First Examination – Finance 3321 Fall 2006 (Moore)

advertisement

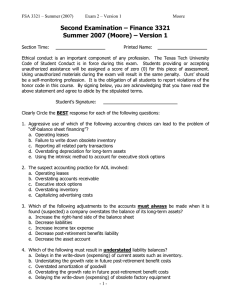

FSA 3321 – Fall (2006) Exam 1-1 Moore First Examination – Finance 3321 Fall 2006 (Moore) Student ID: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. Which of the following statements is correct? a. The FASB has the legal authority to proscribe GAAP. b. Transparent financial reporting allows users to get a true and fair picture of the firm. c. Conservatism of financial reporting standards increases valuation relevance. d. Prospective analysis involves assessing the past performance of the firm. e. The external auditor certifies the financial statements are correct. 2. Which of the following is not an element of the “Five-Forces” model? a. Potential and Actual Competition b. Maintaining Competitive Advantage(s) c. Bargaining Power of Customers d. Threat of New Entrants e. Threat of Substitute Products 3. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, Low First mover advantage, High Product Differentiation c. High Industry Concentration, Low Distribution Access, High Customer Switching Costs d. High Industry Concentration, High Fixed-Variable Cost Ratio, Low Customer Switching Costs e. Supply > Demand, Low Supplier Switching Costs, Steep Industry Learning Curves -1- FSA 3321 – Fall (2006) Exam 1-1 Moore 4. Which of the following strategies leads to either a pure cost leadership or a pure product differentiation strategy? a. Economies of scale and scope, Low R&D investment, Superior product variety b. Superior product variety, lower input costs, High investment in R&D c. Lower input costs, flexible distribution, low investment in R&D d. Low investment in brand image, Low investment in R&D, Focus on cost control e. Simpler product designs, Tight cost control, superior product quality 5. Determining whether the firm currently has the resources and capabilities to deal with the identified key success factors is an example of: a. Competitive Strategy Analysis b. Differentiation Analysis c. Analysis of the Degree of Actual and Potential Competition d. Analysis of the Threat of Substitute Products e. Analysis of the Bargaining Power in Input and Output Markets 6. Which one of the following companies (cited in class) was found guilty of channel stuffing (shipments) to artificially boost revenues and net income on its published financials. a. QWEST b. Enron. c. Visteon. d. Regina Vacuum. e. Krispy Kreme. 7. Which of the following will result in understated liability balances? a. Delays in the write-down (expensing) of current assets such as inventory. b. Understating the growth rate in future post-retirement benefit costs c. Overstated amortization of goodwill d. Overstating the growth rate in future post-retirement benefit costs e. Delaying the write-down (expensing) of obsolete factory equipment 8. Which of the following accounting adjustments would have to be made when it is determined that expenses are improperly understated? a. Sales would be increased b. Accounts Receivable would be increased c. Cost of Sales would be decreased d. Inventory would be increased e. Retained earnings would have to be decreased -2- FSA 3321 – Fall (2006) Exam 1-1 Moore Use the following information for problems 9 through 12 ABC Company was established in 2003 and sells product warranty contracts on household appliances. These product service contracts last for 3 years. In the first year (2003), all $12,000,000 of contract sales were credited to revenue. In 2004, the auditor caught the error in accounting and forced ABC to adjust its accounts to reflect service contract liabilities. Assume a tax rate of 30%. 9. Adjust ABC’s 2003 books to reflect the initial recognition future service contract liabilities. a. $12,000,000 increase to long-term liabilities and $12,000,000 decrease to revenues b. $8,000,000 increase to long-term liabilities and $8,000,000 decrease to revenues c. $4,000,000 reduction of long-term liabilities and $8,000,000 decrease to revenues d. $4,000,000 increase to current liabilities and $4,000,000 decrease to revenues e. $4,000,000 increase to long-term liabilities and $8,000,000 decrease to revenues 10. Adjust ABC’s 2003 books to properly reflect service contract liabilities. The adjustment to reduce net income would be: a. $12,000,000 b. $8,400,000 c. $8,000,000 d. $5,600,000 e. $4,000,000 11. How much 2003 service contract sales should be recognized in 2004? a. $8,400,000 b. $8,000,000 c. $5,600,000 d. $4,000,000 e. $2,800,000 12. The overall effect on Owners’ Equity in 2003 for ABC after adjustment would be? f. $12,000,000 g. $8,400,000 h. $8,000,000 i. $5,600,000 j. $4,000,000 13. Which of the following ratios would be used in the diagnostic analysis of the quality of financial statements as it relates to the detection of manipulated revenues? a. (Sales)/(Total Assets) b. (Cash Flow From Operations)/(Operating Income) c. (Total Accruals)/(Change in Sales) d. (Net sales)/(Inventory) e. (Pension Expenses)/(Selling, General and Administrative Expenses) -3- FSA 3321 – Fall (2006) Exam 1-1 Moore 14. Which of the following would be indicative of manipulated core expenses for the purpose of overstating income? a. Unexpected (unexplained) increases in asset turnover b. Unexpected (unexplained) decreases in asset turnover c. Unexpected (unexplained) increases in (Pension expense)/(SG&A expense) d. Unexpected (unexplained) declines in (Net sales)/(Inventory) e. Unexpected (unexplained) increases in (Operating Cash Flow)/(Operating Income) 15. Aggressive use of which of the following accounting choices can lead to the problem of “off-balance sheet financing”? a. Operating leases b. Failure to write down obsolete inventory c. Reporting all related party transactions d. Overstating depreciation for long-term assets e. Using the intrinsic method to account for executive stock options 16. The suspect accounting practice for Lucent Technologies involved: a. Operating leases b. Overstating accounts receivable c. Executive stock options d. Overstating inventory e. Understating pension liabilities 17. Which of the following adjustments to the accounts would have to be made when it is found (suspected) a company overstates the balance of it’s long-term assets? a. Increase depreciation expense b. Decrease retained earnings c. Increase income tax expense d. Decrease post-retirement benefits liability e. Increase the asset account -4- FSA 3321 – Fall (2006) Exam 1-1 Moore Use the following information for questions 18-20 - Net Sales/Cash from sales Net Sales/Net Accounts Receivable Net Sales/Warranty Liabilities Changes in CFFO/OI Changes in CFFO/NOA Total Accruals/Change in Sales 2001 0.99 12.0 104 0.88 0.15 0.50 2002 0.98 10.0 106 0.81 0.18 .049 2003 1.01 11.0 118 0.82 0.17 0.62 2004 1.00 6.00 48 1.65 0.28 1.58 18. Which of the expense diagnostic ratios would provide a “red flag” raising concerns that expenses may have been understated for the purpose of overstating net income? a. Net Sales/Cash from sales b. Net Sales/Warranty Liabilities c. Changes in CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) d. Changes in CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) e. Total Accruals/Change in Sales 19. Which of the revenue diagnostic ratios would provide a “red flag” raising concerns that revenues may have been overstated for the purpose of overstating net income? a. Net Sales/Cash from sales b. Net Sales/Net Accounts Receivable c. Net Sales/Warranty Liabilities d. Changes in CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) e. Changes in CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) 20. For which of the following companies would cost leadership not be the main strategy? a. WalMart b. Ford Motor Company c. Apple Computers d. Dell Computers e. Redi-Mix Concrete Company -5-