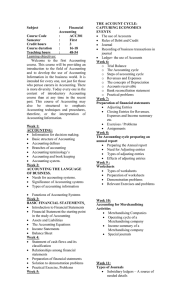

Chabot College Fall, 2002 Course Outline for Business 1A

advertisement

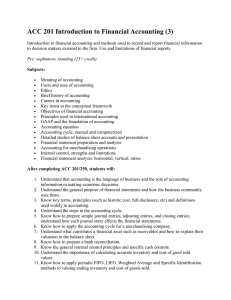

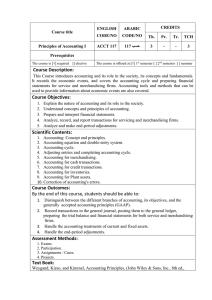

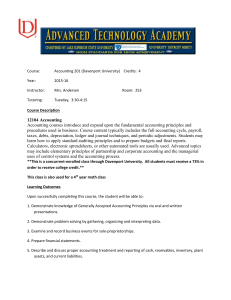

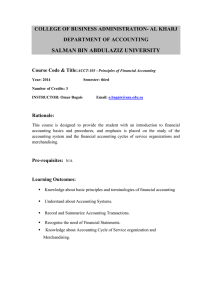

Chabot College Fall, 2002 Course Outline for Business 1A PRINCIPLES OF ACCOUNTING I Catalog Description: 1A - Principles of Accounting I 4 units Basic theory and structure of accounting; accounting cycle and preparation of accounting statements for service and merchandising operations, receivables, inventory, plant assets, current liabilities, payroll, accounting principles, concepts, and partnerships. Strongly recommended: Business 7. 4 hours lecture. Prerequisite Skills: None Expected Outcomes for Students: Upon completion of this course, the student should be able to: 1. 2. demonstrate an understanding of the basic accounting principles and concepts; complete journal entries, post to ledger, perform adjusting and closing entries for a set of books; 3. prepare financial statements and reports; 4. understand the need for internal control as well as preparing a bank reconciliation; 5. process transactions relating to receivables, payables, inventories, plant assets, natural resources and intangible assets; 6. demonstrate an understanding of the cash and accrual methods of accounting; 7. process transactions relating to a merchandising company; 8. display a working knowledge of special journals; 9. demonstrate an understanding of financial analysis and reporting; 10. discuss the difference in the accounting processes of the sole proprietorship and partnership; 11. identify the ethical issues which exist in the business community. Course Content: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Accounting in Action a. What is accounting b. Financial statements The recording process Adjusting the accounts Completion of the accounting cycle Accounting for merchandising operations Accounting information systems a. Subsidiary ledgers b. Special journals c. Accounting software Internal control and cash Accounting for receivables Inventories Plant assets, natural resources and intangible assets Current liabilities and payroll accounting Accounting principles Accounting for partnerships Chabot College Course Outline for Business 1A, Page 2 Principles of Accounting I Fall 2002 Methods of Presentation: 1. 2. 3. Lectures Discussion Problem solving Assignments and Methods of Evaluating Student Progress: 1. 2. Typical Assignments a. Problems dealing with journal entries, financial statements, closing entries b. Mini practice set Evaluation Methods a. Chapter examinations b. Midterm examination b. Final examination Textbook(s) Typical: ACCOUNTING PRINCIPLES, Weygandt, Kiesco, Kimmel, John Wiley & Sons. Inc., 1999. Special Student Materials: Calculator mc 11/06/01 COBUS1A