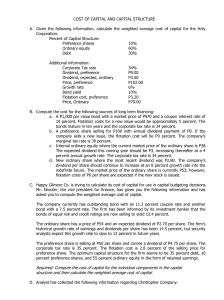

Chapter 16 – Cost of Capital Capital definition:

advertisement

Chapter 16 – Cost of Capital Capital definition: Mix of long-term financing sources, primarily debt and equity, used by the company Opportunity Cost Concept Cost of capital is an opportunity cost The opportunity cost is the return investors could have expected by investing somewhere else at equal risk Weighted Average Concept The cost of capital is an average of the opportunity costs of stockholders and creditors The average is weighted by the proportion of funds provided by each source Marginal Cost Concept The marginal cost of capital is the rate of return that must be earned on new capital to satisfy investors The marginal cost of capital is the weighted average cost of capital that must be earned on new investments The marginal cost of capital is the change in the amount needed to satisfy investors, divided by the amount of new capital raised Cost of Debt Cost of debt is the interest rate the company would be required to pay on new debt, adjusted upward for flotation costs Yield to maturity on bonds frequently measures the marginal cost of debt To sell new bonds, you must pay at least the yield to maturity for new bonds To justify reinvesting existing funds, your internal investments must be better than the return earned by buying back your existing debt in the marketplace After-tax Cost of Debt Payment of interest results in a tax savings After-tax cost of debt: Kd = before-tax cost of debt X (1 – Tax rate) Cost of Preferred Stock Most preferred stock is perpetual; it has no maturity date Cost of preferred stock: Kp = Dividend per share Market price per share The cost of new preferred stock requires the use of a net price, the amount that the company will net after paying flotation costs Cost of Common Stock No direct way to observe the return required by common stockholders; must estimate Use Dividend growth model Earnings yield CAPM Dividend Growth Model Ke = (D1/P) + g Where D1 = Expected dividend at the end of the next year P = Current price of the stock g = Anticipated growth rate of dividends Applies when dividend growth is stable Earnings Yield Model Ke = Earnings per share Price Sometimes used, but Ignores growth Not based on cash flow Mean-variance CAPM Ke = Rf + s,m[E(Rm) - Rf] Where Rf = Risk-free rate s,m = Beta of the company’s stock with regard to the market portfolio E(Rm) = Expected return on the market portfolio Widely used E(Rm) is still widely debated Can use similar company betas for a stock that is not publicly traded Cost of Existing Equity Also called the cost of retained earnings Some authors argue that the cost of retained earnings is Ke(1 – stockholders’ tax rate on dividends) Much stock is held by pension funds and charitable endowments that do not pay taxes on dividends Cost of new Equity No dividend growth anticipated: Kne = Ke/(1 – f) where f is flotation cost as a percent of market price With dividend growth anticipated: Kne = D1/[P/(1 – f)] + g Weight for Weighted Average Cost Market value weights are recommended Target capital structure is typically used if the the company is moving toward that target Additional Issues Deferred taxes: typically not considered a source of funds because deferred tax reconciles difference between accounting records and cash flows Accounts payable and accrued expenses: typically not considered a source of funds because they reconcile the difference between accounting and cash flow Short-term debt is included if it is used as permanent capital Additional Issues Leases: often used as a direct substitute for debt, and therefore the implied amount and cost of debt is included in the WACC calculation (covered in Ch. 21) Convertibles: treat as a straight bond and an option Depreciation-generated funds: It makes sense to talk about internally generated funds, which have the cost of existing capital, but not to look separately at depreciation Risk Differences and WACC The WACC calculations typically assume that projects for a company are all of similar risk When risks are different, they often vary by division Companies often use division cost of capital, estimating the betas and cost of equity for each division if it were a stand-alone company Large individual projects are sometimes evaluated as if they were funded as a stand-alone company International Investments Cost of capital should reflect the risk of the project Cost of capital should be denominated in the same currency used to denominate cash flows for capital investment analysis Equity residual method, discussed in Chapter 20, is sometimes used to evaluate international investments with multi-country financing.