FINC 101 HW #1 – Due Tuesday, January 24th Suppose that you

advertisement

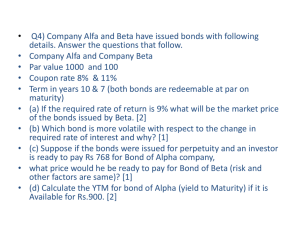

FINC 101 HW #1 – Due Tuesday, January 24th Suppose that you just won the lottery and they give you three different options to collect your winnings: Option #1: $50,000/yr for the next 20 years Option #2: $500,000 today + $500,000 in 10 years Option #3: $25,000/yr for the next 35 years If the interest rate is 10% per year, then which option is more valuable to you today? Be sure to show your work. ANSWERS: Need to figure out the PV of all of these options, and choose the one with the highest value. Option #1 – this is an annuity of $50,000/yr for 20 years, so I need to use the PVIFA table, or exhibit 1-D in chapter 1. PVIFA (10%, 20yrs) = 8.514 So, I take the annuity amount and multiply it by that factor: 50,000 x 8.514 = $425,700 Option #2 – this has two parts: a lump sum today and another lump sum in 10 years. Since I’m looking for the PV, I don’t need to do anything to the lump sum that happens today because it’s already in PV terms. But, I need to find the PV of the $500,000 that occurs in 10 years. This is a lump sum, so I’d want to use the PVIF table, or exhibit 1-C in chapter 1. PVIF (10%, 10yrs) = 0.386 So, the PV of the $500,000 in 10 years is 500,000 x 0.386 = 193,000 Add to that the $500,000 from today and you have $693,000 Option #3 – Similar to option #1, I’d use the PVIFA table, but I see that 35 years is not on the table. To handle this, you’d find the PVIFA for 30 years and the PVIFA for 40 years, and take their midpoint: PVIFA (10%, 30yrs) = 9.427 PVIFA (10%, 40yrs) = 9.779 Therefore, 9.603 is a good estimate of the PVIFA (10%, 35yrs): 25,000 x 9.603 = $240,075 So, option #2 is the most valuable. Midpoint = 9.603