Econ 522 – Lecture 11 (Oct 11 2007)

advertisement

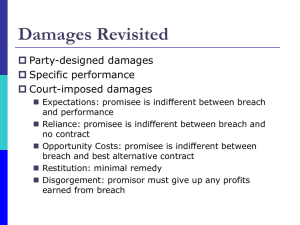

Econ 522 – Lecture 11 (Oct 11 2007) Tuesday, we asked the question of what promises the law should enforce, and introduced contract law as the attempt to answer that question. We talked about one early attempt to answer that question, the bargain theory of contracts, and some of the problems with it. We showed an example of an agency game, where my inability to commit to a future action led to a breakdown in cooperation… …we said that the first purpose of contract law is to enable cooperation, by turning games with noncooperative solutions into games with cooperative solutions… …and we argued that efficiency generally requires a promise to be enforceable if both the promisor and the promisee wanted it to be enforceable when it was made We saw an example of how asymmetric information can inhibit trade… …and claimed that the second purpose of contract law is to encourage the efficient disclosure of information We discussed the fact that efficiency sometimes requires breaching a contract… …and said that the third purpose of contract law is to secure optimal commitment to performing… …and argued that setting the promisor’s liability equal to the promisee’s benefit – expectation damages – accomplishes this goal We discussed the idea of reliance, that is, investments made by the promisee to increase their benefit from the promise… …and said that the fourth purpose of contract law is to secure the optimal level of reliance… …and then we ran out of time. Today, I want to go back over the example of efficient breach, since I think I went through that a bit fast… do an example of reliance… then move on to default rules and mandatory rules I want to quickly go back to the example of efficient breach, since I felt like we went through it too quickly. Suppose that I build airplanes, and you contract to buy one from me. You value the airplane at $500,000. We agree on a price of $350,000. It will simplify the example if we assume you paid me up front; so let’s assume this contract was money-for-a-promise: you already paid up front and I promised to deliver a plane. (This doesn’t really matter much, it just makes all the numbers positive.) The rule for efficient breach is: If [ Promisor’s Cost ] > [ Promisee’s Benefit ] Efficient to breach If [ Promisor’s Cost ] < [ Promisee’s Benefit ] Efficient to perform Since the promisee’s benefit is known to be $350,000, it is efficient to perform whenever the cost of building the airplane is below $350,000, and efficient to breach whenever the cost is above $350,000. Since the promisor only looks at his own private cost and benefit when deciding whether to breach or perform, If [ Promisor’s Cost ] > [ Liability ] Promisor will breach If [ Promisor’s Cost ] < [ Liability ] Promisor will perform In the case of perfect expectation damages, the promisor’s liability would be the amount of benefit the promisee would have received, which is $350,000; this leads to the promisor performing whenever the cost of building the airplane is less than $350,000, which is exactly what efficiency would require. Setting the promisor’s liability at any other level would lead to some instances of either inefficient breach (if liability were too low) or inefficient performance (if liability were too high). On to reliance. You’ll recall that reliance is any investment the promisee makes that increases the value of performance. So you contract to buy my painting, and go buy a frame for it; or you contract to buy an airplane from me, and you start building a hangar. Since reliance increases the value of the promise to you, it increases my liability for breach under the concept of expectation damages as we’ve defined them. (That is, if I break the promise, I’m responsible for making you as well off as you would have been if I had kept my word; so if you’ve built a hangar, now I have to reimburse you for the value of the plane with a hangar, rather than without a hangar.) So reliance increases my losses under breach. But you don’t take that into account when deciding how much to invest in reliance, so there is no guarantee that the level of reliance will be efficient. We’ll use the same example – you contract to buy a plane from me. You value the plane at $500,000, and agree to pay $350,000 for it. Let’s assume that this time, the bargain is promise-for-a-promise – you agree to pay on delivery. And there are perf exp damages. Now you have the option of building yourself a hangar. Building a hangar costs $75,000, and increases the value of owning a plane from $500,000 to $600,000. Suppose that it’s most likely that building the plane will cost me $250,000; but that there’s some probability p that it will instead cost $1,000,000. Clearly, if it costs $1,000,000, I won’t build it; I’ll just breach the contract and accept that I have to pay you damages. Let’s look at what happens in each case. First, suppose the cost of the plane is $250,000, so I build it. Our payoffs (in thousands): If you relied (built the hangar): If you didn’t rely (build) you get 600 – 75 – 350 = 175 I get 350 – 250 = 100 you get 500 – 350 = 150 I get the same 350 – 250 = 100 Now look at the case where the cost of sheet metal went through the roof and I choose to breach. Assuming I owe perfect expectation damages as we’ve defined them – that is, enough to make you as well off as if I’d performed… If you relied (built the hangar): Your surplus would have been 600 – 350 = 250 from the plane, so I owe you 250 in damages And you paid 75 to build the hangar So you end up with payoff of 175 I get –250 (since I have to pay you 250 in damages) If you didn’t rely (build) Your surplus would have been 500 – 350 = 150, so I owe you 150 in damages, which is your payoff I get –150 after paying you damages So whether or not I perform, you get 175 if you relied, 150 if you didn’t. So clearly, reliance makes you better off. But then the question is, is reliance efficient? That depends on how likely I am to breach. If you rely, our combined expected payoffs are (1–p) (175 + 100) + p (175 – 250) = 275 (1–p) – 75 p = 275 – 350 p If you didn’t rely, our combined expected payoffs are (1-p) (150 + 100) + p (150 – 150) = 250 – 250 p So the total social gain from you building the hangar is (275 – 350 p) – (250 – 250 p) = 25 – 100 p So it turns out that when p < ¼, reliance is efficient – it increases our combined payoffs. When p > ¼, reliance is inefficient – it decreases our combined payoffs. This is indicative of a more general idea: when the probability of breach is low, more reliance tends to be efficient; when the probability of breach is high, less reliance tends to be efficient. But if my damages cover your benefit whether or not it’s efficient, then you don’t care about the risk of breach – you end up just as well off whether or not I breach. So you’ll clearly choose the higher level of reliance, whether it’s efficient or not. This will sometimes lead to overreliance – more reliance than is efficient. So how do we fix this? Cooter and Ulen adjust their definition of perfect expectation damages in the following way: Perfect expectation damages restore the promisee to the level of well-being he would have had, had the promise been kept, and had he relied the optimal amount. (This is why they attach the word “perfect” to expectation damages) Thus, the promisee is rewarded for efficient reliance – this increases his payoff from performance of the promise, and also increases his payoff from breach, since it increases the amount of damages he receives. But the promisee is not rewarded for excessive reliance – overreliance – since damages are limited to the benefit he would have received given the optimal level of reliance. It’s a nice idea, but it seems like it would be very hard in general for a court to determine after the fact what the optimal level of reliance was. (It might also be hard for the promisee to know this, since he may not know the probability of breach.) What is actually done in practice? One important legal doctrine is to limit liability to a level of reliance that is “foreseeable”. That is, reliance is “foreseeable” if the promisor could reasonably expect the promisee to rely that much under the circumstances. Reliance is unforeseeable if it would not be reasonably expected. American and British law tend to define overreliance as unforeseeable, and therefore noncompensable. An example given in the book is a telegraph company failing to transmit a stockbroker’s message, resulting in millions of dollars in losses. The telegraph company could not reasonably expect the stockbroker to rely that heavily on one message, and so would not be liable for the extent of the losses. Another example: the rich uncle’s nephew, when he was promised a trip around the world, went out and bought “a white silk suit for the tropics and matching diamond belt buckle”. After the uncle refuses to pay for the trip, the nephew sells the suit and belt buckle at a loss, and sues his uncle for the difference. The court might find the silk suit foreseeable reliance, but the diamond belt buckle unforeseeable, and only award him the loss on the suit. (The book points out that “in American law, gift promises are usually enforceable to the extent of reasonable reliance.”) Reliance is part of the issue in the famous case of Hadley v Baxendale, a precedentsetting English case decided in the 1850s. Hadley ran a mill. The crankshaft broke, forcing the mill to shut down until it was fixed. Hadley contracted with Baxendale to transport the crankshaft to engineers who would fix it – it was supposed to be delivered in a day. Baxendale delivered it a week later than promised, and Hadley sued for the profits he lost during that extra week in which the mill was shut down. The ruling was that the lost profits were not foreseeable – the court specifically listed several circumstances in which a broken crankshaft would not force a mill to shut down – and that Baxendale was only liable for damages he could reasonably have foreseen. However, this isn’t just a question of reliance; part of the issue is that Hadley knew about the urgency of getting the crankshaft fixed quickly, but did not tell Baxendale. We’ll come back to this question of information shortly. default rules If transaction costs are 0, then the two sides to a contract could spell out exactly what should occur in every possible contingency – what happens if the cost of sheet metal rises, what happens if my uncle wants my painting, what happens if a shipment is delayed, and so on. This would make contract law much simpler – courts could simply enforce the letter of the contract, since nothing was left unclear. However, in reality, some circumstances are impossible to foresee; and even if they weren’t, the cost and complexity of writing a contract to deal with every possibility would make perfect contracts unworkable. Risks or circumstances that aren’t specifically addressed in a contract are called gaps; default rules are rules that the court applies to fill in these gaps. Gaps can be inadvertent or deliberate. Our contract to sell you my painting might not have addressed my uncle wanting the painting because I didn’t know he was coming to visit, or because I never would have imagined he would be so excited about it. On the other hand, we could have imagined that it was at least possible for the price of raw materials for building an airplane to go up significantly; however, we might have felt it was such a remote risk that it was not worth the time and effort to build it into the contract. Cooter and Ulen point out the decision to leave a gap or fill it (specifically address a particular contingency) is the difference between the need to allocate a loss after it has occurred (ex post) versus the need to allocate a risk before it becomes a loss (ex ante). In the first case, allocating the risk, the cost of adding it to the contract is definitely incurred; in the second case, allocating a loss that has occurred, the cost of allocating the loss is only incurred when the loss occurs. Thus, it is often rational to leave gaps when the risk is very remote. (On the other hand, it is usually cheaper to allocate a risk ex ante than a loss ex post.) So the courts must decide what “default rules” should apply to circumstances that are not addressed in a contract, that is, what rules should fill the gaps that are left in imperfect contracts. The next obvious question is: what should these default rules be? Cooter and Ulen answer this question by going back to the Normative Coase Theorem: the law should be structured to minimize transaction costs. Since filling a gap in a contract requires some cost, the default rule should be the rule that most parties would want if they chose to negotiate over the issue. This way, most contracts will not have to address this particular rule – they can use the default rule – and therefore avoid additional transaction costs. And the rule that most parties would want is whatever rule is efficient. They give an example: a construction company has contracted to build a house for a family, and there is some risk of a worker strike at the company which would delay completion of the house. They suppose that the company can bear the risk of a strike at a cost of $60, and that the family can bear the risk at a cost of $20. (It might be cheaper for the family to bear the risk because they could stay with friends for a while if the house were delayed; if the company held the risk, it might have to pay for a hotel for the family.) (Also note that these numbers are low not because a strike would have low costs, but because a strike might be fairly unlikely, and so the expected cost is fairly low.) If the risk were not addressed by the contract, the default rule would apply. If the default rule were for the construction company to bear the risk, this would be inefficient in this case. The parties could create an additional $40 of surplus by overruling the default rule (addressing the risk). So as long as the transaction cost of allocating the risk were not too large, they would choose to do so, but incur this transaction cost. On the other hand, if the default rule were for the family to bear the risk, they would not need to address the risk in the contract, and would not incur the transaction cost. This brings Cooter and Ulen to their fifth pronouncement: The fifth purpose of contract law is to minimize transaction costs of negotiating contracts by supplying efficient default rules. They also offer a simple rule for doing this: Impute the terms to the contract that the parties would have agreed to if they had bargained over the relevant risk. That is, figure out what terms the parties would have chosen if they had chosen to address a risk, and let those be the default rule. Of course, you don’t want a lot of ambiguity in the law, so you don’t want the default rule to vary constantly with the particular circumstances of a given case; so what’s more practical to do is to set the default rule to the terms that most parties would have agreed to. This is called a “majoritarian” default rule. In circumstances where this is not the efficient rule, the parties are still free to contract around it, that is, to put terms in the contract that overrule the default rule. Of course, if the parties had chosen to address a particular risk, it’s safe to assume that they would have allocated it efficiently – that is, as long as the parties were choosing to consider a risk, they would allocate it in the way that led to the highest total surplus, and then compensate the party who bears the risk for bearing it. Thus, this is what the court would need to do to figure out the efficient default rule: it should figure out the efficient allocation of risks, and then adjust prices in a reasonable way. The book gives an example of this. Go back to the house construction example, but with different numbers. Suppose the family and the company sign a contract. The construction company knows that with probability ½, the price of copper pipe will go up in such a way as to increase the cost of construction by $2000. So in expectation, the cost of construction will be $1000 higher due to this risk. The company can hedge against this risk (by buying copper pipe in advance and then paying to store it somewhere) at a cost of $400. Assume that the family has no reason to know anything about the cost of copper pipes, and therefore does not anticipate the risk or have any way to mitigate it. The company chooses not to hedge this risk, the price of copper pipes goes up, the company builds the house and bills the family $2000 more than they had expected. The family refuses to pay, and the case goes to court. The original contract does not mention the risk of soaring copper prices. So how would the court address this? First, the court must decide to whom the contract would have allocated this risk, if it had addressed it. Then it must adjust prices to reflect this. In this case, the cost of bearing the risk would be $1000 to the family (since they have no way to mitigate it), but $400 to the company (since hedging the risk is cheaper than bearing it). So the company is the efficient bearer of the risk; so an efficient contract would have allocated this risk to the company. Next, the court must consider whether the price should be adjusted. In this case, the court might rule that the risk of a spike in copper prices was foreseeable. The construction company was the efficient bearer of risk, and foresaw, or should have foreseen, that this risk was present; so the court could assume that the price the parties negotiated already included compensation for bearing this risk. On the other hand, there are some risks that are unforeseeable. Suppose that the leader of the copper miners’ union in Peru died, and there was a battle to succeed him, and that his replacement called a strike to flex his muscles, and that this strike was what led to the increase in copper prices. Here, it’s reasonable that neither party would have foreseen the risk. In this case, the construction company might still be the efficient bearer of this risk – since they might be able to make changes to the construction plan to use less copper and more of other materials. But since the risk was unforeseen, it was not included in the negotiated price. So the court might adjust the price paid to the construction company, to compensate them for the risk; but then still hold the construction company responsible for the extra $2000 in costs. Thus, the ruling might be that the family should pay some smaller amount – say, $700 – which is what the company would have needed to receive as compensation for bearing this risk – but that the company was then responsible for the rest of the $2000. (The book then continues this story to give another example of overreliance and breach – check it out if you’re still confused about these points.) So the rule in Cooter and Ulen is fairly straightforward: courts should set default rules that are efficient in most cases, so that most parties can leave that risk unaddressed and save on transaction costs, while parties can contract around this rule in circumstances where it is not efficient. Ian Ayres and Robert Gertner offer a very different take on default rules, in the article on the syllabus, “Filling Gaps in Incomplete Contracts: An Economic Theory of Default Rules.” Rather than setting default rules to be what the parties would have wanted, they argue that in some instances, it is better to make the default rule something the parties would not have wanted; either to give the parties an incentive to specifically address an issue rather than leaving a gap, or to give one of the parties an incentive to disclose information. They refer to this type of intentionally-inefficient default rule as a “penalty default.” Ayres and Gertner argue that in some cases, gaps are left not because the of the transaction costs of filling them, but for strategic reasons. One party might know that the default rule is inefficient; but negotiating around the default rule would require him to give up some valuable information, so he might be tempted not to. Consider again the case of the Hadley v Baxendale, the miller with the broken crankshaft. While the crankshaft is en route, Hadley’s mill is not operating, so he’s losing money. Baxendale, the shipper, is the only one who can influence when the crankshaft is delivered; so he is likely the efficient bearer of this risk. (It was his choice to ship the crankshaft by boat, rather than by rail, that led to the delay.) If the default rule were for Baxendale to be responsible for any lost profits, however, Hadley has no incentive to make clear how important it is that the crankshaft be delivered promptly. In fact, he is likely to not want to mention it; if he made it clear how important the crankshaft was, then Baxendale might be able to charge him a higher price for delivery! So a default rule holding Baxendale responsible for lost profits due to delay would lead Hadley not to disclose the urgency of his shipment, which would pretty clearly be bad. On the other hand, a default rule that Baxendale is not responsible for lost profits seems to be inefficient – we just argued that Baxendale is the efficient bearer of this risk. So this gives Hadley an incentive to try to negotiate different terms in the actual contract. Over the course of doing so, the urgency would become apparent; Baxendale would take on the risk, but would also know the costs of delay, and could plan around them better. So Ayres and Gertner argue that the ruling in Hadley was a good one, not because the default rule was efficient, but because it was inefficient in a way that created good incentives: the incentive for the better-informed party to disclose information. (In this sense, the default rule is a “penalty default:” it penalizes the better-informed party, giving an incentive to contract around the default.) They give other examples where penalty defaults are used in the same way. Consider a real estate broker who is brokering the sale of a house by a private seller to a private buyer. When a buyer’s offer is accepted, he puts down a deposit, called “earnest money,” to show that he is serious; if he then backs out of the deal, this earnest money is lost. The question remains, how should the earnest money be divided between the seller and the broker? Both the broker and the seller are inconvenienced by the breach; it’s not really clear who is the efficient bearer of this risk. However, what is clear is that the broker is probably better informed about the laws of real estate contracts. The broker is a professional, who does this type of transaction for a living. The seller might be selling a house for the first time. If the default rule allowed the broker to keep the earnest money, the broker has no reason to bring this up when negotiating a contract with the seller. But the seller might not know to bring this up; the seller might have no idea about earnest money, and not realize that this was another point that could be negotiated with the broker. On the other hand, if the default rule gave the earnest money to the seller, the broker would clearly know this, and would have a clear incentive to raise this with the seller, and then they could negotiate whatever was the efficient allocation of the earnest money. Thus, whether or not it’s efficient, a default rule favoring the less-informed party once again gives an incentive to disclose information, which may be desireable. Ayres and Gertner give another compelling example of penalty defaults used for a different purpose. When a contract does not specify a price for a good, courts will tend to impute whatever the market price was at the time of the transaction. However, when a contract does not specify a quantity, courts will refuse to enforce the contract – in effect, setting a quantity of 0. That is, the default rule for price tends to be market price, while the default rule for quantity tends to be 0. A quantity of 0 cannot possibly be what the parties would have wanted – nobody would go through the hassle of signing a contract in order to transact no goods. So what is the reason for this default rule? Ayres and Gertner argue it is a penalty default, to force the parties to decide on a quantity. But why should the parties be forced to decide on a quantity and not a price? This is because it’s easier (cheaper) for the court to fill in the price than the quantity. The rule for figuring out the price the parties would have agreed to is easy – the court can usually ascertain the market price of a given good on a given date without much difficulty. However, if the court had to impute the quantity the parties would have wanted, this is much more difficult – the court would have to figure out the marginal value of an incremental unit of the good to each side to figure out the efficient amount to transact. Thus, shifting the burden of calculating the right quantity from the parties in the contract to the courts is inefficient; so the default rule forces the parties to decide on the quantity themselves. Ayres and Gertner do not argue penalty defaults should always be used, only that they are appropriate in certain circumstances. They basically argue that we need to look at why parties to a contract leave a particular type of gap. When gaps are left due to transaction costs of filling them, efficient defaults make sense. However, when gaps are left strategically – by a well-informed party who chooses not to contract around an inefficient default in order to get “a bigger share of a smaller pie” – penalty defaults may be more efficient. (In the conclusion, they cite an analogous view in a dissent by Supreme Court Justice Scalia in a case where the Court was asked to supply a default statute of limitations for a RICO statute where the legislature had not specified a statute of limitations. The majority set the statute of limitations at 4 years. Scalia proposed no statute of limitations; he was “unmoved by the fear that this… might prove “repugnant to the genius of our law”, saying, “indeed, it might even prompt Congress to enact a limitations period that it believes appropriate, a judgment far more within its competence than ours.”) It’s a pretty cool article – take a look if you’re interested. immutable rules/regulations Default rules are rules which hold when a contract leaves gaps, but which parties to a contract are free to contract around. (That is, by specifying a rule for a particular situation, they “overrule” the default.) However, there are some rules that cannot be contracted around. Ayres and Gertner refer to these as immutable rules. Cooter and Ulen refer to them as mandatory rules, or as regulations. Their Fifth Purpose of Contract Law, which we mentioned earlier, is actually, The fifth purpose of contract law is to minimize transaction costs of negotiating contracts by supplying efficient default rules AND REGULATIONS. What are the circumstances where regulations, or mandatory rules, or immutable rules make sense? That is, in what circumstances should a rule be made that individuals are not able to voluntarily contract around? Going back to Coase, if individuals are rational and there are no transaction costs, private negotiations (in this case, contracting) will lead to efficiency, so any additional regulation would be inefficient. Conversely, regulation may be efficient in situations where individuals are not rational, or there are transaction costs or market failure. We look at a bunch of these cases. The first thing we said – that individuals are rational – is not always the case, and courts generally do not enforce contracts made by irrational individuals. Several ways that this can happen: children cannot sign binding contracts the legally insane cannot sign binding contracts courts will not enforce contracts signed under “dire constraints”, specifically, duress and necessity Necessity is when I’m at the point of starvation, and someone comes along and offers me a sandwich for $10,000. I don’t have it on me, so I sign a contract agreeing to pay him $10,000 and I eat the sandwich. Or I’m on a boat that’s about to sink, and another boat offers me a ride back to shore for a million dollars. In either case, the contract would not be upheld, since I signed it out of necessity. Duress is similar, but the uncomfortable situation is being caused by the other party. This is when someone kidnaps my child, and I agree to pay ransom to get her back. The contract is not enforceable, because I agreed to it under duress. Much as everyone loves the idea of “making him an offer he can’t refuse” from the Godfather, courts would not uphold a contract signed at gunpoint. (Of course, whether you want to breach a contract with the Mafia, or sue the Mafia, is a separate question.) There are a number of other situations in which private contracting would not necessarily lead to efficient results, and therefore there is potential gain from regulation. The book categorizes all of these situations as “transaction costs,” but they are worth talking about individually. One is spillovers, that is, when a contract between two parties (A and B) has an effect on another party (C). In many cases, this can be thought of as an externality. A is a power plant, and signs a contract with B to provide power; but generating more power generates more pollution, which harms C. In these cases, the remedy is generally not through contract law, but through other branches of law – property and nuisance law, or torts, or other areas. In this case, the contract between A and B would be upheld, and C could sue A for damages under nuisance law. One exception to this is contracts that deliberately “tie one’s hands” in negotiations. Suppose that B and C are labor and ownership at some factory, and are engaged in negotiations over wages. B wants the workers it represents to earn $15 an hour, C is offering $10, and negotiations are ongoing. Now B turns around and signs the following contract with A: B promises to go to work for A for $1 an hour if he ever signs a contract with C for less than $15 an hour. The intent of this contract is purely to strengthen his bargaining position with C – by “burning his bridges”, that is, by making it much more painful to back down from his demands. Clearly, this contract between A and B would have an effect on C. In the U.S., unions have a statutory obligation to bargain “in good faith”; the contract between the union (B) and firm A would make B violate this obligation; so the contract would be ruled to be unenforceable. Contracts may be deemed unenforceable if enforcing them would derogate public policy. In this example, enforcing the contract between A and B would derogate (undermine) B’s statutory obligation to bargain in good faith. There are other examples of contracts which would derogate public policy. The book gives the example of a victim of a crime offering a policeman a reward for solving the crime. The police’s job is to solve crimes; allowing rewards might distort the focus toward crimes with rewards, away from more important crimes without rewards. Another example would be a contract among competitors to act as a cartel, similar to a monopoly. A contract that fixed prices, say, would derogate laws designed to foster competition, and would therefore be unenforceable. A contract to buy illegal drugs would similarly be considered unenforceable. There are examples where, even though one side performing would require laws to be broken, the contract is still enforced, that is, a remedy is still supplied for breach. Three examples from the book: “A married man may be liable for inducing a woman to rely on his promise of marriage, even though the law prohibits him from marrying without first obtaining a divorce.” “A company that fails to supply a good as promised may be liable even though selling a good with the promised design violates a government safety regulation.” “A company that fails to supply a good as promised may be liable even though producing the good is impossible without violating an environmental regulation.” In all these examples, the liability should rest on the party that knew, or should have known, that it was committing to something illegal. Similar to the reasoning in Ayres and Gertner, putting the liability on the informed party gives them an incentive to be honest (or in these cases, to not enter into this type of contract). Thus, Cooter and Ulen argue that the promisor should be liable for breach if he knew (or should have known) that the promise was illegal but the promisee did not. On the other hand, the promisor should not be liable if he did not know the promise was illegal and the promisee did.