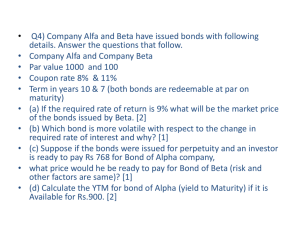

CHAPTER 10 Making Capital Investment Decisions

advertisement

CHAPTER 10

Making Capital Investment Decisions

Learning Objectives

LO1

LO2

LO3

LO4

LO5

LO6

LO7

LO8

How to determine relevant cash flows for a proposed project.

How to project cash flows and determine if a project is acceptable.

How to calculate operating cash flow using alternative methods.

How to calculate the present value of a tax shield on CCA.

How to evaluate cost-cutting proposals.

How to analyze replacement decisions.

How to evaluate the equivalent annual cost of a project.

How to set a bid price for a project.

Answers to Concepts Review and Critical Thinking Questions

1.

(LO1) An opportunity cost is the most valuable alternative that is foregone if a particular project is undertaken.

The relevant opportunity cost is what the asset or input is actually worth today, not, for example, what it cost

to acquire.

2.

(LO1) It’s probably only a mild over-simplification. Current liabilities will all be paid presumably. The cash

portion of current assets will be retrieved. Some receivables won’t be collected, and some inventory will not be

sold, of course. Counterbalancing these losses is the fact that inventory sold above cost (and not replaced at the

end of the project’s life) acts to increase working capital. These effects tend to offset.

3.

(LO7) The EAC approach is appropriate when comparing mutually exclusive projects with different lives that

will be replaced when they wear out. This type of analysis is necessary so that the projects have a common life

span over which they can be compared; in effect, each project is assumed to exist over an infinite horizon of Nyear repeating projects. Assuming that this type of analysis is valid implies that the project cash flows remain

the same forever, thus ignoring the possible effects of, among other things: (1) inflation, (2) changing

economic conditions, (3) the increasing unreliability of cash flow estimates that occur far into the future, and

(4) the possible effects of future technology improvement that could alter the project cash flows.

4.

(LO1) Depreciation is a non-cash expense, but it is tax-deductible on the income statement. Thus depreciation

causes taxes paid, an actual cash outflow, to be reduced by an amount equal to the depreciation tax shield t cD.

A reduction in taxes that would otherwise be paid is the same thing as a cash inflow, so the effects of the

depreciation tax shield must be included to get the total incremental aftertax cash flows.

5.

(LO1) There are two particularly important considerations. The first is erosion. Will the essentialized book

simply displace copies of the existing book that would have otherwise been sold? This is of special concern

given the lower price. The second consideration is competition. Will other publishers step in and produce such

a product? If so, then any erosion is much less relevant. A particular concern to book publishers (and producers

of a variety of other product types) is that the publisher only makes money from the sale of new books. Thus, it

is important to examine whether the new book would displace sales of used books (good from the publisher’s

perspective) or new books (not good). The concern arises any time there is an active market for used product.

6.

(LO1) This market was heating up rapidly, and a number of other competitors were planning on entering. Any

erosion of existing services would be offset by an overall increase in market demand.

7.

(LO1) Pistachio should have realized that abnormally large profits would dwindle as more supply of services

came into the market and competition became more intense.

10-1

Solutions to Questions and Problems

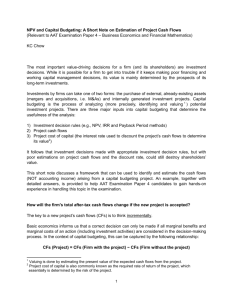

NOTE: All end of chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to

space and readability constraints, when these intermediate steps are included in this solutions manual, rounding

may appear to have occurred. However, the final answer for each problem is found without rounding during any

step in the problem.

Basic

1.

(LO1) The $6 million acquisition cost of the land six years ago is a sunk cost. The $6.4 million current aftertax

value of the land is an opportunity cost if the land is used rather than sold off. The $14.2 million cash outlay

and $890,000 grading expenses are the initial fixed asset investments needed to get the project going.

Therefore, the proper year zero cash flow to use in evaluating this project is

$6,400,000 + 14,200,000 + 890,000 = $21,490,000

2.

(LO1) Sales due solely to the new product line are:

19,000($13,000) = $247,000,000

Increased sales of the motor home line occur because of the new product line introduction; thus:

4,500($53,000) = $238,500,000

in new sales is relevant. Erosion of luxury motor coach sales is also due to the new portable campers; thus:

900($91,000) = $81,900,000 loss in sales

is relevant. The net sales figure to use in evaluating the new line is thus:

$247,000,000 + 238,500,000 – 81,900,000 = $403,600,000

3.

(LO1) We need to construct a basic Statement of Comprehensive Income. The Statement of Comprehensive

Income is:

Sales

Variable costs

Fixed costs

Depreciation

EBT

Taxes@35%

Net income

4.

$ 830,000

498,000

181,000

77,000

$ 74,000

25,900

$ 48,100

(LO3) To find the OCF, we need to complete the Statement of Comprehensive Income as follows:

Sales

Costs

Depreciation

EBIT

Taxes@34%

Net income

$ 824,500

538,900

126,500

$ 159,100

54,094

$ 105,006

The OCF for the company is:

OCF = EBIT + Depreciation – Taxes

OCF = $159,100 + 126,500 – 54,094

10-2

OCF = $231,506

The depreciation tax shield, also called the CCA tax shield, is the depreciation times the tax rate, so:

Depreciation tax shield = tcDepreciation

Depreciation tax shield = .34($126,500)

Depreciation tax shield = $43,010

The depreciation tax shield shows us the increase in OCF by being able to expense depreciation.

5.

(LO3) To calculate the OCF, we first need to calculate net income. The Statement of Comprehensive Income

is:

Sales

Variable costs

Depreciation

EBT

Taxes@35%

Net income

$ 108,000

51,000

6,800

$ 50,200

17.570

$ 32,630

Using the most common financial calculation for OCF, we get:

OCF = EBIT + Depreciation – Taxes

OCF = $50,200 + 6,800 – 17,570

OCF = $39,430

The top-down approach to calculating OCF yields:

OCF = Sales – Costs – Taxes

OCF = $108,000 – 51,000 – 17,570

OCF = $39,430

The tax-shield approach is:

OCF = (Sales – Costs)(1 – tC) + tCDepreciation

OCF = ($108,000 – 51,000)(1 – .35) + .35(6,800)

OCF = $39,430

And the bottom-up approach is:

OCF = Net income + Depreciation

OCF = $32,630 + 6,800

OCF = $39,430

All four methods of calculating OCF should always give the same answer.

6.

(LO1)

Sales

Variable costs

Fixed costs

CCA

EBIT

Taxes@35%

Net income

$ 940,000

385,400

147,000

104,000

$ 303,600

106,260

$ 197,340

10-3

7.

(LO1, 2)

Cash flow year 0 = -990,000

Cash flow years 1 through 5 = 460,000(1 – .40) = $276,000

PV of CCATS = 990,000(.3)(.4) x (1 + .5(.15))

.15 + .3

1 + .15

= $246,782.61

NPV = -990000 + 276,000 x PVIFA (15%, 5) + 246,782.61

= -990,000 + 276,000 x {1 – [1/1+.15]5/.15} + 246,782.61

= $181,977.42

8.

(LO2)

Cash flow year 0 = -990,000 – 47,200 = -$1,037,200

Cash flow years 1 through 5 = 460,000(1 – .4) = $276,000

Ending cash flow = 100,000 + 47,200 = $147,200

PV of CCATS =

990,000(.3)(.4) x (1 + .5(.15)) –

.15 + .3

1 + .15

100,000(.3)(.4) x

1

.15 + .3

(1.15)5

= $233,524.56

NPV = -1,037,200+ 276,000 x PVIFA(15%, 5) + (147,200)/(1.15)5 + 233,524.56 = $194,703.78

9.

(LO2) The NPV will be smaller because the Capital Cost Allowances are smaller early on.

PV of CCATS = 990,000(.25)(.4) x (1 + .5(.15)) –

.15 + .25

1 + .15

100,000(.25)(.4) x

1

.15 + .25

(1.15)5

= $218,929.28

Therefore with a 25% CCA rate, the

NPV = 194,703.79 + (218,929.28– 233,524.57) = $181,108.50

10.

(LO1) Neither one is correct. What should be considered is the opportunity cost of using the land, at the very

least what the land could be sold for today.

11.

(LO4) Generally, as long as there are other assets in the class, the pool remains open and there are no tax

effects from the sale. This fact does not hold here since we are told that there will be no assets left in the

class in 6 years.

Beyond the first year, the UCC at the beginning of the N th year is given by the formula:

N 2

d

UCCN C 1 1 d where C = installed capital cost; d = CCA rate. Note that the half-year rule has

2

been incorporated. In this case:

10-4

UCC6 = $548,000 (1 – (0.2/2)) (1-0.2)6-2 = $202,014.72. This is the book value of the asset at the end of the

5th year (beginning of the sixth).

The asset is sold at a (terminal) loss to book value = $202,014.72 – $105,000 = $97,014.72. The terminal loss

acts as a tax shield which the company can use to reduce its taxes. The reduction in taxes is a cash inflow.

The tax shield = 0.35 $97,014.72 = $33,955.15

The after tax salvage value = $105,000 + $33,955.15 = $138,955.15

.

12.

(LO2) A/R fell by $6,140, and inventory increased by $5,640, so net current assets fell by $500. A/P rose by

$6,930.

∆NWC = ∆(CA – CL) = –500 – 6,930 = – 7,430

Net cash flow = S – C – ∆NWC = 102,000 – 43,500 – (– 7,430) = $65,930

13.

(LO3)

CCA1 = 0.3($3.9M/2) = $585,000; CCA2 = 0.3(3.9M – $585,000) = $994,500;

CCA3 = 0.3($3.9M – 585,000 – 994,500) = $696,150.

OCF1 = (S – C)(1 – tc) + tcD = ($2.65M – $840K)(1 – 0.35) + 0.35($585,000) = $1,381,250

OCF2 = (S – C)(1 – tc) + tcD = ($2.65M – $840K)(1 – 0.35) + 0.35($994,500) = $1,524,575

OCF3 = (S – C)(1 – tc) + tcD = ($2.65M – $840K)(1 – 0.35) + 0.35($696,150) = $1,420,152.50

14.

(LO2)

Initial Cash Flow year 0 = -$2,650,000

After-tax net revenue years 1-3 = (S – C)(1 – tC) = ($2,650,000 – 840,000)(1 – 0.35) = $1,176,500

Ending cash flows (year 3) = salvage value = $1,624,350

PV of CCATS = 3,900,000(.3)(.35) x (1 + .5(.12)) –

.12 + .3

1 + .12

1,624,350 (.3)(.35) x

1

.12 + .3

(1.12)3

= $633,722.80

NPV = – $3.9M + $1,176,500(PVIFA12%, 3) + $633,722.80 + $1,624,350/1.123

15.

= $715,657.53

(LO1, 2)

Cash Flow year 0 = -$3,900,000 – 300,000 = -$4,200,000

After-tax net revenue years 1-3 = (S – C)(1 – Tc) = ($2,650,000 – 840,000)(1 – 0.35) = $1,176,500

Ending cash flows (year 3) = recovery of NWC + salvage value = $300,000 + 210,000 = $510,000

PV of CCATS = 3,900,000(.3)(.35) x (1 + .5(.12)) –

.12 + .3

1 + .12

210,000(.3)(.35) x

.12 + .3

1

(1.12)3

= $885,399.39

NPV = –$4.2M + $1,176,500(PVIFA12%,3) + $885,399.39 + $510,000/1.123 = -$125,838.20

10-5

16. (LO1, 2)

Initial Cash Flow year 0 = -785,000 – 140,000 = -$925,000

After-tax net revenue years 1 through 5 = (13,500,000 – 11,700,000 – 215,000)(1 – .35) = $1,030,250

Ending cash flows (year 5) = $140,000

PV of CCATS = 785,000(.25)(.35) x (1 + .5(.19))

.19 + .25

(1 + .19)

= $143,645.55

NPV = -925,000 + 143,645.55 + 1,030,250 x PVIFA(19%,5) + 140,000/(1.19) 5

= $2,427,440.81

Since the NPV is positive, it is probably a good project.

17.

(LO2) Assuming that all outstanding accounts receivable from the previous quarter are collected in the current

quarter, the amount of cash collections in the current quarter is:

$15,200 – 9,500 = $5,700

This can be seen by making collections from current quarter sales a plug number Y in the current quarter’s

cash flow summary for accounts receivable:

Opening balance of A/R

Current quarter sales

Collections of outstanding A/R from previous quarter

Collections from current quarter sales

Closing balance of A/R

X

$15,200

–X

–Y

$15,200 - Y

This gives the equation: 15,200 – Y = X + 9,500

So the total cash collections in the current are:

X + Y = $5,700

18. (LO1) Management’s discretion to set the firm’s capital structure is applicable at the firm level. Since any one

particular project could be financed entirely with equity, another project could be financed with debt, and the

firm’s overall capital structure remains unchanged, financing costs are not relevant in the analysis of a

project’s incremental cash flows according to the stand-alone principle.

19. (LO1) The $7.2 million acquisition cost of the land seven years ago is a sunk cost, and so it is not relevant.

The $586,000 grading cost to make the land usable is relevant. The $962,000 current appraisal of the land is an

opportunity cost if the land is used rather than sold off. If the land is sold at $962,000 there will be a capital

loss of (7,200,000 – 962,000) $6,238,000 of which the company can write off 50% of it against any taxable

Capital Gains. This means that at a tax rate of 30% they would be able to write off 30% x $3,119,000 and thus

save $935,700 in taxes.

The $25 million cash outlay is the initial fixed asset investment needed to get the project going. Therefore, the

proper year zero cash flow to use in evaluating this project is = $0.962M + $25M + .586M - $.9357M=

$25,612,300.

20. (LO1) Currently the firm has sales of 23,000($14,690) + (38,600) ($43,700) = $2,024,690,000. With the

introduction of a new mid-sized car its sales will change by (28,500) ($33,600) + (12,500) ($14,690) – (8,200)

10-6

($43,700) = $782,885,000. This amount is the incremental sales and is the amount that should be considered

when evaluating the project.

21. (LO1, 2)

Initial Cash Flow 0 = -560,000 – 29,000 = -$589,000

After-tax savings in Operating Costs years 1 through 5 = (165,000) (1 – .34) = $108,900

Ending cash flows (year 5) = $85,000 + 29,000 = $114,000

PV of CCATS = 560,000(.2)(.34) x (1 + .5(.10)) – 85,000(.2)(.34) x

.10 + .2

(1 + .10)

.10 + .2

1

(1.10)5

= $109,200.55

NPV = -589,000 + 109,200.55+ 108,900 x PVIFA(10%, 5) + 114,000/(1.10)5

= $3,802.26

22. (LO1, 2)

Initial cash flow net revenue year 0 = -720,000+ 110,000 = -$610,000

After-tax savings in order processing costs years 1 through 5 = (350,000)(1 – .35) = $227,500

Ending cash flows (year 5) = $280,000 – 110,000 = $170,000

PV of CCATS = $260,000

NPV = 0 = -610,000 + 260,000 + 227,500 x PVIFA(IRR%,5) + 170,000/(1+IRR)5

NPV = 0 = -610,000 + 260,000 + 227,500 x ({1-[1/(1+IRR)]5}/IRR) + 170,000/(1+IRR)5

IRR = 61.85%

23. (LO1, 2)

$300,000 cost saving case

Initial Costs year 0 = -720,000+110,000 = -$610,000

After-tax savings in processing costs years 1 through 5 = (300,000)(1 – .35) = $195,000

Ending cash flows (year 5) = $280,000 – 110,000 = $170,000

PV of CCATS = $114,969.60

NPV = -610,000 + 114,969.60 + 195,000 x PVIFA(20%,5) + 170,000/(1+.20)5 = $156,458.15 Accept the

project.

$240,000 cost saving case

Initial cash flow year 0 = -$610,000

After tax savings in order processing costs years 1 through 5 = (240,000)(1 – .35) = $156,000

Ending cash flows (year 5) = $280,000 – 110,000 = $170,000

PV of CCATS = $114,969.60

NPV = -610,000 + 114,969.60 + 156,000 x PVIFA(20%,5) + 170,000/(1+.20)5 = $39,824.28 Accept the

project.

Required pretax cost saving case (RCS)

Initial cash flow year 0 = -$610,000

Ending cash flows (year 5) = $280,000 – 110,000 = $170,000

PV of CCATS = $114,969.60

NPV = 0 = -610,000 + 114,969.60 + RCS(1 – .35) x PVIFA(20%,5) + 170,000/(1+.20)5 Solve for RCS

10-7

RCS = Required pretax cost saving = $219,513.18.

24.

(LO8)

PV @ 20%

-$1,300,000

376,157.41

-340,000

196,759.26

Aftertax operating income

?

Tax shield on CCA*

146,791.67

NPV

0

Solving for PV of after-tax operating income we obtain:

$ 920,291.67

Dividing by PVIFA(20%,3) we find that annual after-tax operating income must be $436,885.71

Capital Spending

Salvage

Additions to NWC

Cash flow

-1,300,000

650,000

-340,000

340,000

Year

0

3

0

3

1 to 3

Consequently, sales must be $436,885.71/ (1 – .36) + 89($96,000) = $9,226,633.93 in order to break even.

Therefore the selling price should be no less than $9,226,633.92 / 89 or $103,670.04 per system.

*PV of CCATS = 1,300,000(.2)(.36) x (1 + .5(.2))

.2 + .2

1 + .2

– 650,000(.2)(.36) x

1

3

.2 + .2

(1.2)

= $146,791.67

25.

(LO3)

a. EBIT = Sales – cost – depreciation = $425,000 – $96,000 – $375,000 0.2 = $254,000

b. According to the bottom-up approach:

OCF = (S – C – D)(1 – T) + D = $254,000 (1 – 0.35) + $75,000 = $ 240,100

c. According to the tax shield approach:

OCF = (S – C)(1 – T) + TD = ($425,000 – $96,000) (1 – 0.35) + 0.35 $75,000 = $240,100

26.

(LO3)

Depreciation = $280,000/2 .25 = $35,000

According to the top down approach:

OCF = (S – C) – (S – C – D) T = ($650,000 – $490,000) – (650,000 – $490,000 – $35,000) 0.38

= $112,500

According to the tax shield approach:

OCF = (S – C)(1 – T) + TD = ($650,000 – $490,000) (1 – 0.38) + 0.38 $35,000 = $112,500

27.

(LO7)

Method 1: PV @ 13%(Costs) = -$6,700 – 400 PVIFA (13%, 3) = -$7,644.46

Method 2: PV @ 13%(Costs) = -$9,900 – 620 PVIFA (13%, 4) = -$11,744.17

Difference= $4,099.71 in favour of Method 1

Without replacement: On this basis we would need to know whether the benefit of 1 more year’s use is

sufficient to offset the additional cost of $4,099.71.

10-8

With replacement:

Method 1: EAC = -7,644.46/PVIFA(13%,3) = -$3,237.60

Method 2: EAC = -11,744.17/PVIFA(13%,4) = -$3,948.32

On this basis, Method 2 is again more expensive.

28.

(LO7)

Method 1: CF0 = -$6,700

PVCCATS = (6,700)(.39)(.25)(1.065)/[(.13 + .25)(1.13)] = $1,620.19

PV(Costs) = -400(1 – .39)PVIFA (13%, 3) – 6,700 + 1,620.19 = -$5,655.93

EAC = -$5,655.93/PVIFA(13%, 3) = -$2,395.41

Method 2: CF0 = -$9,900

PVCCATS = (9,900)(.39)(.25)(1.065)/[(.13 + .25)(1.13)] = $2,394.02

PV(Costs) = -620(1 – .39)PVIFA (13%, 4) – 9,900 + 2,394.02 = -$8,630.93

EAC = -$8,630.93/PVIFA(13%, 4) = -$2,901.67

Method 2 is more expensive.

29. (LO7) To calculate the EAC of the project, we first need the NPV of the project. Notice that we include the

NWC expenditure at the beginning of the project, and recover the NWC at the end of the project. The NPV of

the project is:

NPV = –$270,000 – 25,000 – $42,000(PVIFA11%,5) + $25,000/1.115 = –$435,391.39

Now we can find the EAC of the project. The EAC is:

EAC = –$435,391.39 / (PVIFA11%,5) = –$117,803.98

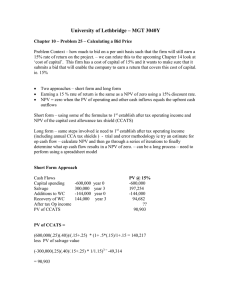

30. (LO7)

Assuming a carry-forward on taxes:

Both cases: salvage value = $40,000

Techron I: After-tax operating costs = $67,000(1 – 0.35) = $43,550

PVCCATS = (290,000)(.35)(.20)(1.05)/[(.10 + .20)(1.10)] – {[(40,000)(0.20)(0.35)/[0.10 + 0.20]]

(1/1.10)3}= $57,578.64

PV(Costs) = -$290,000 – 43,550(PVIFA10%,3) + (40,000/1.103) + 57,578.64 = -$310,671.17

EAC = -$310,671.17 / (PVIFA10%,3) = -$124,925.48

Techron II: After-tax operating costs = $35,000(1 – 0.35) = $22,750

PVCCATS = (510,000)(.35)(.20)(1.05)/[(.10 + .20)(1.10)] – {[(40,000)(0.20)(0.35)/[0.10 + 0.20]]

(1/1.10)5}= $107,795.64

PV(Costs) = -$510,000 – 22,750(PVIFA10%,5) + (40,000/1.105) + 107,7795.64 = -$463,607.90

EAC = -$463,607.90 / (PVIFA10%,5) = -$122,298.60

The two milling machines have unequal lives, so they can only be compared by expressing both on an

equivalent annual basis which is what the EAC method does. Thus, you prefer the Techron II because it has the

lower annual cost.

31.

(LO7)

Pre-fab segments

Given: Initial cost = $6.5M; d = 4%; k = 11%; T = 35%; S = .25 x $6.5M = $1,625,000;

n = 25

PVCCATS = $565,442.71

Assuming end of year costs: PV(Costs) = -$150,000x(1-.35) x PVIFA(11%, 25) = -$821,120.11

10-9

Total PV(Costs) = -$6,500,000 – $821,120.11 + $565,442.71 + $1,625,000PVIF(11%, 25)

= -$6,636,064.25

EAC = -$6,636,064.25/PVIFA(11%, 25) = -$787,967.88

Carbon-fibre technology

Given: Initial cost = $8.2M; d = 4%; k = 11%; T = 35%; S = .25 x $8.2M = $2,050,000;

n = 40

PVCCATS = $724,467.86

Assuming end of year costs:

PV(Costs) = -$650,000x(1-.35)x[PVIF(11%, 10) + PVIF(11%, 20) + PVIF(11%, 30) + PVIF(11%,

40)] = -$226,158.17

Total PV(Costs) = -$8,200,000 – $226,158.17 + $724,467.86 + $2,050,000PVIF(11%, 40)

= -$7,670,152.27

EAC = -$7,670,152.27/PVIFA(11%, 40) = -$856,899.65

The pre-fab segments represent a lower cost choice.

32. (LO7) The present value of the operating costs can be evaluated as a growing annuity. The first annual aftertax operating cost = C =$32,000(1 – .35) = $20,800. We know that:

PV(Growing annuity) =

C

x (1 – (1+g/1+R)n) = $20,800 x (1 - (1.02/1.11)7) = $103,243,32

(R – g)

(.11-.02)

PVCCATS = $96,023.55

PV(Costs) = -$550,000 + $96,023.55 – $103,243.32 + $98,000/(1.11)7 = -$510,017.24

EAC = -$510,017.24/PVIFA(11%,7) = -$108,233.45

33. (LO8)

Given: Initial cost = $940,000; d = 30%; k = 12%; T = 35%; S = $70,000; n = 5; NWC=$75,000

PVCCATS = $212,480.74

NPV = $0 = – $940,000 – 75,000 + 212,480.74 + (After-tax net revenue)(PVIFA12%,5) +

[(75,000 + 70,000) / 1.125]

After-tax net revenue = $720,242.36 / PVIFA12%,5 = $199,802.24

$199,802.24 = [ (P–v)Q – FC ](1 – tc) = [(P – 9.25)185,000 – 305,000](.65)

Solve for P to find:

P = $12.56

34. (LO5)

PVCCATS = $115,911.97

Annual after-tax savings = $210,000(1 – .35) = $136,500

There is an initial increase in inventory of $20,000, and in each year there is any additional cash outflow of

$3,000 to finance inventory costs. At the end of the project, there is a recovery of the initial and annual

outflows = $20,000 + 4($3,000) = $32,000.

NPV = -$560,000 – $20,000 + $115,911.97+ ($136,500 – $3,000)PVIFA(9%,4) + ($80,000 + $32,000)/1.094 =

$47,758.20

Accept the project.

10-10

Intermediate

35. (LO2) CF0 = -24,000,000 – 1,800,000 = -$25,800,000

ΔNWC= (15% × ΔSales) = – 15% (next period sales – current period sales)

Sales

Variable costs

Fixed costs

Net profit

Taxes(35%)

Net profit after-tax

ΔNWC= (15% × ΔSales)

NWC balance

Cash flow = Net profit

after-tax + (ΔNWC) or

NWC recovered

Salvage value (20%)

Total cash flow

PV(t = 0)

1

35,340,000

24,645,000

1,200,000

9,495,000

3,323,250

6,171,750

-684,000

-2,484,000

5,487,750

2

39,900,000

27,825,000

1,200,000

10,875,000

3,806,250

7,068,750

-1,311,000

-3,795,000

5,757,750

3

48,640,000

33,920,000

1,200,000

13,520,000

4,732,000

8,788,000

-342,000

-4,137,000

8,446,000

4

50,920,000

35,510,000

1,200,000

14,210,000

4,973,500

9,236,500

2,679,000

-1,458,000

11,915,500

5

33,060,000

23,055,000

1,200,000

8,805,000

3,081,750

5,723,250

1,458,000

0

7,181,250

5,487,750

4,650,635.59

5,757,750

4,135,126.40

8,446,000

5,140,496.35

11,915,500

6,145,882.34

4,800,000

11,981,250

5,237,114.80

PVCCATS = $3,697,357.13

NPV

= -$25,800,000 + $3,697,357.13 + $4,650,635.59+ $4,135,126.40+ $5,140,496.35+ $6,145,882.34

+ $5,237,114.80

= $3,206,612.61

The project should be accepted because NPV is positive.

36. (LO6) New excavator costs=$950,000 but SV0=$50,000; Therefore, CF0 = $900,000. Operating revenues

=$90,000 and SV10=175,000 – 3,000=$172,000.

PV of CCATS = 900,000(.25)(.35) x (1 + .5(.14)) - 172,000(.25)(.35) x

1

10

.14 + .25

1 + .14

.14 + .25

(1.14)

= $179,114.95

NPV = 90,000(1 – .35) x PVIFA (14%, 10) + 172,000 x PVIF (14%, 10) + 179,114.95 – 900,000

= -$369,345.35

Do not replace the existing excavator.

37. (LO6)

CF0 = 12,000 – 500 = $11,500, SV4 = 1,600 – 250 = $1,350, and Operating revenues = $8,000.

PV of CCATS = 11,500(.25)(.22) x (1 + .5(.15))

.15 + .25

1 + .15

– 1,350(.25)(.22) x

1

4

.15 + .25

(1.15)

= $1372

NPV = 8,000(1 – .22) x PVIFA (15%, 4) +1372 + 1,350 x PVIF (15%, 4) – 11,500

= $8,458.93

The student should buy the new equipment.

10-11

38. (LO7) Underground (U): CF0 = $9.2M, annual costs = $80,000, n=20

PV(CostsU) = [-$80,000(1 – .39) + ($9.2M/20)(.39)] x PVIFA (13%, 20) – $9.2M = -$7,988,559.57

EACU = -$7,988,559.57/PVIFA(13%, 20) = -$1,137,201.72

Above ground (A): CF0 = $6.8M, annual costs = $190,000, n = 9

PV(CostsA) = [-$190,000(1 – .39) + ($6.8M/9)(.39)] x PVIFA (13%, 9) – $6.8M = -$5,403,772.29

EACA = -$5,403,772.29/PVIFA(13%, 9) = -$1,053,027.17

The above ground system is cheaper for the firm.

39. (LO1, 2)

Product A:

PV of CCATS = 382,000(.2)(.36) x (1 + .5(.16))

.2 + .16

1 + .16

+ (102,000/15)(.36) x PVIFA (16%, 15) = $84,779.75

PV (Net cash flows) = (323,100 – 174,700)(1 – .36) x PVIFA (16%, 15) = $529,534.52

NPV = 84,779.75 + 529,534.52 – 19,200(1 – .36) x PVIF (16%, 15) – (102,000 + 382,000) = $61,803.06

Product B:

PV of CCATS = 456,000(.2)(.36) x (1 + .5(.16)) + (192,250/15)(.36) x PVIFA (16%, 15) = $110,635.50

.2 + .16

1 + .16

PV (Net cash flows) = (396,000 – 235,700)(1 – .36) x PVIFA (16%, 15) = $571,997.20

NPV = 110,635.50 + 571,997.20 – 129,250(1 – .36) x PVIF (16%, 15) – (192,250 + 456,000) = $25,454.98

Continue to rent:

NPV = 75,000(1 – .36) x PVIFA (16%, 15) = $267,621.90

Continue to rent the building (highest NPV).

Note: If the lost rent from renovations is included as an opportunity cost in the evaluation of Products A and

B, their NPVs would be negative, indicating that the firm should not produce either of those items and, instead,

continue to rent the facility.

40. (LO1, 2) The rule is to discount nominal cash flows using nominal rates and real cash flows using real rates.

Our choice is simple here. We should use nominal values for cash flows and rates since the rate of inflation is

not provided.

V = ($820K/.16) + ($1,900,000 – $1,400,000) = $5,625,000.

Therefore, P0 = $5,625,000/385,000=$14.61/share.

41. (LO1, 2)

Operating costsA = $135,000(1 – 0.34) = $89,100

PVCCATSA = $82,744.90

PV(CostsA) = -$360,000 – $89,100 x PVIFA(12%, 4) + $82,744.90 = -$547,882.93

Operating costsB = $98,000(1 – 0.34) = $64,680

PVCCATSB = $98,834.18

10-12

PV(CostsB) = -$430,000 – $64,680 x PVIFA(12%, 6) + $98,834.18 = -$597,091.64

If the system will not be replaced when it wears out, then system A should be chosen, because it has a lower

present value of costs.

42. (LO1, 2)

EACA = -$547,882.93 / PVIFA(12%, 4) = -$180,381.93

EACB = -$597,091.85 / PVIFA(12%, 6) = -$145,228.04

If the system is replaced, system B should be chosen because it has a smaller EAC.

43. (LO8)

Let: After-tax net revenue = ATNR = [(P–v)Q – FC ](1 – tc)

v = $0.009 per stamp

Q = 140 million

FC = $961,000

Tax rate = 34%

Required rate of return = 11%

After-tax opportunity cost of land today = $1,800,000

After-tax salvage value of land in 5 years = $1,800,000

Initial investment = $4,600,000

Salvage value = $756,000

NWC 0 = $569,000

NWC 1 – 5 = $68,000

All NWC recoverable in year 5

PV of Tax shield using straight line dep. = (($4,600,000 – 756,000)/5)(0.34)PVIFA(11%, 5) = $966,077.91

NPV = 0 = – $1,800,000 – $4,600,000 – $569,000 + $966,077.91 + ATNR*PVIFA(11%, 5) –

68,000*PVIFA(11%, 5) + (756,000 + (569,000 + 5x 68,000) + 1,800,000)*PVIF(11%, 5)

ATNR = $6,552,020.48 / PVIFA(11%, 5) = $1,772,787.51

ATNR = $1,772,787.51 = [(P–v)Q – FC ](1 – tc)

$1,772,787.51= [(P – 0.009)(140,000,000) – 961,000](1 – 0.34)

P = $0.0351 per stamp

44. (LO7)

SAL5000

12 machines needed

cost/machine=$15,900

Op. Costs=$1,850/yr

SV6 = $1,300

DET1000

10 machines needed

cost/machine=$19,000

Op. Costs=$1,700/yr

SV4 = 0

NPVSAL5000=[-1,850 x PVIFA (15%, 6) – 15,900 + 1,300 x PVIF (15%, 6)](12) = -$268,071.21

NPVDET1000=[-1,700 x PVIFA (15%, 4) – 19,000](10) = -$238,534.63

Using a replacement chain, we effectively assume that each alternative is duplicated over identical future

periods of time until they both meet at the same point in time. If the SAL5000 is repeated once it will extend

out to 12 years. If the DET1000 is repeated two more times (two subsequent four-year periods) it will also

extend out to the same point in time thus allowing for a more reasonable comparison between the two.

NPVSAL5000 = -268,071.21– 268,071.21 / PVIF (15%, 6) = -$383,965.79

NPVDET1000 = -238,534.63– 238,534.63/ PVIF (15%, 4) – 238,534.63/ PVIF (15%, 8) = -$452,894.98

Choose the SAL5000 model.

10-13

Note that we would have arrived at the same recommendation, namely choose the SAL model, if we had

calculated EAC values for the two alternatives. The EAC method implicitly assumes the replacement chain that

we have used here.

45. (LO7)

X:

C0 = 743,000

Savings/yr. = 296,000

n=6

Y:

C0 = 989,000

Savings/yr. = 279,000

n=10

k = 12%

NPVX = 296,000 x PVIFA (12%,6) – 743,000 = $473,976.57

With replacement chain of 5 links (5 x 6 = 30):

NPVX = 473,976.57+ 473,976.57x PVIF (12%, 6) + 473,976.57x PVIF (12%, 12) + 183,213.43 x PVIF (12%,

18) + 473,976.57x PVIF (12%, 24)

= $928,628.12

NPVY = 279,000 x PVIFA (12%, 10) – 989,000 = $587,412.22

With replacement chain of 3 links (3 x 10 = 30):

NPVY = 587,412.22+ 587,412.22 x PVIF (12%, 10) + 587,412.22 x PVIF (12%, 20)

= 837,438.48

Choose Mixer Y.

Challenge

46. (LO1, 2)

a. Assuming the project lasts four years, the NPV is calculated as follows:

Year

0

1

2

3

After-tax profit

$1,525,000

$1,525,000 $1,525,000

Change in NWC

Capital spending

Total cash flow

(2,000,000)

(7,000,000)

($9,000,000)

0

0

$1,525,000

0

0

$1,525,000

PVCCATS = $1,941,860.08

Net present value = -$1,295,433.70

b. Abandoned after one year:

Year

After-tax profit

Change in NWC

Capital spending

Total cash flow

0

1

$1,525,000

(2,000,000)

(7,000,000)

($9,000,000)

2,000,000

5,000,000

$8,525,000

PVCCATS = $639,472.37

Net present value = -$816,279.85

10-14

0

0

$1,525,000

4

$1,525,000

2,000,000

0

$3,525,000

Abandoned after two years:

Year

After-tax profit

Change in NWC

Capital spending

Total cash flow

0

1

$1,525,000

2

$1,525,000

(2,000,000)

(7,000,000)

($9,000,000)

0

0

$1,525,000

2,000,000

4,740,000

$8,265,000

1

$1,525,000

2

$1,525,000

3

$1,525,000

0

0

$1,525,000

0

0

$1,525,000

2,000,000

2,600,000

$6,125,000

PVCCATS = $849,237.47

Net present value = -$328,497.67

Abandoned after three years:

Year

0

After-tax profit

Change in NWC

Capital spending

Total cash flow

(2,000,000)

(7,000,000)

($9,000,000)

PVCCATS = $1,411,480.56

Net present value = -$799,730.99

The decision to abandon is an important variable when evaluating the NPV of a project. This particular project

should not proceed because all NPV values are negative, but it can be seen that the option to abandon results in

the maximum NPV occurring after two years.

47. (LO1, 2)

Cash flows for year 0 = -$364,000

Cash flows for years 1-5 = (36,000 + 43,000)(1 – .36) + (364,000/5)(.36)

= $76,768

PV of after-tax cash flows = $76,768*PVIFA(13%, 5) = $270,010.81

NPV

= $270,010.81 – $364,000

= -$93,989.19

No, they should not renovate.

48. (LO5, 8)

PV of CCATS = 620,000(.20)(.35) x (1 + .5(.11)

.11 + .20

(1 + .11)

= $133,063.06

a.

620,000 – 133,063.06 = PMT x PVIFA(11%, 5)

PMT = $131,750.68

Cost savings = 131,750.68 /(1 - .35) = $202,693.35

b.

PV of CCATS = 620,000(.20)(.35) x (1 + .5(.11) - 90,000(.20)(.35) x 1

5

.11 + .20

(1 + .11)

.11 + .20

(1.11)

= $121,002.60

5

620,000 – 121,002.60= PMT x PVIFA (11%, 5) + 90,000/(1.11)

PMT = $120,562.55

Cost savings = 120,562.55/ (1 - .35) = $185,480.85

10-15

49. (LO1, 2)

Cash flow year 0 = -96,500,000 – 7,200,000 – 19,200,000 – 4,600,000(1 – .39) = -$125,706,000

Cash flow years 1-7 = [(19,600)(45,900 – 35,000) – 39,100,000](1 – .39) = $106,469,400

Cash flow year 8 = 106,469,400 + 27,900,000 + 19,200,000 = $153,569,400

PVCCATS (Class 3) = 16,000,000(.05)(.39) x (1 + .5(.17)) - 8,700,000(.05)(.39) x 1

8

.17 + .05

(1 + .17)

.17 + .05

(1 + .17)

= $1,095,545.47

PVCCATS (Class 8) = 80,500,000(.20)(.39) x (1 + .5(.17)) - 12,000,000(.20)(.39) x

1

8

.17 + .20

(1 + .17)

.17 + .20

(1 +.17)

= $15,016,964.95

NPV = -125,706,000 + 106,469,400*PVIFA(17%, 7) + 153,569,400*PVIF(17%, 8) + 1,095,545.47+

15,016,964.95

= $351,753,827.90

The net present value is positive, so they should produce the robots.

50.

(LO2)

Year

Units/yr

Price/unit

Vcost/unit

1

107,000

395

295

2

123,000

395

295

3

134,000

395

295

4

156,000

395

295

5

95,500

395

295

Sales

VC

FC

Net Rev

Taxes

(S-C)(1-T)

42,265,000

31,565,000

192,000

10,508,000

4,203,200

6,304,800

48,585,000

36,285,000

192,000

12,108,000

4,843,200

7,264,800

52,930,000

39,530,000

192,000

13,208,000

5,283,200

7,924,800

61,620,000

46,020,000

192,000

15,408,000

6,163,200

9,244,800

37,722,500

28,172,500

192,000

9,358,000

3,743,200

5,614,800

0

1

6,304,800

2

7,264,800

3

7,924,800

4

9,244,800

5

5,614,800

-800,000

-19,500,000

-2,528,000

-1,738,000

-3,476,000

0

8,542,000

5,850,000

3,776,800

5,526,000

4,448,800

9,246,800

20,006,800

Year

A-T Rev

Ch in NWC

Cap Spend

PVCCATS

Total CF

2,902,121.33

-17,397,878.67

Net present value = $2,861,990.17

An approximate solution for the IRR can be found by assuming that the PVCCATS is discounted at the

23% cost of capital of the firm, so that the PVCCATS value in the table is held constant. In this case: IRR

= 28.04%.

The alternative is to enter the data into a spreadsheet and search for the rate that produces a NPV = 0,

where PVCCATS is discounted at the IRR.

10-16

51.

(LO5)

PVCCATS(class 8) = 865,000 x 0.20 x 0.36 x (1+0.5(0.135)) –

0.20 + 0.135

1 + .135

138,000 x 0.20 x 0.36 x 1/(1.135)6

0.20 + 0.135

= $160,980.42

NPV = 0 = -$865,000 – $58,000+ (S-C)(1-.36)*PVIFA(13.5%, 6) + $160,980.42 +

($138,000 + $58,000)/1.1356

(S-C)(0.64)*PVIFA(13.5%, 6) = $670,338.25

(S-C) = $265,669.58

52. (LO6)

a.

For the new computer: PVCCATS = 368,000 x 0.30 x 0.38 x (1+0.5(0.13)) –

0.30 + 0.13

1 + .13

198,000 x 0.30 x 0.38 x 1/(1.13)5 = $63,459.66

0.30 + 0.13

For the old computer: PVCCATS = 140,000(.38) + 140,000(.38)

(1+.13)

(1+.13)2

= $88,743.05

Difference in PVCCATS = -$25,283.39

If old computer is replaced now:

Year

After-tax cost savings

(S – C)(1 – T)

Capital spending

Total cash flow

0

1

80,600

2

80,600

3

80,600

4

80,600

5

80,600

(208,283.39)*

($208,283.39)

0

$80,600

(95,000)

($14,400)

0

$80,600

0

$80,600

198,000

$278,600

*Initial Capital spending

= Payment for new computer + resale of old computer + loss in PVCCATS

= -$368,000 + $190,000 – $25,283.39 = -$208,283.39

NPV = $113,272.98 Replace the old computer now.

b.

New Computer:

Year

Cost savings

PVCCATS

Capital spending

Total cash flow

0

63,459.66

(368,000)

($304,540.34)

1

80,600

2

80,600

3

80,600

4

80,600

5

80,600

0

$80,600

0

$80,600

0

$80,600

0

$80,600

198,000

$278,600

Net present value = $86,414.97

EAC = $24,569.03

10-17

Old Computer:

Year

0

1

2

3

4

5

Depreciation tax shield

Change in NWC

0

Capital spending

(190,000)

Total cash flow

($190,000)

53,200

0

0

$53,200

53,200

0

95,000

$148,200

0

0

0

$0

0

0

0

$0

0

0

0

$0

Net present value = -$26,858.02

EAC = -$16,100.94

Once we consider that there is going to be a planned replacement of the old machine after the second year, we

must compare the EACs. The decision is to still replace the old computer.

53.

(LO8)

a. Assume price per unit = $15 and units/year = 185,000

After-tax net revenue/yr. = [(P-V)Q FC](1 Tc) = [($15 – 9.25)(185,000) – 305,000](0.65) = $493,187.50

PVCCATS = $212,480.74; Salvage value = $70,000; Initial working capital increase = $75,000

NPV

= -$940,000 – 75,000 + 212,480.74 + 493,187.50*PVIFA(12%, 5) + (70,000 + 75,000)*PVIF(12%, 5)

= $1,057,588.20

The positive NPV tells us that to break even the number of cartons sold must be less than 185,000, and that

our costs are lower than revenues.

b. NPV = $0 = -$940,000 – 75,000 + 212,480.74 + [($15 – 9.25)(Q) – 305,000](0.65)*PVIFA(12%, 5) +

(70,000 + 75,000)*PVIF(12%, 5)

Solve for Q to find: Q 106,502.27 cartons. At Q = 106,502.27 : NPV $0

c. NPV = $0 = -$940,000 – 75,000 + 212,480.74 + [($15 – 9.25)(185,000) – FC](0.65)*PVIFA(12%, 5) +

(70,000 + 75,000)*PVIF(12%, 5)

Solve for FC to find: FC $756,361.94. At FC = $756,361.94: NPV $0

Appendix 10A

A1. Nominal discount rate = 13%; Inflation rate = 3%

Real rate = (1.13/1.03) – 1 = 0.0970874 = 9.70874%

Year

0

1

2

3

4

Real Cash Flows

Method 1

Method 2

$6,700.00 $9,900.00

388.35

601.94

377.04

584.41

366.06

567.39

550.86

Discounting the real cash flows at the real rate we get:

10-18

Method 1: PV(Costs) = -$7,644.46

Method 2: PV(Costs) = -$11,744.17

Note that these are the identical PV values as obtained in the earlier Problem 27. When nominal cash flows are

discounted by a nominal discount rate, the same PV is obtained as when real cash flows are discounted by a

real discount rate.

However, we do not get the same EAC values as before:

Method 1: EAC = -7,644.46 / PVIFA(9.71%,3) = -$3,058.20

Method 2: EAC = -11,744.17 / PVIFA(9.71%,4) = -$3,681.61

The EAC values from Problem 27 for Method 1 and 2 were -3,237.60 and -3,948.32, respectively. The

differences arise because, with inflation, the PVIFA values with the real rate are larger than with the nominal

rate since the real rate of 9.71% is lower than the nominal rate of 13%.

10-19