Income Trusts Josh Cavers Ian Herle Ashish Mali

advertisement

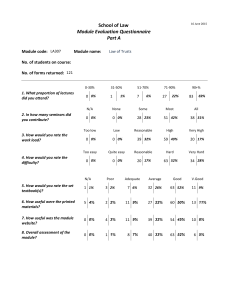

Income Trusts Josh Cavers Ian Herle Ashish Mali Lindsey Polishuk Outline Income Trust Characteristics Types of Trusts Associated Risks Prior Benefits Tax Law Income Trusts Similar to common stock Tax Savings Trusts are exchange traded equity instruments. “Trust” represents a tax designation, a legal structure, and a capital structure. The Trust evades income taxes by paying out all of its distributable net income. Passes income to “unitholders” Beneficiaries of the trust that receive quarterly or monthly residual distributions that are typically higher than stock dividends. Their units are the right to the income and capital of the company. Primary Roles High yield investment alternative The Income Trust market serves to distribute excess cash from mature industries or businesses because: Trapped capital creates overinvestment and slow growth business Contributes to declining return on invested capital Trust distributions stimulate productivity and economic efficiency An alternative form of organization that is well suited to many businesses and industries in which they operate Businesses have proven to operate a Trust efficiently Types of Trusts 4 3 1.Business Trusts 2.Energy Trusts 3.Real Estate Investment Trusts 2 1 4.Power & Pipeline Trusts Source: Tsx.ca Market Capitalization Types of Trusts Real Estate Investment Trust (REIT) Provides an investment vehicle into real estate similar to mutual funds investing in stock. Investors pool capital to purchase and manage income properties. REITs: Boardwalk, H&R Energy / Royalty Trust Distributions in an energy trust will vary due to fluctuations in production, commodity prices, royalty rates, and corporate costs. Royalty Trusts: Canadian Oil Sands, Builders Energy Business Trust Individual business that has converted their shareholder equity into an Income Trust capital structure. Not a diversified pool of assets. Business Trusts: Boston Pizza Royalties Risks Income trusts are equity investments and they share many of the risks associated with stock ownership. Over-valuation: the higher the yield, the higher the risk Since distributions include return of capital, the investor is really receiving his own capital back through the distributions. Units will be priced above their economic value since the unit valuation is most frequently driven by a multiple applied to the distribution as a whole. Lack of income guarantees: Income Trusts do not guarantee minimum distributions or even return of capital. If the business starts to lose money, the Trust can reduce or even eliminate distributions. Risks Interest rate risk: Sacrifice of growth: If interest rates in the rest of the cash/treasury market increase there is the risk that trust units will decline in value. This risk is common to other dividend/income based investments such as bonds. Most income is passed on to unit holders rather than reinvested in the business. Because many income trusts pay out more than their net income, the shareholder equity may decline over time. Exposure to regulatory changes: The value of the Trust is driven by the deferral or reduction of tax, so as we have seen, any change in government tax regulations to remove the benefit will reduce the value of the Trusts. Risks Liability: Depending on the local regulations, Income Trusts may be considered partnerships that do not provide the same limited liability protection as common stocks. Who’s Interested? The main attraction of Income Trusts is their ability to generate constant cash flows for investors, which is especially attractive when interest rates on bonds are low. They are especially useful for financial requirements of institutional investors such as pension funds. Because the earnings from the business are distributed to investors each month or quarter, with yields ranging anywhere from 6 to 20 per cent a year (typically higher than dividend yields) Income Trusts are ideal for anyone seeking a constant cash flow. i.e. retired persons. Income Trust Prior to Tax Law If the market value increased to $17/unit $15 $1 $14 $1 unit ROC Adjusted Cost Base ROC $13 Adjusted Cost Base $17 $13 $4 0.5 Selling Price Adjusted Cost Base Capital Gain Inclusion Rate $2 Taxable The Tax Law The federal government announced on October 31, 2006 that Income Trusts will be subject to taxation. However, there will be a transition period granted to established trusts until 2011 Taxation will be Identical to dividends. (i.e. taxed on every distribution) REITs excluded Tax Rate Comparison Boardwalk REIT Canadian Oil Sands Boston Pizza Royalties Thank You! Questions?