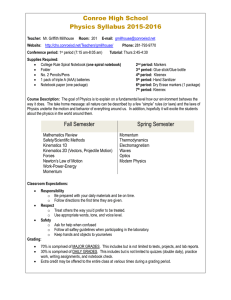

ACCOUNTING 2 COURSE SYLLABUS Instructor: Mrs. Natalie Schaublin Voice Mail: 797-8663

advertisement

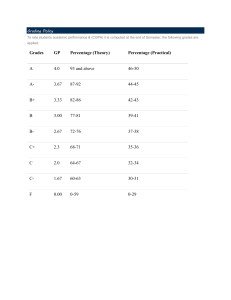

ACCOUNTING 2 COURSE SYLLABUS Instructor: Mrs. Natalie Schaublin Voice Mail: 797-8663 E-mail: Schaubln@wcsoh.org I. Course Description/Overview Accounting 2 is a semester course worth .5 credit for students in grades 9, 10, 11 and 12. Accounting is considered the language of business. Students who are interested in a career in the business field should enroll in Accounting 2. Students will also learn skills that will help them in managing their personal finances. This course will focus on planning, recording, analyzing and interpreting financial information for a business. II. Course Content III. Accounting concepts related to partnerships and corporations. Business transaction analysis Accounting terminology Principles of a double-entry system Accounting Cycle Microsoft Office Software - Students will work with Microsoft Excel and Word in this class. Course Materials South Western Century 21 General Journal Accounting textbook Students will be using the workbook that was purchases for Accounting 1 class. You will need a pencil, calculator and folder/binder to keep all of your papers in for this class. IV. Course Policies Students are responsible for approaching me upon their return from an absence in order to schedule time for them to make up their work. Bring all materials to class each day. Profanity and cussing are not acceptable or tolerated in this class. When your classmates or the teacher are presenting, please do not talk! Homework for this class will mainly consist of completing any assignments that you were not able to finish in class. Students must be on time to class. They should be in the classroom when the bell rings. If a teacher from another class detains a student for any reason, a note must be brought from that teacher to excuse the tardy. After three tardies, a student is assigned a detention. Work Area: The work area is the students’ responsibility. We share these desks with other classes so please keep your area clean. Students will be assigned a computer station. You will always work at that station unless you are asked to move by the teacher. V. Student ID Internet Access – Students must have a school ID with an Internet sticker. You will not be able to participate in the class if you do not have permission to access the Internet. Cheating – Students are expected to do their own work so that they can learn the material and the objectives of the lessons. Do not duplicate another student’s work. If you are caught cheating, you and the student you have copied off of will receive a zero on the entire assignment. 68-69 62-67 60-61 0-59 D+ D DF Grading – Points are given for completed daily work, quizzes, tests and projects. The total points you earn will be averaged with the total points possible for a grading period. Once graded papers are returned to students, late papers will still be accepted for ½ credit. Students’ grades will be posted on Power School and will be updated weekly. Students and parents will be provided a password and ID number in order to log on to the program so that they can check grades at anytime. Extra Help and Extra credit – Individualized help will always be made available along with extra credit opportunities. These will both be made available to students on an individual basis. VI. Course Procedures VI. Grading Policy/Assessment Grading Scale: 98-100 A+ 92-97 A 90-91 A88-89 B+ 82-87 B 81-80 B78-79 C+ 72-77 C 70-71 C- I recognize that all students learn differently and at different paces. I am always willing to arrange time to work with students individually. Students will be encouraged to communicate with me when they feel extra help is needed. Goals The National Accounting Standards for Business Education will be taught in this course. National Accounting Standards are listed below: Standard I – The Accounting Cycle/ Achievement Standard: Complete and explain the purpose of the various stops in the accounting cycle. Standard II – The Accounting Process/ Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities and owner’s equity. Standard III – Financial Statements/Achievement Standard: Prepare, interpret, and analyze financial statements using manual and computerized systems for service, merchandising, and manufacturing businesses. Standard IV – Special Applications/Achievement Standard: Apply appropriate accounting principles to payroll, income taxation, managerial systems and various forms of ownership. (From the National Standards for Business Education, 2007 by the National Business Education Association, 1914 Association Drive, Reston, VA 20191.)

![plus minus grade communication[1]](http://s2.studylib.net/store/data/018167144_1-623af90e48800ac78ee361ccf4acce2c-300x300.png)