London and the UK Economy Duncan Melville Senior Economist, GLA Economics

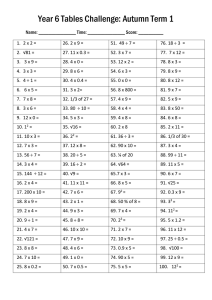

advertisement

London and the UK Economy Duncan Melville Senior Economist, GLA Economics What is GLA Economics? GLA Economics provides expert advice and analysis on London's economy and the economic issues facing the capital. The unit is funded by the Greater London Authority, Transport for London and the London Development Agency (LDA). This seminar is based on: GLA Economics Report – “Growing Together: London and the UK Economy” Available at: http://www.london.gov.uk/gla/publications/ec onomy.jsp#growing Three views of London UK relationship: London grows at the expense of the rest of the UK / “the North” London is the driver of the UK economy Both these views are incorrect Relationship is one of mutual and positive interdependency Growth in London and UK moved in tandem for at least 20 years Many channels via which London and UK interact. Here consider: Migration and Commuting Trade and Specialisation London’s role as a World City London’s Tax Export More out, than in Net influx into London by people in their early to mid 20s Probably a net inflow of high skilled Inflow early in individuals’ careers and then outflow later Analysis of migration shows: No one way “brain drain” to London Rather London acts as training ground London gains from the net inflow of talented young people Rest of the UK gains when people migrate out of London later in their careers taking their skills and experience with them. Commuting Commuting helps to integrate London’s housing & labour markets with those in Greater South East Just under a fifth of London’s jobs are filled by commuters Around one in ten of employed residents of South East and East of England regions are employed in London. Commuting 1991-2001 Census data: 1991 In: 673,000 Out: 150,000 Net: 523,000 2001 In: 723,000 Out: 236,000 Net: 487,000 - 2003 Autumn 2003 Spring 2002 Autumn 2002 Spring 2001 Autumn 100,000 2001 Spring 2000 Autumn 2000 spring 1999 Autumn 1999 spring 1998 Autumn 1998 spring 1997 Autumn 1997 spring 1996 Autumn 1996 spring 1995 Autumn 1995 spring 1994 Autumn 1994 spring 1993 Autumn 1993 spring 1992 Autumn 1992 spring Commuting Trends 1992-2003 Figure 2.10: In, Out and Net Commuting to London 800,000 700,000 600,000 500,000 400,000 300,000 200,000 London Net London Total Out London Total In Commuters in senior occupations In Commuters more prevalent in Finance Trade and Specialisation Trade is driven by specialisation Individuals, regions, and nations specialise in certain activities and then trade to obtain other goods and services So the more different the structure of the London economy is from the rest of the UK, the more the potential for gains from trade. London’s economy is different London Specialisations London Employment Professional & Business Services Legal, accounting, research & consultancy Labour recruitment etc Miscellaneous business activities nec Industrial cleaning Architectural/ engineering activities etc Investigation and security activities Advertising 693098 224805 152231 99511 84776 59811 38835 33129 London Index of Employment Specialisation Index of Specialisation 2.41 1.55 1.98 1.39 1.37 1.89 3.57 Financial Services Monetary intermediation Activities auxillary to financial intermediation Other financial intermediation Activities auxillary to insurance / pension funding 291143 149163 65654 38943 37383 Wholesale, Retail & Catering Restaurants Wholesale of household goods Canteens and catering Retail: second-hand goods in stores 249852 128406 58993 57045 5408 ICT Software consultancy and supply Telecommunications Other computer related activities Data base activities 143332 61095 52953 25608 3676 1.53 1.47 1.82 2.97 Creative Industries 317828 2.41 2.26 7.52 3.05 2.11 1.62 1.54 1.48 1.71 Transport Scheduled air transport Activities of travel agencies etc nec Other supporting transport activities Activities of other transport agencies Transport via railways 126972 39569 32570 23060 19037 12736 6.52 1.94 1.81 1.92 1.95 Media and Publishing Publishing Radio and television activities Motion picture and video activities News agency activities Reproduction of recorded media 126885 58095 39970 17820 8033 2967 3.43 7.40 4.31 17.10 3.29 Property Real estate activities Letting of own property Real estate activities with own property 91972 38545 32156 21271 1.80 1.63 2.00 Entertainment & Recreation Arts and other entertainment activities Gambling & other recreational activities Library, archives, museums etc 80440 36908 25756 17776 3.24 1.32 1.45 Representative Organisations Activities of business & professional organisations Activities of trade unions 17277 12511 4766 4.26 2.53 2003 2003 1.49 Manufacturing Manufacture of jewellery etc London’s specialist strengths: Almost all in service sector requiring workers with high levels of human capital Bulk of identified specialist strengths produce intermediate products sold to other businesses Highly interrelated – finance, business services, ICT Often co-located e.g. City obvious centre of finance but 36% of employment in business services. Agglomeration benefits Specialist input services Specialised labour forces Knowledge spillovers Challenge from competitive neighbours Productivity Benefits Agglomeration benefits A doubling of “City Type” financial and business services reduces unit costs by around 18 per cent. UK – low cost of capital on OECD – both lending rate and spread between deposit and lending rates. For UK business the strength of performance of London’s corporate orientated F&B sector is a key source of competitive advantage London’s regional trade patterns reflect its specialisations. London’s international trade pattern is distinct. London is a World City (whatever that is) World Cities house corporate HQs, corporate financial services and related business services. Together this bundle of activities allows business establishments within world cities to coordinate economic activity across the world Empirical analysis centred on the presence & connectedness of finance & business services London ranked 1, Manchester 101, London’s Global Linkages (1) London’s Global Linkages (2) London is a global centre of finance and business services. And this benefits UK business Potential demand for London’s finance and business services is global. The magnitude of this potential global demand is a key driving force supporting the concentration of these activities in London. This leads to greater agglomeration benefits boosting the performance of London’s F&B sectors – to the benefits of its customers. Attracts Corporate HQs to London Concentration of strongly performing F&B encourages location of corporate HQs in London 33% of European HQs of Fortune Global 500 companies – well ahead of Paris on 9%, Brussels 6%. International HQs if not in London are unlikely to be elsewhere in the UK. Cosmopolitan nature of London is attractive to international migrants Tax and Public Spending in London Previous estimates of tax raised in, and public spending in London have consistently suggested that the former outweighs the latter. So London exports taxes. Only right as London is on average a relatively well off part of the country. First time we have undertaken a historical analysed this issue – for 1989/90 to 2002/03. London’s tax export increases with London’s output growth UK fiscal policy also affects London’s tax export London’s tax export: Between £2 bn and £9 bn in 2002/03 London’s contribution to the nation’s coffers is greater the stronger the performance of the London economy Hence public investment in London to underpin its economic performance is of benefit to the whole of the UK not just London and Londoners. Summary and Conclusions London’s contribution to UK rest on its distinctiveness within the UK economy. Economic growth in London and the rest of the UK move in tandem. London continues to export taxes to the rest of the UK and was the source of a very large part of the UK public sector financial surpluses of the late 1990s / early 2000s.