117.docx

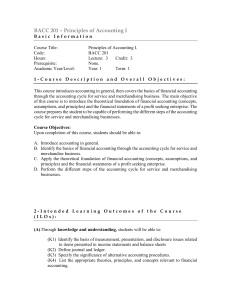

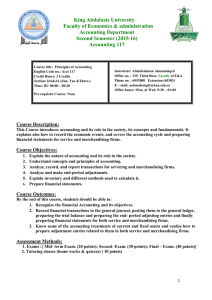

advertisement

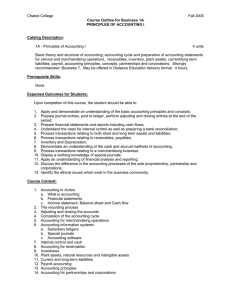

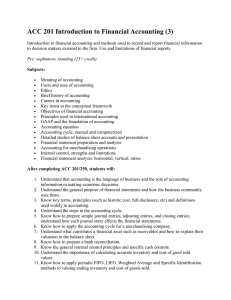

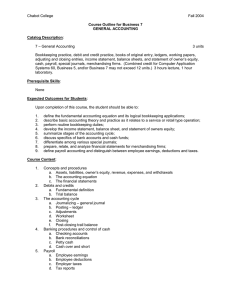

Course title Principles of Accounting I CREDITS ENGLISH ARABIC CODE/NO CODE/NO Th. Pr. Tr. TCH ACCT 117 117 حسب 3 - - 3 Prerequisites The course is [√] required [] elective The course is offered at [√] 1st semester [ ] 2nd semester [ ] summer Course Description: This Course introduces accounting and its role in the society, its concepts and fundamentals. It records the economic events, and covers the accounting cycle and preparing financial statements for service and merchandising firms. Accounting tools and methods that can be used to provide information about economic events are also covered. Course Objectives: 1. 2. 3. 4. 5. Explain the nature of accounting and its role in the society. Understand concepts and principles of accounting. Prepare and interpret financial statements. Analyze, record, and report transactions for servicing and merchandising firms. Analyze and make end-period adjustments. Scientific Contents: 1. Accounting: Concept and principles. 2. Accounting equation and double-entry system. 3. Accounting cycle. 4. Adjusting entries and completing accounting cycle. 5. Accounting for merchandising. 6. Accounting for cash transactions. 7. Accounting for credit transactions. 8. Accounting for inventories. 9. Accounting for Plant assets. 10. Correction of accounting's errors. Course Outcomes: By the end of this course, students should be able to: 1. Distinguish between the different branches of accounting, its objectives, and the generally accepted accounting principles (GAAP). 2. Record transactions in the general journal, posting them to the general ledger, preparing the trial balance and financial statements for both service and merchandising firms. 3. Handle the accounting treatments of current and fixed assets. 4. Handle the end-period adjustments. Assessment Methods: 1. Exams. 2. Participation. 3. Assignments / Cases. 4. Projects. Text Book: Weygand, Kieso, and Kimmel, Accounting Principles, (John Wiley & Sons, Inc., 8th ed., 2007). Supplementary References: Larson, Wild, and Chiappetta, Fundamental Accounting Principles, (McGraw-Hill, 17ed, 2005) Time table for distributing Theoretical course contents Week Topic 1 Accounting: Concept and principles 2 Accounting equation and double-entry system 3 Accounting cycle 4 Adjusting entries and completing accounting cycle 5 Adjusting entries and completing accounting cycle (First Exam) 6 Accounting for merchandising 7 Accounting for merchandising 8 Accounting for merchandising 9 Accounting for cash transactions 10 Accounting for credit transactions (Mid-term Exam) 11 Accounts Receivable 12 Notes Receivable 13 Accounting for inventories 14 Accounting for Plant assets 15 Correction of accounting's errors Final Exam Notes