reporting—Elements are the building blocks with which financial statements are constructed. 1. Classes of items the financial statements comprise: A = L + OE a. Items that affect equity: i. Increase: Revenue, Gains, Investments by Owners ii. Decrease: Expenses, Losses, Distributions to Owners b. Comprehensive Income—changes in equity from nonowner sources. All differences between beginning balance sheet and ending balance sheet other than transactions with owners (net income plus other comprehensive income) i. Unrealized holding gains/losses on available for sale securities ii. Excess of additional liability over unrecognized prior service costs iii. Cumulative translation adjustment c. Ten Elements that provide information required in the objectives stated in SFAC No. 1 i. Comprehensive Income—excludes items ix and x ii. Revenues—inflows, enhancements of assets, or reduction of liabilities. Record at gross amounts. iii. Expenses—outflows, uses of assets, or incurring liabilities iv. Gains—increases in equity from peripheral transactions and other events except revenue and investments from owners. v. Losses—decreases in equity from peripheral transactions and other events except epenses and distributions to owners. vi. Assets—probable future economic benefits vii. Liabilities—probable future sacrifices viii. Equity—the residual of assets and liabilities ix. Investments by Owners x. Distributions to Owners *IASB Framework outlines the following elements of financial statements: assets, liabilities, equity, income (including revenue and gains), expenses (including expenses and losses), and capital maintenance adjustments. Capital maintenance adjustments are increases and decreases in equity that arise from the revaluation or restatement of assets and liabilities. The IASB Framework does not include the concept of comprehensive income. E. SFAC 7: Using Cash Flow Information and Present Value in Accounting Measurements—provides a framework for accountants to employ when using future cash flows as a measurement basis for assets and liabilities—applies only to measurement issues for assets and liabilities that are determined using future cash flows only. The objective in valuing an asset or liability using present value is to approximate fair value of that asset or liability. 1. Determine the present value of future cash flows 2. Consider uncertainty and timing of cash flows 3. Example: Lease payment (certain—use traditional PV approach with interest rate) vs. Pending lawsuit (uncertain—use expected cash flows approach). If future cash flow ranges from $100,000 to $300,000, with a 10% probability it will be $100, 60% probability it will be $200,000 and a 30% probability it will be $300,000, expected cash flow would be $220,000 (.10 X $100,000)+(.6 X $200,000)+(.3 X $300,000). This approach is often used in measuring pensions and postretirement benefits. *The IASB Framework does not consider the use of cash flow information and present value in accounting measurements.