Econ 522 Economics of Law Dan Quint Fall 2012

advertisement

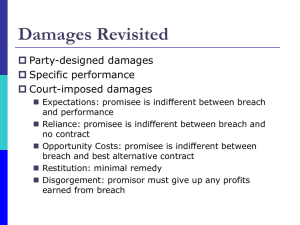

Econ 522 Economics of Law Dan Quint Fall 2012 Lecture 12 Economic Issues in the November Election Thursday, October 25th 3pm-5pm 6210 Social Science Please join the Department of Economics and the Economics Student Association as we host Douglas HoltzEakin and Jeffrey Liebman, discussing economic policy issues in the upcoming election. Holtz-Eakin, is former Director of the Congressional Budget Office and was a top economic adviser for McCain 2008. Liebman, is the former Deputy Director of the Office of Management and Budget and is an economic adviser for Obama 2012. They will address economic issues such as the labor market, tax and budget policy, and the international economy: issues that are at the heart of the November election. 1 Logistics MT1 – to be returned today HW3 (contract law) – online, due Thursday November 8 2 Results of Monday’s experiment (trust) 3 The game we played Player A starts with $10 Chooses how much of it to give to player B That money is tripled Player B has $10, plus 3x whatever A gave him/her Chooses how much (if any) to give back to player A Tried it four ways: Anonymous On paper, but with names Face to face In “public” 4 What did we find With anonymity, trust was a problem Average A sent $5.15, got back $5.50 So about half of potential gains were realized On average, trust paid off, but just barely: of those who sent money, 44% got back less than they sent including 22% who got back zero on the other hand, 27% got back at least twice what they sent Names made a huge difference! Average A sent $7.91, got back $12.39, so 80% of gains realized Of those who sent something… 11% got back less than they sent (7% got nothing) 54% got back at least twice what they sent Face to face: every A sent $10, every B sent $20 (boring!) 5 What did we find With Names Anonymous A sent # Obs Avg back Avg gain % less % zero 10 14 10.79 +0.79 43% 21% 6-9 6 8.17 +0.67 50% 0% 3-5 21 4.57 +0.43 38% 19% 1-2 4 0.25 –1.25 75% 75% 0 9 0.00 +0.00 100% >0 Avg: 6.18 6.60 +0.42 44% 22% A sent # Obs Avg back Avg gain % less % zero 10 34 16.03 +6.03 9% 6% 6-9 9 11.00 +4.56 11% 11% 3-5 11 5.45 +0.91 9% 9% 1-2 2 1.00 –0.50 50% 0% 0 1 0.00 +0.00 12.60 +4.55 >0 Avg: 8.05 100% 11% 7% 6 Reliance 7 Monday Breach of contract To get efficient breach, make promisor’s liability for breach = promisee’s benefit from performance (expectation damages) Reliance Any investment whose value depends on performance Or, any investment which increases value of performance If reliance increases damages owed, promisees will rely more than the efficient amount (overreliance) I promised you a continuous example of this Stick with example we’ve already used: I’m building you an airplane Price is $350,000, you value plane at $500,000 You need to decide how much to invest in building a hangar 8 Continuous reliance investments Price of plane = $350,000 Cost: either $250,000 or $1,000,000 Value of plane + $x hangar = $500,000 + 600x Additional value of plane y 600 x Designer hangar with Starbucks - $480,000 Functional heating - $240,000 Metal poles, rigid roof - $120,000 Plywood frame, canvas roof - $60,000 Tarp and rope - $6,000 benefit Investment in hangar 9 Three questions Price of plane = $350,000 Cost: either $250,000 or $1,000,000 Value of plane + $x hangar = $500,000 + 600x Let p be probability of breach Three questions What is the efficient level of reliance? What will promisee do if expectation damages include anticipated benefit from reliance? What will promisee do if expectation damages exclude anticipated benefit from reliance? 10 Three questions Price of plane = $350,000 Cost: either $250,000 or $1,000,000 Value of plane + $x hangar = $500,000 + 600x Let p be probability of breach Three questions What is the efficient level of reliance? x = $90,000 (1 – p)2 What will promisee do if expectation damages include anticipated benefit from reliance? x = $90,000 What will promisee do if expectation damages exclude anticipated benefit from reliance? x = $90,000 (1 – p)2 11 Reliance and breach Just showed: if damages include added benefit from reliance, promisee will invest more than efficient amount But if damages exclude added benefit… Then promisor’s liability < promisee’s benefit from performance Which means: promisor will breach more often than efficient And promisor will underinvest in performance “Paradox of compensation” Single “price” (damages owed) sets multiple incentives… …impossible to set them all efficiently! 12 So what do we do? Cooter and Ulen: include only efficient reliance Perfect expectation damages: restore promisee to level of wellbeing he would have gotten from performance if he had relied the efficient amount So promisee rewarded for efficient reliance, not for overreliance 13 So what do we do? Cooter and Ulen: include only efficient reliance Perfect expectation damages: restore promisee to level of wellbeing he would have gotten from performance if he had relied the efficient amount So promisee rewarded for efficient reliance, not for overreliance Actual courts: include only foreseeable reliance That is, if promisor could reasonably expect promisee to rely that much 14 Foreseeable reliance: Hadley v Baxendale 1850s England Hadley ran flour mill, crankshaft broke Baxendale’s firm hired to transport broken shaft for repair Baxendale shipped by boat instead of train, making it a week late Hadley sued for the week’s lost profits “The shipper assumed that Hadley, like most millers, kept a spare shaft. …Hadley did not inform him of the special urgency in getting the shaft repaired.” Court listed several circumstances where broken shaft would not force mill to shut down Ruled lost profits not foreseeable Baxendale didn’t have to pay15 Foreseeable reliance: Hadley v Baxendale “Before you can award damages for wages paid and lost sales while the mill was idle, you must first find that at that time they entered into the contract to ship the crankshaft, the shipping company contemplated that the mill owner would suffer those idleness damages as a result of late delivery.” To award damages for lost sales, Hadley should have to prove that Baxendale could have predicted those losses 16 Foreseeable reliance: Hadley v Baxendale Why didn’t Hadley and Baxendale just specify in the original contract what happens in case of delay? What rules should apply in circumstances that aren’t addressed in a contract? 17 Default Rules 18 Default rules Gaps: risks or circumstances that aren’t specifically addressed in a contract Default rules: rules applied by courts to fill gaps 19 Default rules Gaps: risks or circumstances that aren’t specifically addressed in a contract Default rules: rules applied by courts to fill gaps Writing something into a contract vs leaving a gap Allocating a risk (ex ante), before it becomes a loss Versus allocating a loss (ex post) Only have to deal with it if the loss occurs 20 What should default rules be? Cooter and Ulen: use the rule parties would have wanted, if they had chosen to negotiate over this issue This will be whatever rule is efficient 21 What should default rules be? Cooter and Ulen: use the rule parties would have wanted, if they had chosen to negotiate over this issue This will be whatever rule is efficient Fifth purpose of contract law is to minimize transaction costs of negotiating contracts by supplying efficient default rules Do this by imputing the terms the parties would have chosen if they had addressed this contingency 22 Default rules Don’t want ambiguity in the law So default rule can’t vary with every case Majoritarian default rule: the terms that most parties would have agreed to In cases where this rule is not efficient, parties can still override it in the contract Court: figure out efficient allocation of risks, then (possibly) adjust prices to compensate 23 Default rules Example: probability ½, the cost of construction will increase by $2,000 Construction company can hedge this risk for $400 Family can’t do anything about it Price goes up – who pays for it? 24 Default rules Example: probability ½, the cost of construction will increase by $2,000 Construction company can hedge this risk for $400 Family can’t do anything about it Price goes up – who pays for it? Construction company is efficient bearer of this risk So efficient contract would allocate this risk to construction company Should prices be adjusted to compensate? 25 Default rules Example: probability ½, the cost of construction will increase by $2,000 Construction company can hedge this risk for $400 Family can’t do anything about it Price goes up – who pays for it? Construction company is efficient bearer of this risk So efficient contract would allocate this risk to construction company Should prices be adjusted to compensate? 26 Default rules So, Cooter and Ulen say: set the default rule that’s efficient in the majority of cases Most contracts can leave this gap, save on transaction costs In cases where this rule is inefficient, parties can contract around it 27 Default rules: a different view Ian Ayres and Robert Gertner, “Filling Gaps in Incomplete Contracts: An Economic Theory of Default Rules” Sometimes better to make default rule something the parties would not have wanted To give incentive to address an issue rather than leave a gap Or to give one party incentive to disclose information “Penalty default” 28 Penalty defaults: Hadley v Baxendale Baxendale (shipper) is only one who can influence when crankshaft is delivered; so he’s efficient bearer of risk If default rule held Baxendale liable, Hadley has no need to tell him the shipment is urgent So Hadley might hide this information, which is inefficient Ayres and Gertner: Ruling in Hadley was a good one, not because it was efficient, but because it was inefficient… …but in a way that created incentive for disclosing information 29 Penalty defaults: example Suppose… 80% of millers are low-damage – suffer $100 in losses from delay 20% of millers are high-damage – suffer $200 in losses from delay Shipper liable for actual damages Average miller would suffer $120 in losses Shipper makes efficient investment for average type But not efficient for either type Shipper liable for foreseeable damages Shipper makes efficient investment for low-damage millers High-damage millers have strong incentive to negotiate around default rule 30 Penalty defaults: other examples Real estate brokers and “earnest money” Broker knows more about real estate law Default rule that seller keeps earnest money encourages broker to bring it up if it’s efficient to change this 31 Penalty defaults: other examples Real estate brokers and “earnest money” Broker knows more about real estate law Default rule that seller keeps earnest money encourages broker to bring it up if it’s efficient to change this Courts will impute missing price of a good, but not quantity Forces parties to explicitly contract on quantity, rather than leave it for court to decide 32 When to use penalty defaults? Look at why the parties left a gap in contract Because of transaction costs use efficient rule For strategic reasons penalty default may be more efficient Similar logic in a Supreme Court dissent by Justice Scalia Congress passed a RICO law without statute of limitations Majority decided on 4 years – what they thought legislature would have chosen Scalia proposed no statute of limitations; “unmoved by the fear that this… might prove repugnant to the genius of our law…” “Indeed, it might even prompt Congress to enact a limitations period that it believes appropriate, a judgment far more within its competence than ours.” 33 When should a contract not be enforced? 34 When should voluntary trade not be allowed? Going back to property law… Coase Theorem: to get efficient outcomes, we should let people trade whenever they want to But also saw some exceptions – some trades that aren’t, and shouldn’t, be allowed Selling enriched uranium to a terrorist Similarly with contract law… First day: to get efficient outcomes, enforce any contract both parties wanted enforced But next, we’ll see exceptions – contracts which shouldn’t be enforced, due to externalities or market failures/transaction costs 35 Example of an unenforceable contract: a contract which breaks the law Obvious: contract to buy a kilo of cocaine is unenforceable 36 Example of an unenforceable contract: a contract which breaks the law Obvious: contract to buy a kilo of cocaine is unenforceable Less obvious: otherwise-legal contract whose real purpose is to circumvent a law Legal doctrine: derogation of public policy Derogate, verb. detract from; curtail application of (a law) Applies to contracts which could only be performed by breaking law… …but also to “innocent” contracts whose purpose is to get around a law or regulation 37 Derogation of public policy – example Labor unions required by law to negotiate “in good faith” Recent NBA labor troubles Old CBA: 57% of “basketball-related income” went to player salaries Owners were offering less than 50%, players demanding 53%... Imagine the following contract: “For the next 50 years, if the NBAPA accepts a CBA paying less than 55% of BRI in player salaries, then we also agree that all non-retired players will work for you as coal miners every offseason at federal minimum wage.” Purpose is purely to “bind hands” in negotiations with ownership Contract would not be enforced 38 Derogation of public policy In general: a contract is not enforceable if it cannot be performed without breaking the law Exception: if promisor knew (and promisee didn’t) I’m married, my girlfriend in California doesn’t know; I promise her I’ll marry her, she quits her job and moves to Madison My company agrees to supply a product that we can’t produce without violating a safety or environmental regulation Keeping either promise would require breaking the law… …but I’d still be liable for damages for breach Like in Ayres and Gertner: default rule penalizes betterinformed party for withholding information 39 Default rules versus regulations Talked earlier about default rules Default rules apply if no other rule is specified… …but can be contracted around Rules like “derogation of public policy” cannot be contracted around Parties to a contract can’t say, “even though this type of contract would normally not be valid, this one is” Rules which always apply: immutable rules, or mandatory rules, or regulations Fifth purpose of contract law is to minimize transaction costs of negotiating contracts by supplying efficient default rules and regulations. 40 Ways to get out of a contract 41 Formation Defenses and Performance Excuses Formation defense Claim that a valid contract does not exist (Example: no consideration) Performance excuse Yes, a valid contract was created But circumstances have changed and I should be allowed to not perform without penalty Most doctrines for invalidating a contract can be explained as either… Individuals agreeing to the contract were not rational, or Transaction cost or market failure 42 One formation defense: incompetence Courts will not enforce contracts with people who can’t be presumed to be rational Children Legally insane Incompetence One party was “not competent to enter into the agreement” No “meeting of the minds” 43 So… If courts won’t enforce a contract signed by someone who wasn’t competent… What if you signed a contract while drunk? You need to have been really, really, really drunk to get out of a contract (“Intoxicated to the extent of being unable to comprehend the nature and consequences of the instrument he executed”) Lucy v. Zehmer, Virginia Sup Ct 1954 44 Lucy v. Zehmer Zehmer and his wife owned a farm (“the Ferguson farm”), Lucy had been trying to buy it for some time While out drinking, Lucy offers $50,000, Zehmer responds, “You don’t have $50,000” “We hereby agree to sell to W.O. Lucy the Ferguson Farm complete for $50,00000, title satisfactory to buyer.” 45 Lucy v. Zehmer Zehmer and his wife owned a farm (“the Ferguson farm”), Lucy had been trying to buy it for some time While out drinking, Lucy offers $50,000, Zehmer responds, “You don’t have $50,000” “We hereby agree to sell to W.O. Lucy the Ferguson Farm complete for $50,00000, title satisfactory to buyer.” 46 Lucy v. Zehmer So, you can be pretty drunk and still be bound by the contract you signed Might think “meeting of the minds” would be impossible But imagine what would happen if the rule went the other way 47 Lucy v. Zehmer So, you can be pretty drunk and still be bound by the contract you signed Might think “meeting of the minds” would be impossible But imagine what would happen if the rule went the other way Borat lawsuits Julie Hilden, “Borat Sequel: Legal Proceedings Against Not Kazahk Journalist for Make Benefit Guileless Americans In Film” Moral of the story: don’t get drunk with people who might ask you to sign a contract 48 First Midterm Overall: pretty good Average and median both 81, std dev 11 Not assigning letter grades till end of semester, but… A-H to give a rough idea of how you’re doing, based on distribution of scores on first midterm, 77-87 roughly a B, 65-72 roughly a C I-O P-Z 49