MODELING CATASTROPHE

THE EXPECTED UTILITY HYPOTHESIS AND EVIDENCE FROM CALIFORNIA

EARTHQUAKE INSURANCE

A Thesis

Presented to the faculty of the Department of Economics

California State University, Sacramento

Submitted in partial satisfaction of

the requirements for the degree of

MASTER OF ARTS

in

Economics

by

Christopher John Newton

SUMMER

2013

© 2013

Christopher John Newton

ALL RIGHTS RESERVED

ii

MODELING CATASTROPHE

THE EXPECTED UTILITY HYPOTHESIS AND EVIDENCE FROM CALIFORNIA

EARTHQUAKE INSURANCE

A Thesis

by

Christopher John Newton

Approved by:

__________________________________, Committee Chair

Jonathan D. Kaplan, Ph.D.

__________________________________, Second Reader

Kristin Kiesel, Ph.D.

____________________________

Date

iii

Student: Christopher John Newton

I certify that this student has met the requirements for format contained in the University

format manual, and that this thesis is suitable for shelving in the Library and credit is to

be awarded for the thesis.

__________________________, Graduate Coordinator

Kristin Kiesel, Ph.D.

Department of Economics

iv

___________________

Date

Abstract

of

MODELING CATASTROPHE

THE EXPECTED UTILITY HYPOTHESIS AND EVIDENCE FROM CALIFORNIA

EARTHQUAKE INSURANCE

by

Christopher John Newton

Catastrophic events and the damages they cause have recently been paid more

attention due to their increased severity and frequency. For society to better prepare for

and ameliorate the consequences of these events, it is important to understand how people

make decisions when faced with choices involving disaster mitigation strategies. This

thesis examines the expected utility theory of insurance demand, insurance being a

widely-used disaster mitigation tool, and uses an empirical demand estimation to test the

predictions it makes concerning how the purchase of earthquake insurance varies with

price, income, and risk. Expected utility theory is one of the most widely used decision

theories of the past century, it can and has been used to model people’s choices under the

type of uncertainty catastrophic events create, and its predictive validity is still uncertain.

Three years of zip code level California Earthquake Authority (CEA) data are used

to estimate income, risk, and price elasticities for residential housing earthquake

insurance demand. In order to better deal with the disadvantages created by the time

v

invariant risk data used, several models are estimated to study the robustness of the

results across specification. A total of six models are estimated, including two pooled

models, two time fixed effects models, and two earthquake zone fixed effects models.

The first four models estimate elasticities for price, income, and risk. The two earthquake

zone fixed effects models estimate elasticities for price, and income.

The estimated elasticities are then compared to theoretical predictions of the

elasticities. Both the price and income elasticities are predicted to be either positive or

negative, the empirical results showing them negative and positive respectively. The

predicted risk elasticity is positive, and the empirical results agree with the prediction.

The empirical results find the signs of the elasticities of price, income, and risk robust

over specification, but the magnitudes change from elastic to inelastic across some of the

different models. The estimated risk elasticity changes significance depending on

specification. One concern with the analysis was in how risk was measured. Every effort

was made to characterize risk so inferences could be drawn from the analysis. In the

future, researchers should try to obtain risk data that changes over time and across entity

in order to more accurately test predictions about how risk plays a part in individual’s

insurance purchasing decisions.

_______________________, Committee Chair

Jonathan D. Kaplan

_______________________

Date

vi

ACKNOWLEDGEMENTS

First, I would like to thank Professors Jonathan Kaplan and Kristin Kiesel for

their guidance and support throughout the completion of this thesis.

Secondly, I would like to thank my family, the Berkeley Crew, Skunky Dunky,

and the Sacramento Crew. I would also like to thank those people close by and abroad I

hope to see soon, thank you.

vii

TABLE OF CONTENTS

Page

Acknowledgements .................................................................................................... vii

List of Tables ................................................................................................................ x

List of Figures ............................................................................................................. xi

Chapter

1. INTRODUCTION ………………………………………………………………... 1

2. LITERATURE REVIEW ....................................................................................... 5

2.1. Introduction ................................................................................................ 5

2.2. Expected Utility Theory............................................................................. 6

2.2.1. Theoretical Studies...................................................................... 6

2.2.2. Empirical Studies ........................................................................ 9

2.3. Demand Estimation Studies ..................................................................... 11

2.4. Theoretical and Empirical Studies ........................................................... 13

2.5. Summary .................................................................................................. 13

3. THEORY .............................................................................................................. 14

4. DATA ................................................................................................................... 19

4.1. Data Summaries and Variable Formulation ............................................. 19

4.2. Scatter Plots ............................................................................................. 28

4.3. Summary .................................................................................................. 32

viii

5. DEMAND ESTIMATION.................................................................................... 33

5.1. Estimation Models and Estimation Results ............................................. 33

5.2. Pooled Data Regression Model ................................................................ 34

5.3. Inclusion of Time Fixed Effects .............................................................. 35

5.4. Further Examination without Risk ........................................................... 38

5.5. Earthquake Zone Fixed Effects ................................................................ 40

5.5. Remarks ................................................................................................... 41

6. CONCLUSION ..................................................................................................... 43

References ................................................................................................................... 46

ix

LIST OF TABLES

Tables

Page

1.

Table 4.1. Summary Statistics for Insurance and Income Data………………. 22

2.

Table 4.2. Summary Statistics for Census Data………….………………...….. 24

3.

Table 4.3. Summary Statistics for Interpolated Census Data…………………. 24

4.

Table 4.4. Summary Statistics for Dependent and Independent Variables….... 27

5.

Table 5.1. Regression Results for Models 1 and 2……….…………………… 36

6.

Table 5.2. Regression Results for Models 3 and 4……………………….….... 38

7.

Table 5.3. Regression Results for Models 5 and 6..……………..……………. 42

x

LIST OF FIGURES

Figures

Page

1.

Figure 4.1. Scatter Plots for the 2005 Data……………….…………….….. 29

2.

Figure 4.2. Scatter Plots for the 2007 Data…………….…………….…….. 30

3.

Figure 4.3. Scatter Plots for the 2009 Data….………….……………….…. 31

4.

Figure 5.1. Estimated Zonal Effect for Model 6 By Income…….…………. 41

xi

1

Chapter 1

INTRODUCTION

The decision making processes of individuals faced with the uncertainty of low

probability-high impact events has long been studied by economists, management

scientists, and psychologists. Low probability, high consequence events can be defined

here as those events perceived both by the public and by experts as having a low

probability of occurrence. The study of this subject involves scientists employing a wide

spectrum of techniques and reporting an even broader spectrum of results. Today this

research has extra relevance due to its affiliation with modern catastrophes both natural

and man-made, garnering the continued interest of scientists, politicians, and the general

community.

Scientists use a range of tools, both theoretical and empirical, in their pursuit of

understanding people’s choices. One of these tools is the expected utility hypothesis,

which is a decision making theory described by Schoemaker (1982) as one of the most

important decision making tools developed in the last half century. The theory assumes

economic agents maximize expected utility, while at the same time adhering to several

axioms. The theory enjoys a long and diverse literature, and is applied in all types of

decisional situations. For example, Arrow (1963) shows that if actuarial fair insurance is

offered, then it is optimal to purchase full coverage. Also, the theory is discussed in

Shoemaker’s (1982) review of Bernoulli and Cramer (1738) to explain the Petersburg

2

paradox1. These empirical and theoretical studies have had mixed results in showing that

the theory can explain real world circumstances.

The expected utility hypothesis as applied to decisions specifically involving low

probability-high consequence events has a much less extensive literature associated with

it. These related studies have the same amount of varying success as the larger body of

research showing that the expected utility hypothesis is an accurate way of modeling

people’s decisions. Many, including Kunreather and Schoemaker (1979) have concluded

that an individual does not act like they are maximizing expected utility when making

decisions about these types of low probability events.

This thesis aims to study the consumer demand for catastrophic earthquake

insurance, and asks questions about people’s decision making behaviors relative to the

underlying expected utility theory assumptions. Catastrophic events and the damages

they can cause have recently been paid more attention due to their increased severity and

frequency, and this thesis uses publicly available data on earthquake insurance in

California to advance knowledge in the area of decision science as applied to catastrophic

mitigation tools. The results indicate the expected utility theory, when assuming a risk

averse utility function, correctly predicts the signs of income and risk elasticity as

positive. The empirical results are all mostly significant, with risk having possible fixed

effects issues. The theory predicts that price elasticity can have either a positive or a

negative relation with insurance demand, and the empirical results report a statistically

significant negative relationship across specifications.

1

A game considered to have an infinite expected payoff but also considered to be worth low amounts of

money

3

This thesis presents an expected utility model for the demand for insurance

developed by Lynch (1967). The model, in order to develop explicit demand expressions,

assumed people are risk averse when it comes to purchasing insurance, and assumed a

log functional form for people’s utility. This thesis makes the same assumptions. The

thesis then presents a utility maximization problem, and using first order conditions for

maximization, solves for the explicit functions of people’s demand as a function of

income, probability of event, and the price of the insurance. The equations for the

income, price, and risk elasticities are found using said first order conditions.

The thesis proceeds with a demand estimation by household over time. A total of

six models are estimated including two pooled models, two time fixed effects models,

and two earthquake zone fixed effects models, with the first four models empirically

synthesizing elasticities for price, income, and risk. In contrast, the two earthquake zone

fixed effects models empirically synthesize elasticities for only price, and income. The

different model formulations are used to check for agreement in estimated values of

independent variable across specification. The data used are California residential

earthquake insurance figures on amounts of insurance purchased, personal income

expenditures, and regional risk estimates. The data is publicly available through the

California Earthquake Authority (CEA). The signs of these elasticities can then be

compared with the theorized values, which, if they match, will add supporting evidence

to the validity of the expected utility theory’s assumptions.

All six models estimate price elasticities as negative and statistically significant.

The results continue to agree with the expected utility theory (when assuming a risk

4

averse utility function) by correctly predicting the positive sign of risk elasticity. Four

out of the six models estimate income elasticities as positive and statistically significant,

with only the zonal effects models reporting a non-statistically significant positive

elasticity. The two models estimating risk both report positive elasticities, with only the

time fixed effects model reporting a statistically significant value. Both results tentatively

correspond with the theories prediction that risk and income elasticities should always be

positive.

The remainder of this thesis is structured into four subsequent chapters. Chapter 2

presents previously conducted research in the area of decision theory, and in particular,

expected utility studies as they related to the purchase of consumer insurance. A survey

of work done in estimating different types of insurance then follows to give the reader a

solid background of the techniques, successes, and non-successes in estimating insurance

demand as a broad subject. Chapter 3 continues with a theoretical development of the

expected utility theory of catastrophic insurance demand first presented by Lynch (1967).

Theoretical predictions of the signs of income, price, and risk elasticities are developed.

The data used in the empirical estimation are presented in Chapter 4 as well as the

independent and explanatory variable formulations. Chapter 5 presents the empirical

estimation of California earthquake insurance demand and the results, along with

interpretations of the resulting variable coefficients. The thesis concludes with a

discussion of the results in Chapter 6.

5

Chapter 2

LITERATURE REVIEW

2.1. Introduction

This literature review describes past work and how this thesis adds to the current

body of knowledge concerning testing predictions of the expected utility (EU)

hypothesis. The thesis uses an earthquake insurance demand model over time to estimate

price, income, and risk elasticities and compare them with theoretical EU model

predictions. Past work on catastrophic insurance demand and the EU theory has not been

concerned with developing explicit demand functions for insurance purchases by

assuming any precise functional form of the utility function, which this thesis does.

While some studies (Lynch 1967) have assumed a functional form of the utility function

and then tested demand predictions using insurance purchase data, none have been done

using catastrophic insurance purchase data. Others, to be described below, have

performed demand estimation studies of earthquake insurance purchases but their results

were not used to test EU predictions.

This literature review first describes work related to the theoretical development

of the expected utility (EU) theory and the corresponding empirical studies supporting the

accuracy of its predictions. This thesis tests predictions derived from EU theory and the

reviewed studies also in one form or another test predictions made by the EU theory.

Some test the predictions in ways similar to this work, while others do not.

The review continues by focusing specifically on empirical insurance demand

studies and even more specifically, on earthquake insurance studies. The second part of

6

this thesis estimates several different earthquake insurance demand models, and then uses

the results of these estimations to test EU predictions. The empirical literature

summarized here provides insights for developing this thesis by exploring methods for

estimating demand models for earthquake insurance.

2.2. Expected Utility Theory

2.2.1. Theoretical Studies

This section outlines past theoretical research with regards to the expected utility

hypothesis, which is used in this thesis to explain the demand for catastrophic earthquake

insurance. Some past work has shown the EU framework does a good job explaining

observed behavior, and some have found the opposite. Though these studies do not all

use insurance demand estimation to test EU predictions, the broader concept of testing

EU predictions is what these studies have in common with this thesis.

The first contribution to the field came from Bernoulli (1738) when he

incorporated risk into the study of games. The Bernoulli/ Somers (1954) translation

elaborates on the details which include the assumption an individual perceives higher

satisfaction with higher wealth at a decreasing rate. This is another way of saying people

are assumed to be risk averse. Further, assuming that an individual’s satisfaction curve or

utility curve is concave, Somers was able to show specific insurance situations when the

expected utility after paying an insurance premium was higher than the expected utility if

not insured. This was the beginning of what would become the idea that people buy

insurance to maximize expected utility, and the framework would be used extensively. A

7

standard prediction of expected utility maximization models is that expected utility and

risk aversion are positively correlated. Though these studies by Bernoulli/ Somers (1954)

developed the language of expected utility, they did not develop explicit demand

functions to derive results from an empirical catastrophe insurance demand estimation,

which this thesis does.

Not until the work of von Neumann and Morgenstern (1953) would expected

utility be formally proved to be a rational choice. Shoemaker (1982), using this result,

explores how the EU framework contributes to a broad range of fields such as finance,

economics, psychology, and management science. Though mathematically manageable,

he describes how many empirical studies have shown the structural model of EU is not

capable of describing individual decision making.

There have been studies that have used the expected utility theory to make

predictions about insurance purchases, which is what the theoretical chapter of this thesis

does. Beenstock (1988) and Schlesinger (1981) have done work using the EU theoretical

framework that shows the purchase of insurance will increase with the size of possible

losses and the probability of these losses. Along similar lines, Beenstock (1988) shows

insurance purchases should decrease with the increasing price of the insurance. These

studies, being completely theoretical, lack real world data estimations.

An interesting result by Lee and Rice (1965) that deals with low probability

events is that people should prefer to insure low probability high loss events over high

probability low loss events for an event with the same expected value. The result

becomes clearer when analyzed through the maximization of expected utility not

8

expected value. Low probability, high loss events have a much lower expected utility

than high probability, low loss events, and therefore someone maximizing expected

utility will choose the former. Lee and Rice (1965) also use the expected utility theory

assumptions to derive theoretical predictions about low probability high impact events,

but they do not empirically test them, which this thesis does.

Another theoretical prediction of insurance demand based on an EU framework is

that insurance is an inferior good, and the demand for it should decrease with income.

Many have produced work which supports this, like Pratt (1964) who developed

methodologies to measure absolute risk aversion and argued income and the demand for

insurance are inversely related. There has also been work by Mossin (1968) showing that

if the absolute value of the risk aversion decreases with income and there is a positive

premium loading, then as income increases, ceteris paribus, deductible levels should

increase and the price a person is willing to pay for insurance will go down. Past work by

Schlesinger (1981) supports this finding but proves that it is only when assuming an

inverse relationship between absolute value of risk aversion and income. This thesis also

uses the EU theory to formulate predictions about how insurance demand varies with

income, but catastrophic insurance, not regular insurance.

The work done by Huberman (1983) and Keeton (1984) concludes that it may not

be optimal to insure completely if the potential loss an individual faces exceeds their

wealth. This type of work needs the assumption of limited liability or some social

program that aids low-income people. The assumption leads to certain mathematical

constraints that are responsible for the results. Taking a closer look at Huberman (1983),

9

there is no assumption of moral hazard and they show the optimal insurance coverage

depends on the probability distribution of potential losses, the policy holder’s wealth, and

the provisions of bankruptcy statutes. This work focuses on correcting a moral hazard

problem ex-post, or when the insured correct for a moral hazard problem after damages

have occurred.

Keeton (1984), however, focuses on different levels of an individual’s wealth and

its effect on insurance coverage. He found that only those with net worth greater than

possible damages would choose full liability insurance. All others would select less than

full liability insurance.

All of these studies have used the expected utility hypothesis to derive results for

different insurance questions. None of them have derived theoretical predictions for the

demand of catastrophic insurance, which is how this thesis adds to this literature.

2.2.2. Empirical Studies

This section outlines the past work involved with empirical tests of the EU

hypothesis. There has been varied success using the EU model to explain observed

behavior which will be described below. More research is warranted to determine if the

EU framework applies not only as a general theory, but to catastrophic insurance demand

as well. This thesis fills some of this need.

For example, Pashigian et al. (1966) used data from car deductibles to test

hypothesis of the EU model and found that most people spent too little on these insurance

products to support the EU theory. The study starts by assuming a concave utility

10

function of the Neumann-Morgenstern type and outlines the necessary mathematics. This

thesis also assumes a concave utility function of the Neumann-Morgenstern type. They

concede one can test the EU hypothesis but only if one assumes a functional form of the

utility function (in this case quadratic). They further assume only one accident per year at

most by the insured. An algebraic expression is developed for the maximized EU as a

function of the deductible. Acknowledged criticism by Pashigian et al. (1966) of this

work centers on the possibility there may have been limits set on deductibles at the time

and therefore the study may not have been actually testing the EU hypothesis.

Brookshire (1985) used data on housing prices to proxy an insurance study. This

study was intended to test the EU hypothesis by showing the price differential between

similar homes in different risk areas was a type of self-insurance. He was able to show

that the price difference was close to what the EU hypothesis would have predicted.

Beenstock (1988) shows a very direct method for testing the EU prediction by

analyzing national income. His results indicate that insurance for automobiles is a normal

good and that as income rises, more of it is purchased. Sherden (1984) analyzes

comprehensive, liability, and automobile insurance coverage. He finds that insurance

demand decreases with price and increases with loss probability, but his findings did not

support that deductible insurance decreases with wealth. Although these empirical

examples do not consider catastrophic insurance they provide a useful framework for

considering the role risk plays in such insurance decision.

11

2.3. Demand Estimation Studies

The literature outlined below gives a summary of the research on empirical

estimation of earthquake insurance demand. The most relevant studies to this thesis are

those that estimate income, price, and risk elasticities. These studies are similar to the

current thesis in that they estimate elasticities, but differ in that they are not comparing

the signs of the elasticities to theoretical predictions of elasticity signs obtained directly

from a demand function. The studies do not use California earthquake purchase data, and

are generally not testing predictions of the EU hypothesis.

Lai and Hsieh (2007) use spatial econometrics to assess the demand factors for

residential earthquake insurance against such independent variables as disposable

income, government subsidy, and region in Taiwan. The motivation for their research

was that the exposure to loss and financial impact tend to be localized to specific areas or

regions in Taiwan. Their paper uses data from the Taiwan Residential Earthquake

Insurance Pool (TREIP) a public entity created in 2002 to provide residential earthquake

insurance. They specify an econometric model using spatial autocorrelation and spatial

panel data with regional trade data. They find that income correlates positively with

insurance demand, and the number of government subsidies is negatively correlated with

the demand for TREIP insurance.

Athavale and Avila (2011) estimate the demand for earthquake insurance in the

New Madrid fault zone in Missouri. Data from the Missouri Department of Insurance

(DIFP) was used to examine the decision to purchase earthquake insurance by analyzing

data on earthquake insurance price and penetration. The double-log functional form was

12

used to specify a model with independent variables price, income, and risk where risk is

some measure of the likelihood of an earthquake. To account for the endogeneity

problem of price depending on risk, a two stage least squares regression was run. The

price was first regressed on risk, and then the demand was regressed on price. Results

indicate that homeowners acquire earthquake insurance because of risk considerations; at

higher levels of risk the demand for earthquake insurance is higher, and the price of

earthquake coverage does not provide incremental information in explaining the demand

for earthquake coverage.

Grace et al. (2003) study the demand for residential earthquake insurance. They

estimated the demand for insurance coverage in Florida and New York using a two stage

least squares regression, using data on insurance contracts, housing and demographic

data, and insurance firm characteristics. They found price elasticities that were negative

and elastic in New York and Florida, with them being higher in Florida. Income

elasticities were elastic and positive in both States as well.

A major difference between this thesis and the above summarized empirical

studies is that the data used in this thesis makes it possible to disregard the possible

endogeneity problems of price. The California Earthquake Authority sets earthquake

insurance rates every several years, and therefore price can be considered fixed by an

outside entity, not subject to free market considerations.

13

2.4. Theoretical and Empirical Studies

The study most closely related to this thesis is that of Lynch (1967). In his study,

he develops an EU theory of insurance purchases and then subsequently attempted to

empirically test this theory. He develops an expected utility maximization problem for a

three state insurance problem to derive testable hypotheses and insurance demand. He

also assumes a standard Pratt log utility function that is concave, and displays risk

aversion. Lynch then sets out to test the model via inferences about the degree of risk

aversion which should be able to be made from data on changes in insurance purchases

caused by changes in wealth, losses, and premium rates. Lynch subsequently applies the

derived demand functions to life insurance data, and asks if these functions can

accurately explain the extent and pattern of under insuring, and whether the functions can

explain the increasing ratio of aggregate face value of life insurance policies to income.

The author finds a positive result in both cases. This thesis adapts this framework

described in Lynch (1967) to the case of catastrophic insurance rather than life insurance.

2.5. Summary

We have seen above that the literature on the EU hypothesis and insurance spans

theoretical and empirical studies. This thesis extends this literature on EU and insurance

by considering the demand for catastrophic insurance within the EU framework and

applying it to California earthquake insurance. More specifically, this thesis utilizes the

analysis presented in Lynch (1962) for the case of life insurance to test hypotheses about

earthquake insurance in California.

14

Chapter 3

THEORY

This chapter presents the modified expected utility model introduced by Lynch

(1967). The model presented here is adjusted slightly by assuming a two state insurance

problem rather than a three state problem. The first order conditions are solved for

optimal coverage given the expected utility maximization objective. An explicit demand

function for coverage is then derived utilizing a representation on a Pratt (1964) utility

function. The Pratt utility function was chosen because historically it has been the only

utility function that adheres to risk averse behavior, which is the main hypothesis in the

analysis. The corresponding comparative static are derived to yield predictions about the

sign of the price, income, and risk elasticities, which are tested in Chapter 5.

The following model assumes that people are able to make insurance decisions

without background exogenous or endogenous risks being taken. Exogenous risks are

defined as being of the form of uncontrollable risks to overall wealth such as global

financial crisis, disease, political instability, and natural disasters. Endogenous risks are

defined as being moral hazard issues and asymmetric information such as an insurance

company preying on consumers who they know has insufficient information.

Let us assume an individual has initial wealth W0, and will suffer a loss αW with

probability π. The individual therefore is in a game with two possible outcomes, [π (W0αW), (1- π) (W0)]. If insurance is available the individual can instead choose to face the

game with two alternate outcomes, [π (W0- pC-αW0+ C), (1- π) (W0- pC)], given that he

15

or she can purchase insurance for a premium P, which is a linear function of both the

insurance rate p, and the amount of coverage chosen C.

P pC

3.1

To proceed, it is necessary to assume the individual makes decisions according to

a von Neumann-Morgenstern utility function U(W), which has the important properties of

being continuous and twice differentiable, or rather, the marginal utility is positive and

decreasing in wealth (von Neumann and Morgenstern, 1953). If this is the case, an

individual will choose to purchase insurance if and only if there is a C such that the

expected utility of being insured exceeds the expected utility of refusing insurance. The

resulting inequality is of the form:

U (W0 pC W0 C ) (1 )U (W0 pC ) U (W0 W ) (1 )U (W0 )

3.2

From this point we would like to solve an expected utility problem specified as

max E (U (W )) U (W0 pC W0 C ) (1 )U (W0 pC ),

3.3

subject to the following first order condition

(1 p)U ' (W0 pC W0 C ) p(1 )U ' (W0 pC ).

Solving this first order condition and assuming a Pratt-like utility function yields

3.4

16

U (W ) log( W )

3.5

Equation 3.5 was shown by Pratt (1964) to encompass all the necessary assumptions

gives us the relation:2

(1 p )

p (1 )

W0 W (1 p )C W0 pC

3.6

From this point we want to solve explicitly for C in order to have a testable expression

for demand.

`

C

( 1)pW0 ( p )W0

p( p 1)

3.7

Comparative statics for changes in income (W0) gives the following expression:

C

p

W0 p ( p 1)

3.8

No general predictions can be inferred about income elasticities from this result.

However, if insurance is actuarially fair (i.e., when π=p) initial wealth has no effect on

the amount of coverage purchased. If the pricing is unfair (π<p), then coverage is

inversely related to changes in initial wealth given the denominator, p(p-1), is always

negative because 0<p<1.

Comparative statics with respect to risk yields the following result:

2

Risk-averse behavior is captured by a concave Bernoulli utility function

17

C (W0 p W0 )

p( p 1)

3.10

This result, by examination, indicates the elasticity with respect to risk is always positive,

or higher perceived risk always leads to great demand for insurance. It is straight forward

to show that the numerator is also always negative because 0<α≤1 (consumer cannot lose

more than they have).

Next, turning to the comparative static result with respect to price, one would

intuitively postulate a negative coefficient on the expression:

(W0 p 2 W0 ) p 2 (W0 W0 ) 2 pW0

C

p

p 2 ( p 1) 2

3.11

The theory again postulates nothing general about the signs of the price elasticity. The

relationship will depend on the combination of all the values and can be positive, or

negative. The denominator is always positive, and the last term in the numerator is

always negative, making the sign of the elasticity dependent on the combination of the

parameters in the first two terms of the numerator.

This chapter has presented the expected utility model developed by Lynch (1967),

adjusted slightly by assuming a two state insurance problem rather than a three state

problem. The subsequent chapters detail the empirical demand estimation for California

earthquake insurance. In the analysis different approaches are used to estimate price,

income, and risk elasticities given the difficulty in directly observing household level

18

risk. Earthquake zone risk factors are used in the analysis but do not vary over time and

thus may be correlated with other fixed factors. As such, zone fixed effects models are

also estimated and used together to draw inference about the role of risk in coverage. The

results of the estimation are then compared to the theoretical predictions described in this

chapter.

19

Chapter 4

DATA

4.1. Data Summaries and Variable Formulation

This chapter presents the data used for this thesis as well as data summaries and

variable formation methodologies. All data used is on the zip code level from California.

The major variables of interest are the amount of earthquake insurance that was

purchased, personal income per household, the price or rate of earthquake insurance, and

the perceived risk or probability of an earthquake occurrence.

The data consist of several different sets, some collected from different publicly

available sources, and some from private requests of publicly available data. The

California Department of Insurance, after direct public request from the department’s

research division, provided data on earthquake insurance coverage, and number of

earthquake insurance policies spanning the years 2005, 2007, and 2009. Each record

contains the amount and type of policies purchased for both private and CEA insurance,

and the amount of earthquake insurance coverage A, B and C in nominal dollars.

Population and household data are obtained from the California census for the years 2000

and 2010 and includes population data for each zip code as well as number of owner

occupied households per zip code and average number of residents per household.

Personal income data are obtained from the California Department of Finance from tax

records and include reported nominal income for every zip code for the years 2005, 2007,

and 2009. The risk data set is from USGS (http://earthquake.usgs.gov /hazards

20

/products/conterminous/2008/data/) and includes the probability of earthquake on a .05 x

.05 latitude and longitude gridded area for all of California.

The earthquake coverage data for the years 2005, 2007, and 2009 were the only

available years with zip code level data, and only policies sold by the CEA were

considered. This decision was made because these policies comprised more than 80% of

the policies, as well as the fact that no price data was available for non-CEA policies. The

CEA was created in 1996 by Act of the California Legislature and is privately financed

while publicly managed. Insurance companies either offer coverage through the CEA, or

offer their own policies with coverage at least equal to the CEA’s.

Earthquake insurance coverage A (structure only) is the only type of insurance

considered in this thesis due to the fact that only coverage A data was available for the

year 2007, thus narrowing the data usefulness to the common denominator of coverage

A. Only policy data on owner occupied homes were used for the study, and data for

mobile homes and renters were discarded for similar data quality issues. This data

decision is driven by the owner occupied home policies being of the majority kind, as

well as not wanting to contaminate the study by using people’s choices about insurance

that are not directly liable for the possible damages.

Both total earthquake insurance coverage, and the number of policies has

increased from 2005 to 2009. The earthquake insurance coverage increases on a much

higher rate than the number of policies, from an average of $80 million to $135 million,

where the number of policies per zip code changed from an average of 263 to 342. This

indicates people are purchasing different levels of coverage in/for/ different years, or they

21

are not always purchasing full coverage. Alternatively, this might be an indication of

changed owner-occupied demographics. The yearly totals and data summaries can be

found in Table 4.1. The maximum coverage in a zip code increases from $1.27 billion to

$1.79 billion, the minimum coverage increases from $45,000 to $81,000, and finally the

standard deviation increases from $143 thousand to $207 thousand between the years

2005 and 2009.

Data on the number of CEA earthquake insurance policies are also summarized in

Table 4.1. The average and standard deviation amount of policies by zip code increase

from 2005 to 2009. The average per zip code went from 263 to 342 policies and the

standard deviation from 404 to 459 policies. The minimum number of policies remained

at 1. The maximum amount of policies per zip code increases from 2005 to 2007 from

3,474 to 4,134, then decreases slightly from 2007 to 2009 to 3,718 policies.

Personal income data was estimated using the California adjusted gross income

(AGI) reported on tax returns for every zip code in California for the years 2005, 2007,

and 2009. The data is the total income for an entire zip code in nominal dollars, and was

not adjusted for inflation because of the short time frame and extremely low inflation in

2009. The California AGI is obtained by adjusting the Federal AGI, which consists of the

taxable income of individuals who filed a Federal income tax return. From 2005 to 2007

the average income increased from $365 million to $425 million, the maximum increased

from $4.5 billion to $5.9 billion, the minimum increased from $93 thousand to $164

thousand, and the standard deviation increased from $5.3 million to $6.5 million. From

2007 to 2009 the average income decreased from $425 million to $415 million, the

22

maximum decreased from $5.9 billion to $4.8 billion, the minimum decreased from $164

thousand to $142 thousand, and the standard deviation decreased from $6.5 billion to

$6.0 billion. Data summaries can be found in Table 4.1.

Table 4.1: Summary Statistics for Insurance and Income Data.

Year

Variable

Cov

2005

2007

2009

Description

Obs

Mean

Std. Dev.

Min

Max

Total CEA

earthquake

insurance

coverage A

(Dollars)

1,994

80,843,839.14

143,491,800.5

45,100

1,269,437,061

1,938

104,502,926.6

182,763,029.4

50,200

1,749,705,179

1,683

135,400,106.5

207,229,371.2

81,325

1,786,445,658

Aggregate

EQ

insurance

policies

1,994

263

404

1

3,474

1,938

296.07

454.00

1

4,134

1,683

342.73

458.95

1

3,718

2,372

365,414.8284

528,784.7453

93

4,483,873

2,373

425,295.6119

647,365.7275

164

5,863,104

2,391

415,318.752

603,210.0138

142

4,817,698

Pol

2005

2007

2009

Income

2005

2007

2009

Income

(Thousand

Dollars)

Population data per zip code was obtained for the years 2000 and 2010 from the

California census, and a linear trend was used to infer the years 2005, 2007, and 2009 for

every zip code in California. The data summaries for the population data can be found in

Table 4.2. From 2000 to 2010 the average population increased from 19 thousand to 21

thousand, the maximum increased from 105.3 thousand to 105.5 thousand, and the

standard deviation increased from 20 thousand to 21 thousand. The data summaries for

the interpolated population data can be found in Table 4.3.

23

The number of households owning a home and living in it per zip code was

obtained from the California census for the years 2000 and 2010. The census also

provided the average number of persons living in said home. A simple linear trend was

applied to infer the years 2005, 2007, and 2009 for both variables. From 2000 to 2010 the

average number of households increased from 6,500 to 7,100, the maximum decreased

from 33,527 to 33,342, and the standard deviation increased from 6,715 to 6,852. From

2000 to 2010 the average number of persons living in a household increased from 2.66 to

2.70, the maximum from 5.39 to 6.0, where the standard deviation decreased from 0.79 to

0.74 persons. Data summaries for number of households where the homeowners lives in

the home and number of people living in the household can be found in Table 4.2. Data

summaries for the interpolated number of households where the homeowners lives in the

home and number of people living in the household can be found in Table 4.3.

24

Table 4.2: Summary Statistics for Census Data

Year

Variable

Pop

2000

2010

House

2000

2010

Person

2000

2010

Description

Aggregate

population

on zip code

level

Number of

households

owning a

home and

occupying

Average

number of

persons in

home

Obs

Mean

Std. Dev.

Min

Max

1,756

19,288

20,642

0.0

105,275

1,763

21,116

21,332

0.0

105,549

1,756

6,550

6,715

0.0

33,572

1,764

7,129

6,852

0.0

33,342

1,756

2.66

0.80

0.0

5.39

1,764

2.70

0.75

0.0

6

Table 4.3: Summary Statistics for Interpolated Census Data

Year

Variable

Pop

2005

Description

Obs

Mean

Std. Dev.

Min

Max

Aggregate

population on

zip code level

1,654

21,215

20,920

0.0

104,380

1,938

21,522

21,109

0.0

104,847

1,683

21,829

21,352

0.0

105,315

1,654

4,051

3,902

0.0

17,697

1,654

4,088

3,924

0.0

17,986

1,654

4,126

3,958

0.0

18,275

1,654

2.76

0.63

0.0

5.37

1,654

2.75

0.64

0.0

5.36

1,654

2.75

0.66

0.0

5.69

2007

2009

House

2005

2007

Number of

households

owning a home

and occupying

2009

Person

2005

2007

2009

Average

number of

persons in

home

25

The perceived risk of an earthquake was interpreted to be the probability of an

earthquake occurring in a specific geographic area of the state, and the data were

obtained from the U.S. Geological Survey (USGS) National Seismic Hazard Maps using

the 1Hz, 10% in 50 years data set. The data consists of earthquake ground motions for

different probability levels across California, and is used in seismic provisions of

building codes, insurance contracts, and various public risk assessments. The data set is a

subset of an entire USA gridded file in 0.05 degree increments of longitude and latitude.

The same probabilities were used for each of the years 2005, 2007, and 2009. This time

invariant risk data is the source of some concern of the viability of elasticity estimate, and

motivated the inclusion of multiple model estimates.

The rate data for 2005, 2007, and 2009 was obtained by the corresponding CEA

rate manual (2001, 2006, 2009) for the proper year. The rates are calculated by the CEA

and are determined primarily be the age of the structure, the number of stories, and the

location of the structure. The rate data is in nominal dollars per $1000 of coverage. From

2005 to 2007 the average rate decreases from $4.76 to $4.49, the maximum increases

from $7.9 to $8.05, the minimum decreases from $1.60 to $1.20, and the standard

deviation decreases from $2.07 to $2.00. From 2007 to 2009 the average rate decreases

from $4.49 to $2.37, the maximum decreases from $8.05 to $4.19, the minimum

decreases from $1.20 to $0.55, and the standard deviation decreases from $2.00 to $1.03.

In general, rates have been steadily decreasing since 2005 indicating shifts in CEA policy

and underlying supply and demand issues not fully explored in this study. Table 4.3

provides descriptive statistics for the rate data.

26

The empirical portion of the study will estimate the demand for CEA earthquake

insurance as a function of price, income, and risk. The dependent variable will be

insurance demand and will be modeled as the amount of coverage demanded per

household. The coverage amount and the number of households owning a home has been

aggregated on the zip code level and will be further aggregated into earthquake zones.

The summary statistics for the variable of interest is shown in Table 4.3. From

2005 to 2007 the average coverage per household increases from $27 to $31 thousand,

the maximum increased from $76 to $89 thousand, the minimum increased from $2.8 to

$3.4 thousand, and the standard deviation increased from $19 to $21 thousand. From

2007 to 2009 the average coverage increased from $31 to $33 thousand, the maximum

increased from $89 to $90 thousand, the minimum increased from $3.4 to $6.9 thousand,

and the standard deviation increased slightly from $21.7 to $21.9 thousand.

27

Table 4.4: Summary Statistics for Dependent and Independent Variables

Year

Variable

Coverage/Household

2005

2007

2009

Description

Obs

Mean

Std. Dev.

Min

Max

Total

earthquake

insurance

coverage per

earthquake

zone

19

27,400.24

19,149.15

2,814.06

76,063.71

19

31,114.82

21,740.48

3,395.16

89,183.55

19

33,415.72

21,937.77

6,944.94

90,299.54

Disposable

income per

earthquake

zone

19

68.97

30.83

33.76

155.00

19

83.68

43.60

43.42

206.87

19

76.30

38.86

36.96

183.53

19

4.76

2.07

1.6

7.9

19

4.49

2.00

1.2

8.05

19

2.37

1.03

0.55

4.19

Income/Household

2005

2007

2009

Rate

2005

2007

2009

Rate, or

price per

earthquake

zone

In the analysis the variable for income is formulated as per-household nominal

income in a given earthquake zone. The income used is the total income of homeowners

in the zip code, which is normalized by the number of homes in the zip code. The

summary statistics for this variable can be found in Table 4.4. The price variable is the

CEA developed rate per $1000 of earthquake insurance coverage per earthquake zone.

The rate varies across earthquake zones and year. The risk variable is the average risk

measure of the probability of plate movement in an earthquake zone.

28

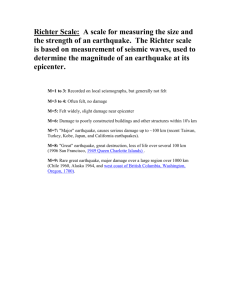

4.2. Scatter Plots

Figures 4.1 through 4.3 show scatter plots between coverage and income, price,

and risk for the three years 2005, 2007, and 2009. The plots reveal the same general

behavior across the three years. The price can be seen to be negatively correlated with

coverage per household while income per household (or wealth) appears positively

correlated with coverage. Risk and coverage, however, look negatively correlated, which

is counter to our intuitive expectations and the previously developed expected utility

theory.

29

Figures 4.1: Scatter plots for the 2005 data

80,000

Coverage/Household

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

0

2

4

6

8

10

Price

80,000

Coverage/Household

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

0

50

100

150

Income/Household

200

80,000

Coverage/Household

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

0

0.5

1

1.5

Risk

2

2.5

3

30

Coverage/Household

Figures 4.2: Scatter plots for the 2007 data

100,000

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

0

2

4

6

8

10

200

250

Coverage/Household

Price

100,000

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

Coverage/Household

0

50

100

150

Income/Household

100,000

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

0

0.5

1

1.5

Risk

2

2.5

3

31

Coverage/Household

Figures 4.3: Scatter plots for the 2009 data

100,000

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

0

1

2

3

4

5

Coverage/Household

Price

100,000

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

Coverage/Household

0

50

100

150

Income/Household

200

100,000

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

0

0.5

1

1.5

Risk

2

2.5

3

32

4.3. Summary

Examining the above average trends over time it can be seen, in general, that as

the price decreases and income increases, the coverage per household increases. This

trend will positively support the postulated demand function and corresponding

comparative statics results. Risk, having no time component, can’t be examined as having

any influence over time changes in demand.

There seems to be a small outlier, that being income dropping drastically from

2007 to 2009 while at the same time, the coverage increases. The drop in income may be

because of the Great Recession, which may be why the data does not support

conventional economic theory. The coverage, however, increases from 2005 to 2009 so

the trend is still positive, supporting previously presented theory. Furthermore, the Great

Recession surely had some anomalous effects on personal income, and correcting for

such effects may lead to seeing a more positive trend in income from 2007 to 2009.

This chapter has introduced the data sets used in the study and presented data

summaries for each variable of interest. Subsequent discussions have outlined their major

features. However, the analysis presented in this chapter only provides a preliminary look

at the relationships within the data. The next chapter gives a more rigor examination of

the data by presenting an econometric analysis of the demand for earthquake insurance

over time.

33

Chapter 5

DEMAND ESTIMATION

5.1. Estimation Models and Estimation Results

This chapter describes the approach used to empirically estimate demand for

California earthquake insurance over time and the subsequent results from the analysis.

As previously developed in Chapter 3, a theoretical hypothesis of the functional form of

this demand for earthquake insurance guides the analysis and allows for a suitable test of

theoretical consistency. Comparative statics derived in Chapter 3 provide hypotheses on

the signs of income, risk, and price elasticities. The analysis described below involved

estimating a series of models using pooled data and panel data techniques.

Additionally, the analysis further evaluates risk given concerns that the risk factor

measures do not change over time and may capture zonal fixed effects that might bias the

estimated effect of risk on coverage.3 To do so, two models are estimated without the risk

factor. One with time fixed effects and one without. Two additional models are estimated

as well to determine if earthquake zone fixed effects (with and without time fixed effects)

provide further insights about the role of risk in determining coverage.

The elasticity results from this analysis appear consistent with those hypothesized

earlier. The risk elasticity appears to be positive, though through the various model

specifications goes in and out of significance and may be highly correlated with other

explanatory variables. The chapter concludes with a discussion on the implications of

these results.

3

If any omitted fixed variables are correlated with the risk factor and explain differences in coverage across

zones, then the estimated coefficient is likely biased.

34

5.2. Pooled Data Regression Model

The first regression model (equation 5.1 below and hereafter referred to as Model

1) uses ordinary least-squares (OLS) to estimate elasticities with pooled data across zones

and times. The model is in log-log form, both for analytic properties and because this

functional form of the demand function leads to a direct estimation of elasticities.

ln Coverageit 1 ln Priceit 2 ln Incomeit 3 ln Risk i

5.1

The i and t subscripts in equation 5.1 above denote earthquake zone and year,

respectively. The regression results are shown in Table 5.1.

The first OLS regression finds the price coefficient to be significantly negative.

This shows that people are decreasing their purchases of earthquake insurance as the rates

set by the CEA have increased. The magnitude is below one showing an inelastic demand

with respect to price. The theory presented in Chapter 3 postulates a price elasticity that

can be either positive or negative, depending on a combination of parameters.

The risk coefficient is positive though not significant, which may be because of

the multicollinearity of risk and price. It also may be because risk is likely correlated with

factors in the error term, or factors that are the same within one risk area but different

across different risk areas. The magnitude of the elasticity is extremely small.

The income coefficient is positive and significant, showing wealth is positively

correlated with the decision. This result is could also be consistent with the theory

presented. A positive association with wealth, according to our theory, indicates that the

35

insurance being offered is more than actuarially fair, and actually being offered at a lower

price. Actuarially fair insurance is insurance offered at the price of the risk, or p=π. From

observation of equation 3.10, we can see the predicted sign of income elasticity when

p=π is positive. The magnitude suggests coverage is elastic with respect to income.

5.3. Inclusion of Time Fixed Effects

The second regression (Model 2) uses OLS and adds time fixed effects to

equation 5.1 as follows.

ln Coverage it t 1 ln Priceit 2 ln Incomeit 3 ln Risk i

5.2

Fixed effects used here control for unobserved explanatory variables that may differ

across time and not across entities. The fixed effect assumption is that these unobserved

quantities are correlated with the independent variable. In this thesis, time fixed effects

are used to control for changes across time such as interest rates, extreme economic

fluctuations such as the financial disaster of 2008, and any other unobserved fluctuation

not taken into account with the empirical estimation model but do not vary across

earthquake zones.4

4

Earthquake zone fixed effects are not considered in this part of the analysis because the risk data does not

vary over time and their inclusion would result in perfect multicollinearity between the earthquake zone

fixed effects and the risk variable.

36

Table 5.1: Regression Results for Models 1 and 2

Variable

ln(price)

ln(income)

ln(risk)

Constant

Model 1

-0.76***

(0.153)

1.11***

(0.174)

0.07

(0.383)

6.16***

(0.756)

Model 2

-1.39***

(0.208)

1.21***

(0.157)

1.13*

(0.424)

6.28***

(0.669)

-0.258

(0.161)

-0.950***

(0.230)

0.56

24.72

0.66

22.55

2007

2009

Adjusted R squared

Overall F-statistic

Note: Robust standard errors are in parentheses. Additionally, ** and ***denote statistically significance at

the 5% and 1% levels respectively.

The pooled data model results found in Table 5.1 includes the estimates for each

independent variable. The pooled data model shows three out of the four variables are

significant. The price coefficient, income coefficient, and the constant are all statistically

significant at the 1% level. The risk coefficient in this case does not show statistical

significance. The adjusted R squared is relatively high at 0.56, showing good fit to the

model.

The time fixed effects regression resulted in all of the coefficients being

statistically significant. The income and price variables are statistically significant at the

1% level. The risk variable is statistically significant at the 5% level. Adjusted R squared

increases and shows a better fit at 0.66.

The time fixed effects model (Model 2) shows significant estimates for all three

explanatory variables, has a higher adjusted R-squared, as it controls for more

37

unobserved factors. The adjusted R squared increases from 0.56 to 0.66, a nearly 18%

increase.

The price coefficient is significantly negative. This shows that people are

decreasing their purchases of earthquake insurance as the rates set by the CEA have

increased. The magnitude changes to above one showing higher elasticity as well as a

magnitude closer in value to reported price coefficients from previous insurance studies.

The elasticity changed from -0.76 to -1.39 from the pooled regression to the fixed effects

regressions indicating that fixed effects did capture some time effects and therefore

reduced potential bias. This also displays a change from inelastic to elastic price

elasticity.

The income coefficient is positive and significant. The elasticity increases slightly

from 1.11 in the pooled data model to 1.21 in the regression with time fixed effects. The

magnitude makes the income elasticity slightly more elastic.

The risk coefficient is positive and significant. The elasticity went from a very

low inelastic number, to a larger elastic value. This is consistent with theory that the risk

is always positively correlated with the decision to buy more insurance. The elasticity

shows a large positive value. Next, the analysis estimates models without risk to observe

how this exclusion affects the price elasticity and income elasticity.

38

5.4. Further Examination without Risk

Two additional models (equations 5.3 and 5.4, hereafter denoted as Models 3 and

4) are estimated without the risk variable so we can better understand the role this

measure plays in explaining variation in coverage. Model 3 is a pooled regression using

only income and price as explanatory variables, and Model 4 is a time fixed effects

regression also excluding risk as an explanatory variable. The results are presented in

Table 5.3.

ln Coverageit 1 ln Price it 2 ln Incomeit

5.3

ln Coverageit t 1 ln Priceit 2 ln Incomeit

5.4

Table 5.2: Regression Results for Models 3 and 4

Variable

ln(price)

ln(income)

Constant

2007

2009

Model 3

-0.72***

(0.115)

1.11***

(0.172)

6.18***

(0.736)

Model 4

-0.944***

(0.132)

1.16***

(0.165)

6.48***

(0.702)

-0.189

(0.168)

-0.590***

(0.197)

Adjusted R squared

0.568

0.658

F-statistic

37.73

22.55

p-value

5.57e-11

7.371e-12

Note: Robust standard errors are in parentheses. Additionally, ** and ***denote statistically significance at

the 5% level and 1% levels respectively.

39

The adjusted R squared of Model 3 has gone up from Model 1. The coefficients of

price and income have not changed much. The higher R squared of this model than when

compared to Model 1 suggests that the risk factor variable does not add useful

information about coverage, which is indicated by the non-statistically significant

coefficient found for risk in Model 1.

The adjusted R squared increases from Model 3 to Model 4 when adding time

fixed effects, indicating relevant variables have been added. The significance of price and

income stays the same but the magnitude of the price coefficient increases by 30%.

Moving from Model 1 to Model 2, then from Model 3 to Model 4 adjusted R

squared increased, and the significance of explanatory variables increased, leading to the

conclusion that Model 3 most likely is not the best model fit to the data. A closer look at

the results between Model 2 and Model 4 suggests that the risk factor plays a role in

describing coverage even though the adjusted R-squared does not increase measurably.

Of course, since the risk factor does not change over time it may also be capturing

unobserved fixed effects that are correlated with the time invariant risk data. Nonetheless,

when risk is included the magnitude of the estimated elasticities for income and price

change and this change is more noticeable in the own-price elasticity, which switches

from inelastic to elastic, suggesting the exclusion of the risk factor variable introduces

bias into these estimated coefficients. To further test relevance of explanatory variables

across specifications zonal fixed effects models are estimated.

40

5.5. Earthquake Zone Fixed Effects

In the next set of regression earthquake zone fixed effects are used to control for

unobserved variations across zones that are constant over time. As noted above these

fixed effects are perfectly collinear with the risk factor variable, resulting in the exclusion

of the risk factor variable in this set of models. Equations 5.5 and 5.6 (Models 5 and 6,

respectively) include the earthquake zone fixed effects model with and without risk time

fixed effects. The results are shown in Table 5.3.

ln Coverageit i 1 ln Priceit 2 ln Incomeit

5.5

ln Coverageit i t 1 ln Priceit 2 ln Incomeit

5.6

The adjusted R-squared for Models 5 and 6 increase substantially when compared

to the previous models, indicating zone fixed effects play a meaningful role in explaining

coverage. The income coefficient is no longer statistically significant and extremely

small, which suggests that income may be highly correlated with earthquake zone fixed

effects. Figure 5.1 illustrates this point with respect to the estimated coefficients for the

zone fixed effects. The price coefficient is still highly significant and appears to be

inelastic.

41

Figure 5.1: Estimated Zonal Effect for Model 6 By Income

3

2.5

Coefficient

2

1.5

1

0.5

0

0

-0.5

50

100

150

200

Income

5.6. Remarks

This Chapter presented several different estimations of California earthquake

insurance demand and the results, along with interpretations of the resulting variable

coefficients. The analysis further evaluated risk given concerns that the risk factor

measures do not change over time and may capture zonal fixed effects that might bias the

estimated effect of risk on coverage. To do so, two models were estimated without the

risk factor. One with time fixed effects and one without. Two additional models were

estimated as well to determine if earthquake zone fixed effects (with and without time

fixed effects) provide further insights about the role of risk in determining coverage.

42

Table 5.3: Regression Results for Models 5 and 6.

Variable

ln(income)

ln(price)

Constant

4

5

6

7

8

11

12

13

15

18

19

20

22

23

24

25

26

27

Model 5

0.14

(0.083)

-0.29***

(0.061)

8.54***

(0.301)

-0.21***

(0.020)

0.29***

(0.021)

1.23

(0.048)

1.52***

(0.058)

0.74***

(0.027)

1.71***

(0.047)

1.62*

(0.048)

2.40**

(0.124)

1.93***

(0.075)

1.76***

(0.104)

0.83***

(0.055)

1.73**

(0.060)

1.33***

(0.070)

1.78***

(0.116)

2.21***

(0.052)

1.16

(0.045)

1.13**

(0.077)

0.87***

(0.103)

Model 6

0.03

(0.067)

-0.39**

(0.119)

9.08***

(0.367)

-0.22***

(0.022)

0.34***

(0.031)

1.20

(0.069)

1.52***

(0.066)

0.77***

(0.022)

1.72***

(0.048)

1.67*

(0.037)

2.48**

(0.102)

1.91***

(0.097)

1.62**

(0.195)

0.80***

(0.078)

1.73**

(0.066)

1.42***

(0.057)

1.90***

(0.089)

2.16

(0.083)

1.13

(0.072)

1.16*

(0.069)

0.74***

(0.188)

0.978

0.09

(0.016)

-0.05

(0.101)

0.981

2007

2009

Adjusted R squared

43

Chapter 6

CONCLUSION

This thesis set out to collect evidence from the purchase of earthquake insurance

in California and evaluate if some of the predictions of an expected utility theory of

insurance corresponded with a demand estimation made using these data. Data from three

years of insurance purchases, personal income, and risk distributions were used in

developing an empirical estimation of the demand for earthquake insurance per

household and over time. A theoretical model was presented that uses expected utility

theory, assuming a Von Neumann-Morgenstern utility function, and comparative static

predictions were derived. Secondly, a demand estimation was used to compare the

theoretical predictions with the signs of empirically estimated elasticities. This was

intended to give some evidence as to whether expected utility theory can be used to help

construct successful insurance schemes for catastrophic events.

The thesis proceeds with a demand estimation by household over time. A total of

six models including two pooled models, two time fixed effects models, and two

earthquake zone fixed effects models, with the first four models estimating elasticities for

price, income, and risk. The two earthquake zone fixed effects models estimate

elasticities for price, and income. The different model formulations were used to check

for robustness in estimated values of independent variable across specification. The signs

of the estimated elasticities were compared with theorized values, adding supporting

evidence to the validity of the expected utility theory’s assumptions. The data used are

California residential earthquake insurance figures on amounts of insurance purchased,

44

personal income expenditures, and regional risk estimates. The data is publicly available

through the California Earthquake Authority (CEA).

The study produced mixed results. The econometric analysis resulted in estimated

elasticities for price, income, and risk that were in the realms of the theoretically

predicted elasticities. Both income and price elasticities, according to the presented

theory, can be either positive or negative depending on the specific values of the

parameters. The income and price elasticities were mainly statistically significant and

were positive, and negative, respectively. The risk elasticity was always positive, though

depending on the model specification sometimes not significant. Based on several

different model specifications, however, the estimated elasticity on risk appears to be

positive, agreeing with theory and supporting the expected utility hypothesis that people,

while selecting amounts of insurance, will purchase higher amounts of insurance when

observing higher amounts of objective risk. The analysis of risk in the empirical

framework is limited, however, as the risk variable does not vary over time, and might

also capture differences across earthquake zones. In a fixed effects analysis, accounting

for unobserved differences across earthquake zones, the risk variable cannot be included

due to this data limitation.

One of the future directions this work could take is refining the data aggregation

scheme as to evaluate decisions on the zip code level. Price was formulated simply as the

rate the CEA set for each specified zone which makes for the easiest and truest measure

of price, but does aggregate the other independent variables over a large population.

Further work needs to define a more sophisticated price based on zip code that takes into

45

account housing characteristics and premiums chosen. Most importantly is finding a

measure of risk that varies over time, so as to not be measuring risk as a fixed effect. This

may or may not be feasible with earthquake data because the objective risk of an

earthquake does not vary from year to year. In the future a measurement of perceived risk

would be valuable.

46

REFERENCES

Arrow, Kenneth J. Uncertainty and the Welfare Economics of Medical Care, The

American Economic Review, Vol. 53, No. 5 (Dec., 1963), pp. 941-973

Athavale, Manoj, Avila, Stephen M. And Analysis of the Demand for Earthquake

Insurance, Risk Management and Insurance Review, 2011, Vol. 14, No. 2, 233-246

Beenstock, Michael, Dickinson, Gerry, Khajuria, Sajay. The Relationship between

Property-Liability Insurance Premiums and Income: AnInternational Analysis, The

Journal of Risk and Insurance, Vol. 55, No. 2 (Jun., 1988), pp. 259-272

Bernoulli, Daniel, Specimen theoriae novae de mensura sortis, Comentarii academiae

scientiarium imperialis Petropolitanae, 1738, pp.175-192, english by Louise Sommer, in

Econometrica, vol. 22, No. 1, January 1954, pp.23-36.

Bernoulli, Daniel. 1954. "Exposition of a New Theory on the Measurement of Risk."

Translated by L. Sommer. Econometrica, vol. 22, no. 1 January):23-36.

Brookshire, David S.,Thayer, Mark A., Tschirhart, John. A Test of the Expected Utility

Model: Evidence from Earthquake Risks, Journal of Political Economy, 1985 vol. 93,

no.2

Huberman, Gur, Mayers, David, Smith, Clifford W. Jr, Optimal Insurance Policy

Indemnity Schedules, The Bell Journal of Economics, Vol. 14, No. 2 (Autumn, 1983),

pp. 415-426

Keeton, William R., Kwerel, Evan. Externalities in Automobile Insurance and the

Underinsured Driver Problem, Journal of Law and Economics, Vol. 27, No. 1 (Apr.,

1984), pp. 149-179

Lai, Li-Hua, Hsieh, Hsiu-Yi. Assessing the Demand Factors for Residential Earthquake

Insurance in Taiwan: Empirical Evidence on Spatial Econometrics, Contemporary

Management Research Pages 347-358, Vol. 3, No. 4, December 2007

Lees, Dennis S., Rice, Robert G. Uncertainty and the Welfare Economics of Medical

Care: CommentAuthor, The American Economic Review, Vol. 55, No. 2-Jan (Mar. 1,

1965), pp. 140-154

Lynch, Michael. The Expected Utility Hypothesis and the Demand for Insurance, A