The Excise Tax Experiment

The Excise Tax Experiment

Distribution of Types of Participants

MWTS

$28

23

18

13

8

3

2

2

2

2

2

#

2

MWTP

$20

25

30

35

40

45

2

2

2

2

2

#

2

Session 1, No Tax: Actual Outcomes

6

7

4

5

Trans #

1

2

3

10

11

8

9

30

25

20

12

Price

$25

23

25

15

34

30

32

MWTP

$45

40

30

35

35

25

20

20

40

45

25

5

8

5

10

CS

$20

17

5

5

6

15

(7)

MWTS

$13

8

8

18

18

13

3

3

28

23

28

7

9

12

7

PP

$12

15

17

7

4

12

6

17

17

12

17

TP

$32

32

22

17

12

22

(3)

Session 2, Tax on Sellers: Actual Outcomes

6

7

4

5

Trans #

1

2

3

30

26

25

35

Price

$25

25

33

MWTP

$45

30

40

35

45

35

40

5

19

10

5

CS

$20

5

7

MWTS

$3

3

8

13

8

18

23

2

3

(8)

(3)

PP

$7

7

10

2

2

7

22

TP

$27

12

17

Session 3, Tax on Buyers: Actual Outcomes

6

7

4

5

Trans #

1

2

3

22

20

19

45

Price

$15

20

10

MWTP

$40

45

40

45

35

35

30

8

10

1

(30)

CS

$10

10

15

MWTS

$8

3

13

8

18

13

23

14

2

6

22

PP

$7

17

(3)

22

2

7

(8)

TP

$17

27

12

Supply Table

P < $3

$3 < P < $8

$8 < P < $13

$13 < P < $18

$18 < P < $23

$23 < P < $28

P > $28

8

10

12

4

6

0

2

Demand Table

P > $45

$40 < P < $45

$35 < P < $40

$30 < P < $35

$25 < P < $30

$20 < P < $25

P > $20

8

10

12

4

6

0

2

The Market for Cardboard Squares -- No Tax

$45

25

20

15

10

40

35

30

$24, 10

5

0 2 4 6 8 10 12 14 16 18 20

The Market for Cardboard Squares -- Tax on Sellers

$45

25

20

15

10

40

35

30

$33, 6

5

0 2 4 6 8 10 12 14 16 18 20

The Market for Cardboard Squares -- Tax on Buyers

$45

25

20

15

10

40

35

30

$17, 6

5

0 2 4 6 8 10 12 14 16 18 20

Using the supply and demand curves for cardboard squares provided:

• Complete the table to show how the government’s tax revenue depends on the excise tax rate. Hint : To fill out the table, you might want to trace a copy of the graph on scratch paper and draw the demansd curve and some “fitted” supply curves for the various tax rates.

•

What is the greatest amount of revenue that the government can get by choosing one of these tax rates?

•

Of the tax rates listed in the table, the government will get the most revenue from which rate(s)?

•

If there are two different rates that raise the same amount of tax revenue, which rate results in the smaller excess burden?

Government Subsidies

Suppose that the government pays a subsidy of $15 to every consumer who buys a square of cardboard.

• How will the subsidy affect the consumer’s willingness to pay for the squares?

•

What will the subsidy do to the demand curve for squares?

• How will the subsidy affect the lowest price that a producer is willing to accept for a square of cardboard?

• Will the subsidy change the supply curve?

• On the graph provided, draw a dashed line to show the demand curve when a $15 subsidy is paid to consumers.

• How does it affect the equilibrium quantity of squares sold?

• How does it affect the equilibrium price range?

Suppose that in addition to paying the $15 subsidy to consumers for every square sold, the government also collects a $15 tax from sellers for every square sold.

• How would this affect the supply curve? ….the demand curve?

• Use a dashed line to draw the supply curve when the tax is imposed.

• Compare the equilibrium number of squares traded when the subsidy is paid and the tax collected to the number traded if there is no tax and no subsidy.

• Compare the equilibrium price ranges in these two scenarios.

• Compare the consumers’ surpluses and the producers’ profits in each scenario.

• When the government pays a subsidy of $15 to consumers and collects a

$15 tax from producers, compare the amount of money the government pays out to the amount it collects in tax revenues.

•

MWTP

•

MWTS

• equilibrium price

• equilibrium quantity

• consumer’s surplus

• producer’s profits

• excise tax

• tax rate

• tax revenues

• excess burden

• subsidy

Terms to

Know

• price elastic demand

• price inelastic demand

• tax shifting

• statutory incidence vs. economic incidence

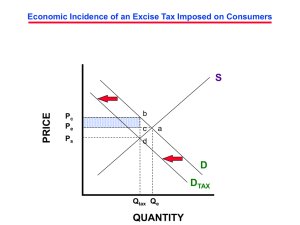

Economic Incidence of an Excise Tax Imposed on Consumers

P c

P e

P s b c d a

Q tax

Q e

QUANTITY

D

D

TAX

S

Economic Incidence of an Excise Tax Imposed on Suppliers

S’

TAX

S’

P c

P e

P s f g h e

D’

Q tax

’ Q e

’

QUANTITY

P c

P e

P s

Economic Incidence of an Excise

Tax Imposed on Consumers

Economic Incidence of an Excise

Tax Imposed on Suppliers

S

S’

TAX

S’ b c d a f g e h

D’

Q tax

Q e

D

D

TAX

QUANTITY

Q tax

’ Q e

’

Economic Incidence of an Excise

Tax Imposed on Consumers When

Demand Is Relatively Price Inelastic

P c

P e

P s b c d a

Q tax

Q e

D

TAX

D

QUANTITY

S

Note : When demand is relatively price inelastic for a good or service on which an excise tax is placed, consumers bear a larger portion of the economic burden of the tax. For example, it is highly likely that smokers do not greatly reduce the quantity of cigarettes they smoke as the result of a tax-induced price increase.

Therefore, smokers

(consumers) bear most of such a tax’s economic burden.

Economic Incidence of an Excise

Tax Imposed on Consumers When

Demand Is Relatively Price Elastic

P c

P e

P s b c d

Q tax

Q e a

QUANTITY

S

D

D

TAX

Note : When demand is relatively price elastic for a good or service on which an excise tax is placed, suppliers bear a larger portion of the economic burden of the tax. For example, consumers DO likely reduce the quantity of imported bottled water they drink as the result of a tax-induced price increase.

Therefore, suppliers would bear most of such a tax’s economic burden.

Taxes: Who Really Pays?

The statutory incidence [legal liability] of a tax falls on the entity that is legally responsible for remitting the tax revenues to the taxing jurisdiction (government).

The economic incidence [economic burden] of a tax falls on the entity (or entities) that incurs economic costs as a result of the tax.

Tax shifting refers to the phenomenon in which the economic burden of a tax is borne by an entity other than the one on which the statutory incidence falls.

How Taxes May Be Shifted

Taxes whose statutory incidence falls on businesses will always be shifted away from the business. A tax imposed on business will be shifted: forward to the consumer in the form of higher prices for the goods and services they buy, backward to the owners of the business in the form of lower return on investment or to the employees of the business in the form of lower wages for the their labor, or some combination of these.