ACCT350, Study Guide for Test 1, Mid-term

advertisement

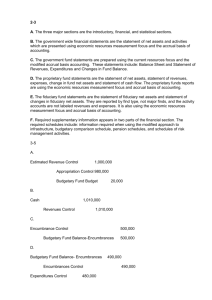

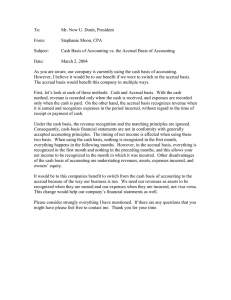

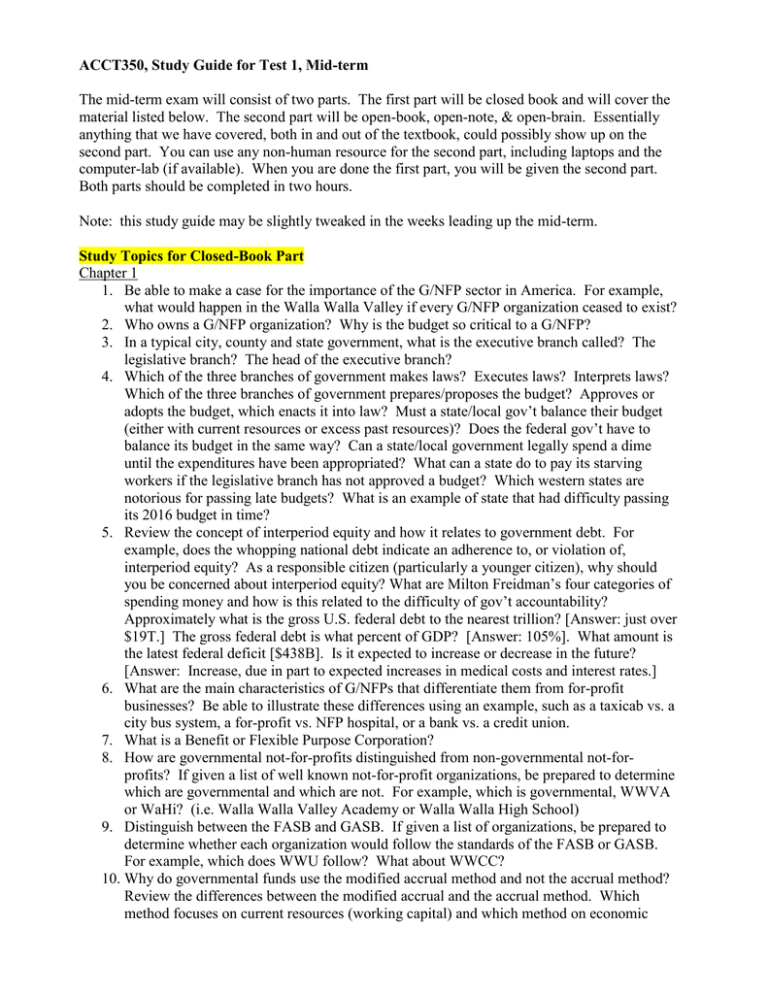

ACCT350, Study Guide for Test 1, Mid-term The mid-term exam will consist of two parts. The first part will be closed book and will cover the material listed below. The second part will be open-book, open-note, & open-brain. Essentially anything that we have covered, both in and out of the textbook, could possibly show up on the second part. You can use any non-human resource for the second part, including laptops and the computer-lab (if available). When you are done the first part, you will be given the second part. Both parts should be completed in two hours. Note: this study guide may be slightly tweaked in the weeks leading up the mid-term. Study Topics for Closed-Book Part Chapter 1 1. Be able to make a case for the importance of the G/NFP sector in America. For example, what would happen in the Walla Walla Valley if every G/NFP organization ceased to exist? 2. Who owns a G/NFP organization? Why is the budget so critical to a G/NFP? 3. In a typical city, county and state government, what is the executive branch called? The legislative branch? The head of the executive branch? 4. Which of the three branches of government makes laws? Executes laws? Interprets laws? Which of the three branches of government prepares/proposes the budget? Approves or adopts the budget, which enacts it into law? Must a state/local gov’t balance their budget (either with current resources or excess past resources)? Does the federal gov’t have to balance its budget in the same way? Can a state/local government legally spend a dime until the expenditures have been appropriated? What can a state do to pay its starving workers if the legislative branch has not approved a budget? Which western states are notorious for passing late budgets? What is an example of state that had difficulty passing its 2016 budget in time? 5. Review the concept of interperiod equity and how it relates to government debt. For example, does the whopping national debt indicate an adherence to, or violation of, interperiod equity? As a responsible citizen (particularly a younger citizen), why should you be concerned about interperiod equity? What are Milton Freidman’s four categories of spending money and how is this related to the difficulty of gov’t accountability? Approximately what is the gross U.S. federal debt to the nearest trillion? [Answer: just over $19T.] The gross federal debt is what percent of GDP? [Answer: 105%]. What amount is the latest federal deficit [$438B]. Is it expected to increase or decrease in the future? [Answer: Increase, due in part to expected increases in medical costs and interest rates.] 6. What are the main characteristics of G/NFPs that differentiate them from for-profit businesses? Be able to illustrate these differences using an example, such as a taxicab vs. a city bus system, a for-profit vs. NFP hospital, or a bank vs. a credit union. 7. What is a Benefit or Flexible Purpose Corporation? 8. How are governmental not-for-profits distinguished from non-governmental not-forprofits? If given a list of well known not-for-profit organizations, be prepared to determine which are governmental and which are not. For example, which is governmental, WWVA or WaHi? (i.e. Walla Walla Valley Academy or Walla Walla High School) 9. Distinguish between the FASB and GASB. If given a list of organizations, be prepared to determine whether each organization would follow the standards of the FASB or GASB. For example, which does WWU follow? What about WWCC? 10. Why do governmental funds use the modified accrual method and not the accrual method? Review the differences between the modified accrual and the accrual method. Which method focuses on current resources (working capital) and which method on economic resources? Which method records only current assets/liabilities? Why does it record only current assets/liabilities? Which method records all assets/liabilities, including those that are long-term? Which method uses the term expenditures and which method uses the term expenses? What is the difference between a capital expenditure and a revenue expenditure? How does the purchase of a capital asset differ under modified accrual vs. accrual accounting? How does the receipt of a long-term borrowing differ under modified accrual vs. accrual accounting? Understand the journal entries that illustrate the difference between the two methods. Know which fund groups use which of the two accounting methods. Chapter 2 11. Review the purpose and usage of the governmental funds, proprietary funds, and fiduciary funds. Given a certain transaction, be able to match which fund it should be recorded in, similar to what you had to do on assignments and quizzes. For example, in which fund would a city water utility be recorded, assuming that the fees charged to city water users entirely support the cost of providing the service? 12. Be able to determine how a transaction would affect the balance sheet of a fund, similar to assignment 2d. 13. Review budgetary accounting. Understand the purpose and of budgetary accounts, including estimated revenues, appropriations, encumbrances, estimated other financing sources/uses, and budgetary fund balance. Understand why fund balance must be reserved for outstanding encumbrances that are to be honored in a new period (non-lapsing). Understand budgetary journal entries and preparation of basic financial statements for a fiscal period, similar to assignment 2d. Also review Problems from the back of Ch. 2. Problem 3-10 solutions are at the end of this document (below), which can serve as a practice problem. You will not have to prepare closing entries but you will need to know how the financial statements are affected by closing transactions. Chapter 3 14. If given a certain transaction, be able to match whether it is an exchange transaction, exchange-like transaction, or non-exchange transaction. For a non-exchange transaction, be prepared to determine which of the four types it belongs to (derived, imposed, mandated, or voluntary). For example, what type of transaction is this: a citizen buys $100 of goods at Walmart in College Place and pays $8.70 of sales tax on top of the purchase price? 15. For each of the different types of revenues listed in the previous item, know how and when the revenues and expenses/expenditures should be recorded. For example, in which month should the State of Washington record the sales tax revenue for the purchase of goods at Walmart on April 29? 16. Review how and when the various tax revenues are recorded (property tax, sales tax, income tax, hotel tax, and licenses/permits). Review how and when the following non-tax revenues are recorded: government-mandated revenues (food stamps, etc.); grants/entitlements; shared revenues; special assessments (note the difference between service-type and capital improvement assessments); charges of goods/services; and fines/forfeitures. 17. Review how and when donation revenues are recorded. Note the definition and treatment of an endowment gift. If a government receives a donation of works of art or historical treasures, what options do gov’ts have to account for this? 18. Note how and when the following interfund transactions are recorded: due to/from other funds, advances to/from other funds, operating transfers to/from other funds, residual equity transfers to/from other funds, and reimbursements. Be able to determine if an interfund transaction is reciprocal (exchange) or non-reciprocal. Review P3-9. 19. Be able to complete a set of journal entries for the revenue/expenditures of the general fund of a typical city, along with basic end-of-year financial statements. You will not need to prepare closing entries. (For examples, see Problem 3-10 at end of Ch. 3 notes, or Quiz 3b, or P3-11-see solutions below). 20. What is Tax Freedom Day? Which type of taxes does the federal gov’t appear to rely more on? Which type of taxes do state/local gov’ts appear to relay more on? 21. How does a progressive tax differ from a regressive tax and a flat tax? Which of these three tax systems (progressive, regressive, flat) applies to income tax? Social Security tax? Be able to intelligently argue whether you think the Federal income tax is too progressive, not progressive enough, or just right (have facts, figures, and philosophical rationale to support your argument). 22. Understand how the levy and collection of property taxes work. Know how to interpret the mill levy rate. Review how the property taxes paid by a resident of College Place are used by the state, county, and local governments. Chapter 4 23. Why is an investment policy important? 24. Understand the causes and effect of Orange County’s bankruptcy. 25. As a general rules, at what value should government investments be recorded on the balance sheet? 26. Understand the purpose/usage/journal entries of the following: repurchase agreements, reverse repurchase agreements, and security lending arrangements. 27. Why are internal investment pool funds not recorded in the consolidated financial statements but external investment pools are recorded? 28. Review the journal entries for the two methods used to record supplies. Which method must be used by the proprietary funds? Do governmental funds have a choice of methods? Why should fund balance be reserved for unused end-of-year supplies? 29. Should cash or liquid investments restricted for a long-term purpose be shown as current assets (e.g. cash donated for endowment)? Why or why not? 30. Review how or when infrastructure assets are recorded by a state/local government. Regarding the infrastructure of the nation, generally in what condition is it? Under what conditions can gov’ts not record depreciation of infrastructure assets? 31. What is the purpose/usage of the each of the following: TAN, RAN, BAN? 32. Note how the costs of a landfill not only include operating costs but also postclosure and environmental costs. This means that the cost of a landfill must factor in the cost to restore the land to alternative uses when the landfill closes. 33. Review the meaning of the following categories of fund balance: reserved, unreserved, nonspendable, committed, restricted, assigned, and unassigned. Note how the expression “net assets” is used instead of “fund balance” for proprietary and fiduciary funds. Chapter 5 34. In recent years, has the GASB been shifting toward accrual or modified accrual accounting? 35. What is the difference between a primary gov’t and a component unit? How are blended component units treated differently than discreet ones? 36. Do Gov’t-Wide Financial Statements follow accrual or modified accrual accounting? Do Fund Financial Statements follow accrual or modified accrual -- or does it depend? Of the three fund groups (governmental, proprietary and fiduciary), which follow(s) accrual accounting? 37. How does one know whether a fund is big enough to have its own separate column (major fund) in the financials? 38. What are the two biggest adjustments to convert financial statements from the modified to full accrual method? (Answer: add long-term assets and liabilities) If you believe there is insufficient material covered on this test, come talk to me and I can easily arrange for more. Good luck. Prob. 3-10. Putting it all together. Prepare journal entries for the following basic transactions. Assume $1 million of cash and unreserved fund balance were carried over from the previous year. a. The budget is adopted. Estimated revenues are $5,000,000 and appropriations are $5,100,000. b. Property taxes in the amount of $5,000,000 are levied and 5% are estimated to be uncollectible. c. Purchase orders in the amount of $2,300,000 are issued. d. $4,800,000 in property taxes are collected. e. The remaining property taxes are reclassified as delinquent. f. The goods ordered on the purchase orders above in (c) arrive with invoices for $2,200,000. g. Employee salaries are paid in the amount of $2,700,000. h. Office supplies in the amount of $30,000 are ordered but do not arrive before fiscal year-end. i. The vouchers for the invoices above in (f) are paid. j. The fiscal year ends, and the budgetary accounts are closed. Answer. a. Estimated Revenues Budgetary Fund Balance Appropriations b. Property Taxes Receivable - Current Allowance for Uncollectible Property Taxes - Current Property Tax Revenue c. Encumbrances Budgetary Fund Balance Reserved for Encumbrances d. Cash Property Taxes Receivable - Current Allowance for Uncollectible Property Taxes - Current Property Tax Revenue e. Property Taxes Receivable - Delinquent Property Taxes Receivable - Current Allowance for Uncoll. Prop. Taxes - Current Allowance for Uncoll. Prop. Tax Delinquent f. Budgetary Fund Balance Reserved for Encumbrances Encumbrances Expenditures Vouchers Payable g. Expenditures-Salaries Cash h. Encumbrances Budgetary Fund Balance Reserved for Encumbrances i. Vouchers Payable Cash j. CLOSING ENTRIES Appropriations Expenditures Budgetary Fund Balance Property Tax Revenues Budgetary Fund Balance Estimated Revenues Unreserved Fund Balance Budgetary Fund Balance Budgetary Fund Balance Reserved for Encumbrances Encumbrances 5,100,000 4,900,000 200,000 4,800,000 200,000 5,000,000 100,000 100,000 30,000 30,000 Unreserved Fund Balance Fund Balance Reserved for Encumbrances 30,000 STATEMENT OF ACTIVITIES Budget Actual Revenues 5,000,000 ? Expenditures/Encumbrances ? 4,930,000 Net ? -130,000 30,000 Variance ? ? 30,000U BALANCE SHEET Cash Prop. Tax. Rec. – Del. Allow. For Uncoll. PT – Del. TOTAL ASSETS Beg. Bal. 1,000,000 0 0 1,000,000 End. Bal. 900,000 ? ? 900,000 Fund Balance Reserved for Encumb. Unreserved TOTAL FUND BALANCE 0 1,000,000 1,000,000 ? ? ?