Note for Chapter 6

advertisement

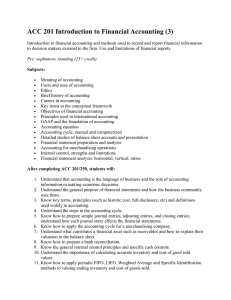

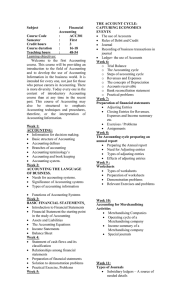

Note for Chapter 6 1. Distinguish between service and merchandising business. Revenue account: Fee earned (service) V.S. Sales (Merchandising business) Difference in I/S: For merchandising business, calculate gross profit before deducting other operating expense. (See example in page254) Gross Profit=Sales-Cost of Merchandising Sold In the B/S, Merchandising business has inventory as current asset. 2. Merchandising Transactions (Very Important) Perpetual V.S. Periodic inventory system (See attachment) For perpetual system: Record purchase of inventory in cash & on account Record purchase discount & purchase return and allowance (pay attention to credit terms) Record sales of merchandise with cash, credit card or on account Record sales discount & sales return and allowance Record freight from view of buyer and seller (FOB shipping point V.S. destination, Capitalized V.S. expense) Please see Page 265 for recording journal entries for both buyers and sellers (Important) Pay attention to chart of account for merchandising business (B/S, I/S accounts, page 269) Record sales transactions with sales taxes and trade discounts 3. Financial statements of merchandising business Prepare Multi-step income statement V.S. single-step income statement (See page 271,272) Prepare a statement of owner’s equity and B/S 4. Adjusting entries and closing entries for merchandising business Adjusting entries for inventory shrinkage (second part of sales activity, no sales but cost only) Closing entries similar to service company but having additional accounts (see page 276) 5. Financial Analysis and Interpretation: Total asset turnover Total asset turnover= Sales/Average total assets (Measure how effectively a business is using its assets to generate sales)