Exam 1 – Fin 3321 - Fall – 2015 -...

advertisement

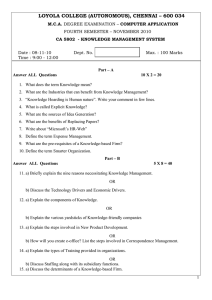

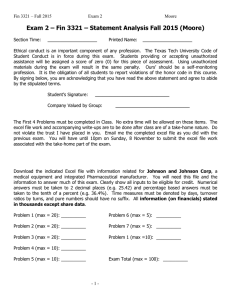

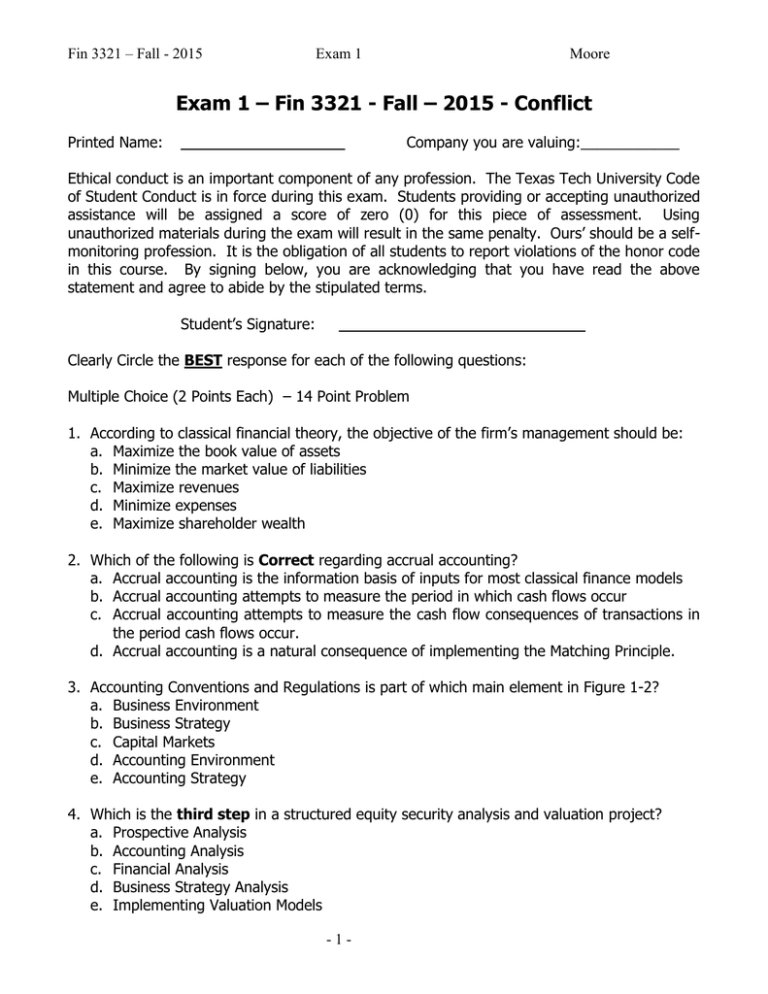

Fin 3321 – Fall - 2015 Exam 1 Moore Exam 1 – Fin 3321 - Fall – 2015 - Conflict Printed Name: ____________________ Company you are valuing:____________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: Multiple Choice (2 Points Each) – 14 Point Problem 1. According to classical financial theory, the objective of the firm’s management should be: a. Maximize the book value of assets b. Minimize the market value of liabilities c. Maximize revenues d. Minimize expenses e. Maximize shareholder wealth 2. Which of the following is Correct regarding accrual accounting? a. Accrual accounting is the information basis of inputs for most classical finance models b. Accrual accounting attempts to measure the period in which cash flows occur c. Accrual accounting attempts to measure the cash flow consequences of transactions in the period cash flows occur. d. Accrual accounting is a natural consequence of implementing the Matching Principle. 3. Accounting Conventions and Regulations is part of which main element in Figure 1-2? a. Business Environment b. Business Strategy c. Capital Markets d. Accounting Environment e. Accounting Strategy 4. Which is the third step in a structured equity security analysis and valuation project? a. Prospective Analysis b. Accounting Analysis c. Financial Analysis d. Business Strategy Analysis e. Implementing Valuation Models -1- Fin 3321 – Fall - 2015 Exam 1 Moore 5. Identify the proper sequence in which following items would be presented on the income statement is: 1. Interest Expense 2. Gross Profit 3. Advertising Expense 4. Operating Income 5. Comprehensive Income a. b. c. d. e. 6. An a. b. c. d. e. 2, 1, 3, 2, 1, 1, 5, 2, 3, 2, 3, 2, 4, 4, 3, 4, 4, 1, 1, 5, 5 3 5 5 4 industry having a high degree of price competition would be characterized by: Low Industry Concentration, Low Legal Barriers to Entry, High Product Differentiation Few Exit Barriers, Low First mover advantage, Low Product Differentiation High Industry Concentration, High Distribution Access, Low Firm Excess Capacity Low Concentration, Low Product Differentiation, Low First Mover Advantage Supply < Demand, No First Mover Advantage, High Fixed to Variable Cost Ratio 7. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, High First Mover Advantage, Low Product Differentiation c. Low Industry Concentration, Low Distribution Access, Low Customer Switching Costs d. High Industry Concentration, High Fixed-Variable Cost Ratio, Hi product differentiation e. Supply > Demand, High Legal Barriers to Entry, High Industry Concentration -2- Fin 3321 – Fall - 2015 Exam 1 Moore Short Problem 2 – Overs and Unders (10 Points) Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N). Base your analysis on Proper GAAP. Number 5 relates to impact on the GAAP stated Financials resulting from the decision not to Hedge. Assets 1 The company used too large a discount rate to estimate the present value of future payments on capital leases. Just consider the recognition of the lease being signed. 2 The company sells a 3 year extended warranty on its products. Customers pay the warranty at the time of purchase. The company booked the entire amount as revenue at the time of sale. 3 The company capitalized all Super Bowl Luxury Box/Suite costs as a deferred marketing cost. 4 A technology company did not impair goodwill associated with an acquired division whose product became obsolete. 5 The U.S. based company, an exporter, did not markto-market its Euro-based Accounts receiveable in a year when the dollar was strengthening. Liabilities -3- Equity Revenues Expenses Net Income Fin 3321 – Fall - 2015 Exam 1 Moore Short Problem 3 – Goodwill and M&A Activity (5 Points) Acquirer Company buys Target Company. Target’s pre-acquisition balance sheet at historical cost showed Total Assets at $730,000 and Total Liabilities at $420,000. Upon acquisition, Acquirer revalued Target’s identifiable assets at $1,350,000 and liabilities at $380,000. Assume the Acquirer recognized goodwill of $600,000 in this transaction. What is the price Acquirer paid for Target Company? -4- Fin 3321 – Fall - 2015 Exam 1 Moore Short Problem 4 – Information & Regulation Value (10 Points) Assume that 75% of the driving population are Bad Drivers and that 25% are good drivers. If given a choice, car drivers are willing to pay no more than their risk-neutral value of the benefits of having insurance. All bad drivers are equal and have the same preferences. The same holds for all good drivers. The risk neutral price for Good Drivers is identified as PG and is equal to $800. The risk neutral price for Bad Drivers is identified as PB and is equal to $2,000. Assume there is only one insurance company and the government regulations stipulate the price that can be charged by the company must be, on average, correct relative to the social risk neutral price established by both pools of drivers. Part 1 (4 Points) Assume that insurance is voluntary and the government allows the insurance company to collect information regarding the quality of the individual drivers that is perfect. What price(s) obtains in this type of insurance market and who chooses to buy insurance? Part 2 (4 Points) Assume that insurance is mandatory but the government prohibits the insurance company from collecting any information regarding the quality of the individual drivers. What price(s) obtains in this type of insurance market and who chooses to buy insurance? Part 3 (2 Points) Compare and contrast the benefits (and social costs) of acquiring information and having regulation. (who wins, who loses, and why?) -5- Fin 3321 – Fall - 2015 Exam 1 Moore Short Essay Problem 1 (write concisely, with bullet points and sentences, but make your answer clear) (15 Points) Company: ___________________________________ This Essay is directly related to the company your group is analyzing. For each of the 5 forces (Porter’s Model), conclude whether that item (force) leads to price-taking, pricesetting or mixed behavior in the industry (e.g. Existing Competition = hi, low or mixed) and then provide 2 specific business activity examples for the industry that support this conclusion for each “force”. (e.g. low industry concentration). Also, identify the three relevant competitors your group is using for industry benchmarks: 1. ______________________________ 2. ______________________________ 3. ______________________________ -6- Fin 3321 – Fall - 2015 Exam 1 Moore Short Essay Problem 2 (Use bullet points with complete sentences for clarity) (6 Points) This Essay is directly related to the company your group is analyzing. Identify 3 (three) specific value drivers for the industry you analyzed and explain, briefly, how these business activities create value and lead to creating or maintaining competitive advantages. Provide specific examples. Short Essay Problem 3 (Use complete sentences for clarity) (5 Points) In class, we discussed how companies may want to create GOODWILL when they spend money on customer service, quality improvement, etc. This would be accomplished by capitalizing these costs. The FASB and GAAP do object to this “substitution effect” for Goodwill but a company would attempt this disclosure on a “Non-GAAP” basis in an 8-K. Briefly explain why this is a justifiable approach to maintain an unimpaired goodwill balance. (in the eyes of the company presenting non-GAAP measures). Next, what type of financial performance should you be able to measure and observe if this argument is correct? (Hint: Think of Tables 2-1 and 2-2) -7- Fin 3321 – Fall - 2015 Exam 1 Moore Take-Home Portion of Exam (60 Points plus 10 Bonus) You must email the completed excel file (in .xls format) to my ttu email address no later than 7am on Tuesday, September 29, 2015 to receive any credit for these problems. The submitted file must have the following name: Exam1-Fin3321-Fall2015-YourLastName-YourFirstName.xls Problem 1 (20 Points) – Capitalize Operating Leases Problem 2 (20 Points) - Goodwill Problem 3 (10 Points) – Capitalize R&D Expenses (just make the schedules) Problem 4 (20 Regular Points and 10 Bonus Points) Restate the 2010 Financials (20 Points) in good form Restate the 2011 Financials in good form (10 point Bonus Problem) Only make adjustments to Goodwill and for Capitalizing Operating Leases. Use the Trial Balance worksheet approach that Includes both income statement and Balance Sheet accounts. Be sure to include the Debit and Credit checking of totals as well as the income summary account. You will need to have both “asStated” and “Re-Stated” account figures. You may have to open new accounts that appear when you re-state. Income summary account must be used. Take this page home with you Your Personal 4-Digit Exam Code: ____ _____ ____ _____ -8-