First Examination – Finance Statement Analysis Fall 2013 – Fin 5324

advertisement

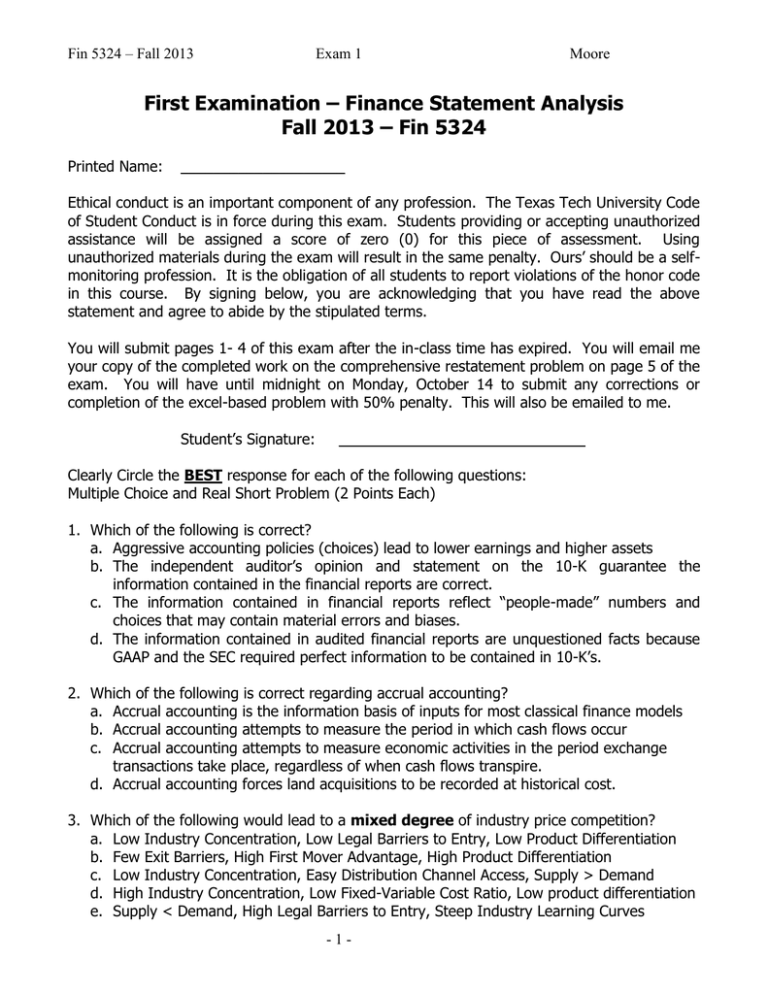

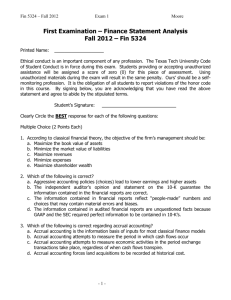

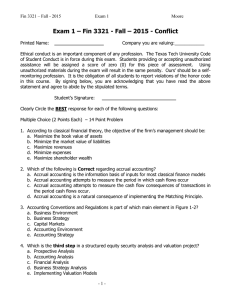

Fin 5324 – Fall 2013 Exam 1 Moore First Examination – Finance Statement Analysis Fall 2013 – Fin 5324 Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a selfmonitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. You will submit pages 1- 4 of this exam after the in-class time has expired. You will email me your copy of the completed work on the comprehensive restatement problem on page 5 of the exam. You will have until midnight on Monday, October 14 to submit any corrections or completion of the excel-based problem with 50% penalty. This will also be emailed to me. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: Multiple Choice and Real Short Problem (2 Points Each) 1. Which of the following is correct? a. Aggressive accounting policies (choices) lead to lower earnings and higher assets b. The independent auditor’s opinion and statement on the 10-K guarantee the information contained in the financial reports are correct. c. The information contained in financial reports reflect “people-made” numbers and choices that may contain material errors and biases. d. The information contained in audited financial reports are unquestioned facts because GAAP and the SEC required perfect information to be contained in 10-K’s. 2. Which of the following is correct regarding accrual accounting? a. Accrual accounting is the information basis of inputs for most classical finance models b. Accrual accounting attempts to measure the period in which cash flows occur c. Accrual accounting attempts to measure economic activities in the period exchange transactions take place, regardless of when cash flows transpire. d. Accrual accounting forces land acquisitions to be recorded at historical cost. 3. Which of the following would lead to a mixed degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, High First Mover Advantage, High Product Differentiation c. Low Industry Concentration, Easy Distribution Channel Access, Supply > Demand d. High Industry Concentration, Low Fixed-Variable Cost Ratio, Low product differentiation e. Supply < Demand, High Legal Barriers to Entry, Steep Industry Learning Curves -1- Fin 5324 – Fall 2013 4. An a. b. c. d. e. Exam 1 Moore industry having a high degree of price competition would be characterized by: Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation Few Exit Barriers, Low First mover advantage, Low Product Differentiation High Industry Concentration, High Distribution Access, Low Firm Excess Capacity Low Concentration, Low Fixed-Variable Cost Ratio, Few Legal Barriers to Entry Supply < Demand, Low First Mover Advantage, High Fixed to Variable Cost Ratio 5. Acquirer Company buys Target Company. Target’s pre-acquisition balance sheet at historical cost showed Total Assets at $730,000 and Total Liabilities at $420,000. Upon acquisition, Acquirer revalued Target’s assets at $1,280,000 and liabilities at $675,000. In addition, Acquirer recognized $660,000 of new Goodwill associated with the acquisition of Target. Determine the amount of Acquirer paid for Target. Short Essay Problem 1 (write concisely, with bullet points and sentences, but make your answer clear) (10 Points) This Essay is directly related to the company your group is analyzing (Goodyear or SkyWest). For each of the 5 forces (Porter’s Model), conclude whether that item (force) leads to price-taking, price-setting or mixed behavior in the industry (e.g. Existing Competition = hi, low or mixed) and then provide 2 specific business activity examples for the industry that support this conclusion for each “force”. (e.g. low industry concentration). -2- Fin 5324 – Fall 2013 Exam 1 Moore Short Essay Problem 2 (Use bullet points with complete sentences for clarity) (10 Points) This Essay is directly related to the company your group is analyzing (Goodyear or SkyWest). Identify 5 (five) specific value drivers for the industry you analyzed and explain, briefly, how these business activities create value and lead to creating or maintaining competitive advantages. Short Essay Problem 3 (Use bullet points with complete sentences for clarity) (10 Points) Describe the process of financial data gathering for a private company business valuation appraisal. How does the process of data gathering for private clients differ from that for external valuation of public companies. Are there expected differences in the quality and relevance of the information obtained related to the engagements. -3- Fin 5324 – Fall 2013 Exam 1 Moore Problem 4 – Overs and Unders (10 Points) Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N). Base your analysis on Proper GAAP. Number 10 relates to impact resulting from the decision. Assets 1 The company failed to write down a 50% impairment of inventory 3 The company used too large a discount rate in estimating capital lease assets and liabilities AOL capitalized CD production and distribution costs related to mailed free-trial subscriptions 4 Regular equipment maintenance expenditures were recognized as capital improvements to the assets 5 The company failed to recognize foreign currency gains related to international sales transactions 2 -4- Liabilities Equity Revenues Expenses Net Income Fin 5324 – Fall 2013 Exam 1 Moore Main Exam Problem – Restating Financial Statements (50 Points) Download the excel spreadsheet with financial information for Google. This information comes directly from GOOGLE’s annual 10-K’s for the years 2009, 2010 and 2011. You are provided Goodwill, Operating Lease and Research and Development expense or activity information. Your mission is to restate the financial report in order to provide an alternative view of the impact of Goodwill, Operating Leases and R&D of the financial condition of the firm. After restating the financials, provide brief responses to basic questions regarding how these restatements impact your view of Google. Your working assumptions are that all Lease contracts are signed (renewed) on December 31. Mergers and Acquisitions are assumed to take place on the last day of the year and the competitive advantage captured by Goodwill is assumed to have a 10-year useful life. Research and Development activities are presumed to take place continuously throughout the year. The R&D cycle is assumed to be 4 Years for firms in Google’s industry. Required: (all work is Pre-Tax) – You may take this page home!!! 1. On the excel spreadsheet, prepare a capitalization of lease schedule for the Operating Leases disclosed on the 2009 and 2010 10-K’s. Be sure to show the amortization of the capitalized lease. Use a separate worksheet tab for each year. Be sure to also identify annual depreciation and interest expense. 2. Prepare, on a separate tab in the worksheet a Goodwill amortization schedule for 2009 through 2016. You should clearly identify both the annual adjusted (restated) balances of Goodwill and the annual adjustment (impairment or amortization) for restated goodwill. 3. Prepare, on a separate tab the adjustments for R&D if you were to capitalize R&D activities and then amortize the R&D assets in a manner consistent with the assumptions. 4. Prepare the trial balance adjusting entries for 2009 and 2010 related to Goodwill, R&D and Capitalizing Operating Leases. Add accounts as you need. 5. Prepare a restated income statement and balance sheet that reflects your work for 2009 and 2010. 6. Briefly comment (below) how these restated financials affect your view of Google’s operating profitability and capital structure risk as compared with the presentation under traditional “as-stated” GAAP financial reports. -5-

![[Date] [Name of College] ATTN: [Department]](http://s2.studylib.net/store/data/015675584_1-19c1f2d4f2acfcfa6a51fd36241fad38-300x300.png)