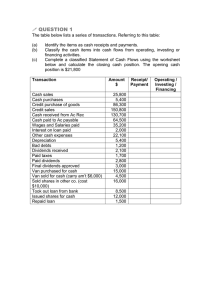

Statement of Cash Flows I. General

advertisement

Statement of Cash Flows I. II. III. IV. General a. Required by GAAP as a part of a full set of financial statements b. Purpose: Provide information about i. Sources of cash and cash equivalents (cash receipts) ii. Uses of cash and cash equivalents (cash disbursements), specifically information about: 1. Operating cash flows: the cash effects of the line items that make up the calculation of net income and current assets and current liabilities (excluding current notes payable and the current portion of LT debt, which are reported in financing cash flows). 2. Investing cash flows: the cash effects from noncurrent assets. 3. Financing cash flows: the cash effects of borrowing, paying back, and buying or selling the equity of the company. Cash and Cash Equivalents—The statement of cash flows reconciles cash and cash equivalents amount presented on the beginning balance sheet to the cash and cash equivalents amount presented on the ending balance sheet a. Definitions i. Cash—actual cash; currency and demand deposits ii. Cash equivalents—short-term, liquid investments that are 1. Quickly convertible into specific amounts of cash AND 2. So near maturity that the risk of changes in the value because of interest rate changes is insignificant. b. Purpose—Investors, creditors, etc. need information about the entity’s available cash and cash needs (ability to pay obligations, dividends, etc.) Methods of Presenting the Statement of Cash Flows—Regardless of method used, the presentation of investing and financing activities is the same. Only the operating activities section changes. a. Direct Method—the entity shows major classes of operating cash receipts and disbursements. A reconciliation of net income and net cash flows from operating activities is required to be provided in a separate schedule (for GAAP; reconciliation not required for IFRS). b. Indirect Method—the entity reports the same amount of net cash flows from operating activities indirectly, by adjusting the net income to reconcile it to net cash flows from operating activities. Sections of the Statement of Cash Flows a. Operating Activities: Involve producing goods and delivering services to customers. Operating activities is also a residual category in that all transactions not categorized as investing or financing activities are categorized as operating activities. (For U.S. GAAP, regardless of the method used—direct or indirect—the reconciliation of net income to net cash provided by operating activities must be calculated. If the direct method is chosen, the reconciliation will appear in a separate schedule to the statement. If the indirect method is chosen, this reconciliation is part of the body of the statement.) i. Direct Method: Major classes of cash receipts and disbursements are presented in their gross amounts and totaled to arrive at “net cash flow provided by (used in) operating activities. 1. Categories Reported Separately: a. Cash received from customers (+) b. Interest received (+) c. Dividends received (+); dividends paid—financing d. Other operating cash receipts such as the receipt of insurance proceeds and lawsuit settlements (+) e. Cash received from sales of trading securities (+) f. Cash paid to supplies and employees (-) g. Interest paid (-) h. Income taxes paid (-) i. Other operating cash payments (-) j. Cash paid to buy trading securities (-) 2. Determination of Cash Received/Disbursed a. Cash Collections: Cash collected from current year’s sales and prior years’ sales Sales to customers + Interest income + Dividend income Increase in receivables + Decrease in receivable + Increase in unearned revenue Decrease in unearned revenue Cash Collections b. Cash Paid to Supplies and Employees: Defined broadly and may include cash paid for insurance, advertising, and most general, selling, and administrative expenses. Cost of goods sold + Increase in inventory Decrease in inventory + Expenses + Increase in prepaid Decrease in prepaid Increase in accounts payable or other liability + Decrease in accounts payable or other liability Cash Paid to Suppliers and Employees ii. Indirect Method: Net income is adjusted to arrive at net cash flows from operating activities a. Adjustment to Net Income: removes the effects on net income of the following items: 1. Deferrals of past operating cash receipts and disbursements 2. Accruals of expected future operating cash receipts and disbursements 3. All items that are included in net income that do not affect operating cash receipts and disbursements b. Determination of Effect on Cash Flow 1. An increase to an asset or debit balance accounts will have the effect on the statement of cash flows as a decrease to cash. 2. A decrease to an asset or debit balance account will have the effect on the statement of cash flows as an increase to cash 3. An increase in a liability, equity, or credit balance account will have the effect on the statement of cash flows as an increase to cash. 4. A decrease in a liability, equity, or credit balance account will have the effect on the statement of cash flows as a decrease to cash. c. Short-cut Flow Effects 1. Changes in debit balance accounts will have the opposite effect on cash flows. 2. Changes in credit balance accounts will have the same effect on cash flows. d. Gains and Losses 1. Gains are adjusted out of the operating activities section and into the investing activities section by subtracting their effects from net income. 2. Losses are adjusted out of the operating activities section and into the investing activities section by adding their effects to net income. Net Income Add Non-Cash Expenses (Depreciation, Amortization) Less Non-operating gains Add Non-operating losses Less Increases in current assets Add Decreases in current assets Add Increases to current liabilities Less Decreases in current liabilities b. Investing Activities—change in non-current assets and some ST investments in debt and equity 1. Making loans to other entities (-) 2. Purchasing (-) or disposing of (+) available-for-sale and held-to-maturity investment securities. 3. Acquiring (-) or disposing of (+) PPE. c. Financing Activities—change in cash from non-current debt and equity 1. Owner-oriented Activities i. Obtaining resources from owners, such as issuing stock (+) ii. Providing owners with a return on investment, such as paying dividends (-) 2. Creditor-oriented Activities i. Obtaining resources from creditors, such as issuing bonds, notes, etc. (+) ii. Payments of principal (NOT interest) on amount borrowed (-) d. Non-Cash Investing and Financing Activities—Material information should be provided separately in a supplemental disclosure. V. IFRS Differences in Reporting Cash Flows—IFRS allows more flexibility than U.S. GAAP in classifying cash flows related to interest, dividends, and income taxes. The following table summarizes the classification differences between U.S. GAAP and IFRS: Transaction Interest Received Interest Paid Dividends Received Dividends Paid Taxes Paid U.S. GAAP CFO CFO CFO CFF CFO IFRS CFO or CFI CFO or CFF CFO or CFI CFO or CFF CFO, CFI, CFF IFRS classifies taxes paid as CFO, but allows allocation to CFI or CFF for portions specifically identified with investing and financing activities. IFRS also requires disclosure of tax related cash flows separately within the statement of cash flows. U.S. GAAP requires the disclosure of interest and taxes paid in a footnote if not presented on the statement of cash flows. VI. Illustrations a. Indirect Method X Company Statement of Cash Flows For the Period Ended XX/XX/XXXX CASH FLOWS FROM OPERATING ACTIVITIES Net Income $760 Adjustments to reconcile N/I to net cash provided by operating activities: Depreciation and amortization $445 Provision for losses on A/R 200 Gain on sale of facility (80) Undistributed earnings of affiliate (25) Payment received on installment N/R 100 for sale of inventory Changes in Current Assets and liab: Increase in A/R (215) Decrease in inventory 205 Increase in PP Expenses (25) Decrease in A/P (250) Increase in interest and taxes payable 50 Increase in deferred tax liability 150 Increase in other liabilities 50 Total Adjustments 605 Net Cash Provided by Operating Act CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from sale of facility 600 Payment received on note for sale of 150 plant Capital expenditures (1000) Payment for purchase of Company X (925) Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Net borrowings 300 Principal payments (125) Proceeds from issuance of LT debt 400 Proceeds from issuance of common stock 500 Dividends paid (200) Net cash provided by financing activities Net increase in cash and cash equivalents Cash, Beginning Balance Cash, Ending Balance $1365 (1175) 875 1065 600 $1665 b. Direct Method X Company Statement of Cash Flows For the Period Ended XX/XX/XXXX CASH FLOWS FROM OPERATING ACTIVITIES Cash received from customers Cash paid to suppliers and employees Dividend received from affiliate Interest Received Interest Paid Income taxes paid Insurance proceeds received Cash paid to settle lawsuit Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from sale of facility Payment received on note for sale of plant Capital expenditures Payment form purchase of Company X Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Net borrowings Principal payments Proceeds from issuance of LT debt Proceeds from issuance of common stock Dividends paid Net cash provided by financing activities Net increase in cash and cash equivalents Cash, Beginning Balance Cash, Ending Balance $13,850 (12,000) 20 55 (220) (325) 15 (30) $1365 600 150 (1000) (925) (1175) 300 (125) 400 500 (200) 875 1065 600 $1665 A required reconciliation of net income to net cash provide by operating activities is required. See indirect method above.