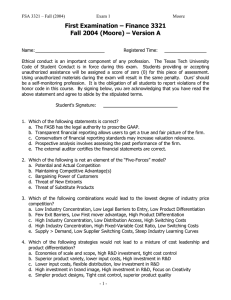

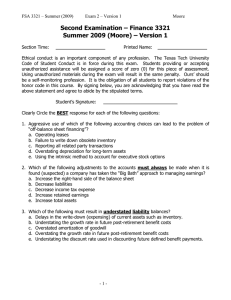

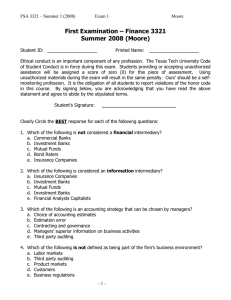

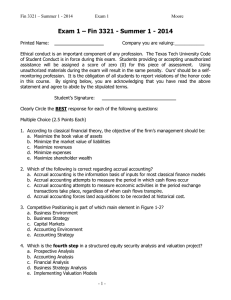

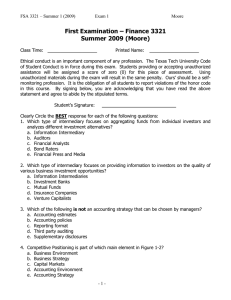

First Examination – Finance 3321 Spring 2010 (Moore)

advertisement

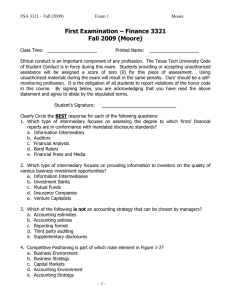

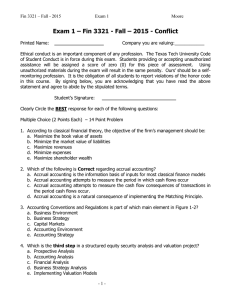

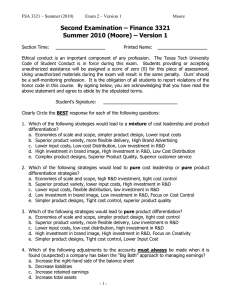

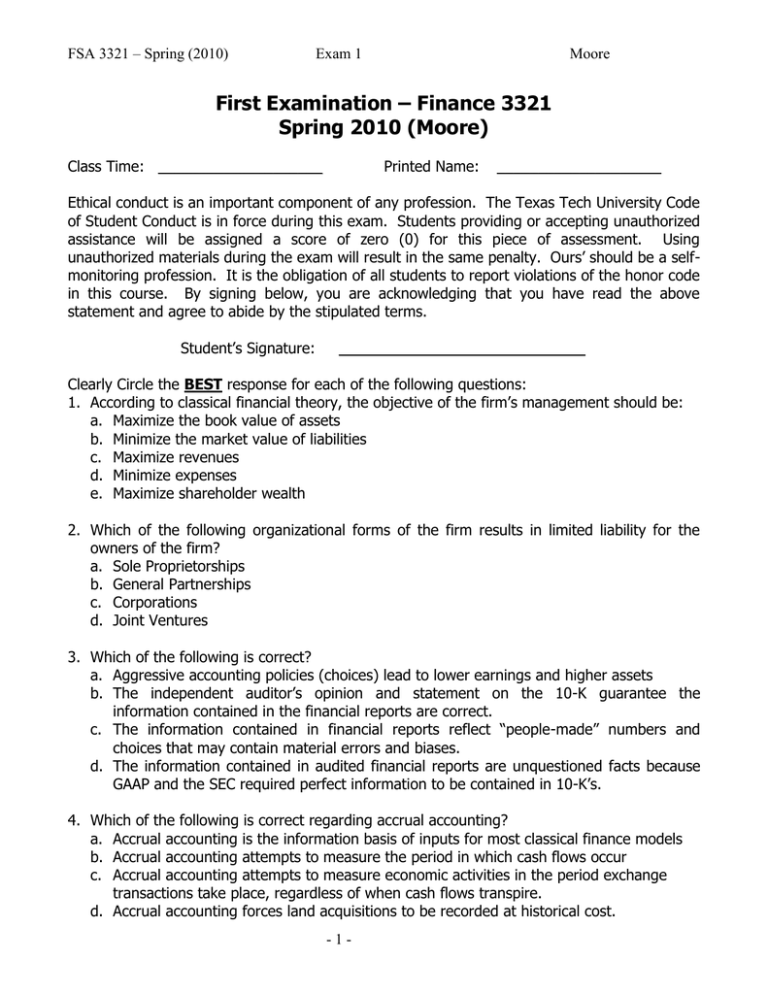

FSA 3321 – Spring (2010) Exam 1 Moore First Examination – Finance 3321 Spring 2010 (Moore) Class Time: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. According to classical financial theory, the objective of the firm’s management should be: a. Maximize the book value of assets b. Minimize the market value of liabilities c. Maximize revenues d. Minimize expenses e. Maximize shareholder wealth 2. Which of the following organizational forms of the firm results in limited liability for the owners of the firm? a. Sole Proprietorships b. General Partnerships c. Corporations d. Joint Ventures 3. Which of the following is correct? a. Aggressive accounting policies (choices) lead to lower earnings and higher assets b. The independent auditor’s opinion and statement on the 10-K guarantee the information contained in the financial reports are correct. c. The information contained in financial reports reflect “people-made” numbers and choices that may contain material errors and biases. d. The information contained in audited financial reports are unquestioned facts because GAAP and the SEC required perfect information to be contained in 10-K’s. 4. Which of the following is correct regarding accrual accounting? a. Accrual accounting is the information basis of inputs for most classical finance models b. Accrual accounting attempts to measure the period in which cash flows occur c. Accrual accounting attempts to measure economic activities in the period exchange transactions take place, regardless of when cash flows transpire. d. Accrual accounting forces land acquisitions to be recorded at historical cost. -1- FSA 3321 – Spring (2010) Exam 1 Moore 5. Which type of intermediary focuses on providing information to investors on the quality of various business investment opportunities? a. Information Intermediaries b. Investment Banks c. Mutual Funds d. Insurance Companies e. Venture Capitalists 6. Which of the following is not an accounting strategy that can be chosen by managers? a. Choice of Accounting estimates b. Choice of Accounting policies c. Choice of Reporting format d. Third party auditing e. Choice of Supplementary disclosures 7. Competitive Positioning is part of which main element in Figure 1-2? a. Business Environment b. Business Strategy c. Capital Markets d. Accounting Environment e. Accounting Strategy 8. Which is the third step in a structured equity security analysis and valuation? a. Prospective Analysis b. Accounting Analysis c. Financial Analysis d. Business Strategy Analysis e. Implementing Valuation Models 9. Which step in a structured business valuation analysis involves estimating the firm’s cost of capital? a. Prospective Analysis b. Accounting Analysis c. Financial Analysis d. Business Strategy Analysis e. Implementing Valuation Models -2- FSA 3321 – Spring (2010) Exam 1 Moore 10. Acquirer Company buys Target Company. Target’s pre-acquisition balance sheet at historical cost showed Total Assets at $300,000 and Total Liabilities at $200,000. Upon acquisition, Acquirer revalued Target’s assets at $600,000 and liabilities at $220,000. In addition, Acquirer recognized $400,000 of Goodwill associated with the acquisition. Determine the amount Acquirer paid for Target. a. $100,000 b. $1,000,000 c. $680,000 d. $780,000 e. $380,000 11. Identify the proper sequence in which following items would be presented on the income statement is: 1. Net Revenue 2. Gross Profit 3. Comprehensive Income 4. Net Income 5. Operating Income a. b. c. d. e. 1, 1, 1, 1, 1, 2, 5, 2, 5, 2, 3, 2, 5, 3, 3, 4, 4, 4, 2, 5, 5 3 3 4 4 12. Which of the following statements is correct? a. The FASB has the legal authority to proscribe GAAP. b. Transparent financial reporting practices provide users a true and fair picture of firms. c. Conservatism of financial reporting standards never reduces valuation relevance. d. Prospective analysis involves determination of the firm’s equity value. e. The external auditor certifies the financial statements are correct. 13. Which of the following is not one of the 5 main dimensions of the “Five-Forces” model? a. Switching Costs b. Rivalry Among Existing Firms c. Threat of New Entrants d. Bargaining Power of Customers e. Threat of Substitute Products 14. An a. b. c. d. e. industry having a high degree of price competition would be characterized by: Low Industry Concentration, Low Legal Barriers to Entry, High Product Differentiation Few Exit Barriers, Low First mover advantage, Low Product Differentiation High Industry Concentration, High Distribution Access, Low Firm Excess Capacity Low Concentration, Low Fixed-Variable Cost Ratio, Few Legal Barriers to Entry Supply > Demand, Low First Mover Advantage, High Fixed to Variable Cost Ratio -3- FSA 3321 – Spring (2010) Exam 1 Moore 15. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, High First Mover Advantage, High Product Differentiation c. Low Industry Concentration, Low Distribution Access, Low Customer Switching Costs d. High Industry Concentration, High Fixed-Variable Cost Ratio, Hi product differentiation e. Supply > Demand, High Legal Barriers to Entry, Steep Industry Learning Curves 16. Assume a company has been classified as belonging in a purely differentiated product (specialty good) industry. Which one of the following disclosures would not be considered a key accounting policy? a. Net Sales/Warranty Liabilities b. Inventory is measured on a Lifo basis at lower of cost or market c. Disclosure regarding new product development R&D expenses d. Disclosure new customer service programs e. Disclosure regarding the strategic placement of new distribution centers 17. Which of the following strategies would lead to a mixture of cost leadership and product differentiation? a. Economies of scale and scope, simpler product design, Lower input costs b. Superior product variety, more flexible delivery, High Brand Advertising c. Lower input costs, Low-cost Distribution, Low investment in R&D d. High investment in brand image, High investment in R&D, Low Cost Distribution e. Complex product designs, Superior Product Quality, Superior customer service 18. Which of the following is not used to determine the Rivalry Among Existing Firms? a. First Mover Advantage b. Excess Capacity c. Concentration d. Switching Costs e. Industry Growth 19. Which of the following models, theorems or hypotheses, if absolutely true in the real world, would make the activities of information production or financial analysis a socially and economically non-productive activities? a. Capital Asset Pricing Model b. Weak Form Efficient Market Hypothesis c. Strong Form Efficient Market Hypothesis d. Modigliani and Miller Theorem, without taxes e. Residual Income Valuation Model -4- FSA 3321 – Spring (2010) Exam 1 Moore 20. Assume PG is the fair insurance price for Good drivers and PB is the fair insurance price for Bad drivers, where PG = 200, PB = 400 and 40% of the drivers are Good drivers. If insurers do not have a mechanism to distinguish good and bad drivers, what price(s) will result in the voluntary insurance market (assume linear risk preferences)? a. Good drivers pay 200 and Bad drivers pay 400 b. All drivers pay 200 c. All drivers pay 300 d. All drivers pay 320 e. All drivers pay 400 21. Which of the following environmental structures (designs) is necessary and sufficient for differential insurance prices to occur that approach theoretically fair prices of PG and PB ? a. Insurance is mandated b. Insurance is voluntary c. Information is perfectly verifiable d. Population statistics regarding the proportion of good and bad drivers are known -5- FSA 3321 – Spring (2010) Exam 1 Moore Use the following information for problems 22-24 You are performing an accounting analysis on ABC Company and noted excessive goodwill balances relative to reported PPE. The following table was constructed from ABC’s 10-K information. Assume all new goodwill is recognized at the end of the year for the purpose of restatement. Further, assume a tax rate of 30%. Finally, you are starting the restatement process from 2006’s financial statements. ABC has a December 31 fiscal year end. Assume goodwill has a 5-year useful life and that you are adjusting the account. Beginning Balance New Goodwill Goodwill Impaired Ending Goodwill 2006 20,000,000 3,000,000 0 23,000,000 2007 23,000,000 5,000,000 2,000,000 26,000,000 2008 26,000,000 8,000,000 3,000,000 31,000,000 2009 31,000,000 2,000,000 10,000,000 23,000,000 22. How much is the goodwill impairment adjustment for 2009? a. $2,800,000 additional impairment b. $2,600,000 additional impairment c. $1,820,000 additional impairment d. $2,800,000 reduced impairment e. $1,960,000 reduced impairment 23. The overall decrease to Net Income in 2008 for ABC after adjustment would be? a. $1,960,000 b. $4,600,000 c. $3,220,000 d. $2,800,000 e. $1,820,000 24. How much Goodwill should on the Balance Sheet in 2008 after all of the restatement adjustments have been made? a. $31,000,000 b. $28,400,000 c. $24,560,000 d. $21,800,000 e. Cannot be determined from the given information. -6- FSA 3321 – Spring (2010) Exam 1 Moore Questions 25-27 (Currency and Hedging) Use the following information for questions 4-7 On January 4, 2010, ABC Company sells 11.4 million euro of farm equipment to a French agribusiness firm. The terms of the contract provide for payment to be made in Euros with payment due by March 4, 2010. The spot exchange rate on January 4 was 1 euro = 1.4387 U.S. dollars. ABC has a December 31 fiscal year end. 25. Assume that ABC did not hedge currency risk in this transaction and that the French customer paid on February 22 when the exchange rate was 1.3592 dollars per euro. How much is the realized foreign exchange gain or loss on this transaction? a. $463,467 gain b. $463,467 loss c. $906,300 gain d. $906,300 loss 26. Now, assume ABC wants to hedge the currency risk. Future contracts are set at 125,000 euro per contract. The following contracts (stated in terms of expiration dates) were considered on January 4: March 15, 2010; June 14, 2010; and September 15, 2010 futures contracts on Euro. The policy for ABC’s risk management is to fully hedge without exceeding the original size of the asset or liability (11.4 million euro). What would be ABC’s hedging policy under these conditions? a. buy 91 March 2010 futures contracts b. sell 91 March 2010 futures contracts c. sell 92 March 2010 futures contracts d. buy 91 June 2010 futures contracts e. sell 91 June 2010 futures contracts 27. Assume, independent of your answer in problem 26, that ABC used the March 2010 futures contract to hedge the risk. On January 4, the March 2010 futures contract opened at 1.4403 and that on February 22 the futures contract was trading at 1.3587 when ABC closed the position. Each futures contract costs $500. Compute the overall net effect of hedging (fx gains/losses on the underlying, the futures and the cost of hedging). a. $13,900 net benefit (gain) b. $13,900 net cost (loss) c. $23,600 net benefit (gain) d. $23,600 net cost (loss) e. $22,060 net cost (loss) -7- FSA 3321 – Spring (2010) Exam 1 Moore Use the following Dell information for problems 28 – 30. (Income Statements) PERIOD ENDING Total Revenue Cost of Revenue Gross Profit 2-Feb-07 57,420,000 47,904,000 9,516,000 1-Feb-08 61,133,000 49,462,000 11,671,000 Operating Expenses Research & Development Selling General and Administrative Total Operating Expenses Operating Income or Loss 498,000 5,948,000 6,446,000 3,070,000 610,000 7,538,000 8,148,000 3,523,000 Net Income 2,583,000 2,947,000 28. Estimate the total variable costs for Dell in the year ending 2 Feb. 2007. a. $47,904,000 b. $54,350,000 c. $53,674,543 d. $50,414,543 e. $49,462,916 29. Estimate the Fixed to Variable cost ratio for Dell for the year ending 1 Feb. 2008. a. 0.0733 b. 0.0781 c. 0.9882 d. 0.9282 e. 13.6387 30. Assume the variable cost of goods sold (per sales dollar) is 0.419607 in 2008. Estimate the total fixed cost of goods sold for that year. a. $23,810,178 b. -$19,874,722 c. $3,935,457 d. $24,093,822 e. $25,651,822 -8- FSA 3321 – Spring (2010) Exam 1 Problem 1 – Overs and Unders (10 Points) Moore Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N) 1 2 3 The company failed to write down a 50% impairment of inventory The company used too large a discount rate to estimate the present value of future service costs on a defined benefit pension plan The company used too low a rate in estimating account receivable defaults 6 The company capitalized all research and development costs The company recognized all gift card sales as revenues in the year sold even though they don't expire for 3 years The company failed to impair goodwill despite having a competitive advantage loss 7 Regular equipment maintenance expenditures were recognized as capital improvements to the assets 8 A car manufacturer knew of potentially faulty accelerators on new cars sold under warranty but didn't adjust financial statement for the estimated costs 9 The company failed to recognize foreign currency losses related to international sales transactions 10 The company, an importer, failed to hedge foreign exchange risk in a year when the dollar was strengthening 4 5 -9-