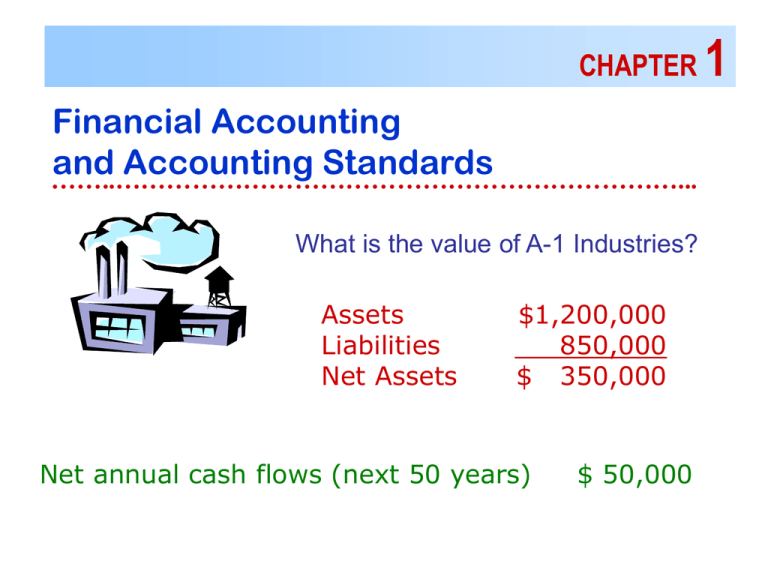

1 Financial Accounting and Accounting Standards CHAPTER

advertisement

CHAPTER Financial Accounting and Accounting Standards ……..…………………………………………………………... What is the value of A-1 Industries? Assets Liabilities Net Assets $1,200,000 850,000 $ 350,000 Net annual cash flows (next 50 years) $ 50,000 1 Accounting provides Information Assets & Liabilities Investors Creditors Government Agencies Future Cash Flows Assets Liabilities Net Assets $1,200,000 850,000 $ 350,000 Net assets might not reflect firm value: Most assets are recorded at historical cost. Intangible assets are frequently not recognized. Net annual cash flows (next 50 years) $ 50,000 A $500,000 investment would yield a 10% return. A $1,000,000 investment would yield a 5% return. Future Cash Flows Characteristics amount timing 2003 2004 2005 uncertainty Important to investors & creditors Projecting future cash flows requires more than just current cash flows financial reporting provides information equipment / depreciation sales gains / losses stock options inventories pension obligations amazon.com ? 4th quarter 1999 Operating loss Net loss $185 million $323 million March 2000 Market value $25.6 billion ? Possible explanations Current financial reporting is irrelevant! backward looking neglects intangibles “rules” have changed Market was overpriced! (A bubble) Objectives of Financial Reporting Information to stockholders and creditors Future cash flows Assets and liabilities Challenges of Financial Reporting Non-financial measurements Forward-looking information Intangible assets Timeliness PARTIES INVOLVED IN STANDARD SETTING Federal agency Requirements for all companies that issue stock CAP ’39 – ‘59 SEC Accounting must conform to GAAP APB ’59 – ‘73 FASB ’73 – present Private organizations Set accounting standards FAF AICPA CAP ’39 – ‘59 FASB ASB APB ’59 – ‘73 Concepts Standards Rsrch Bulletins APB Opinions Auditing Stnds Interpretations Guidelines Technical Bulletins Stmnts of Position Emerging Issues Practice Bulletins ISSUES IN FINANCIAL REPORTING The Political Environment “The FASB is committed to rendering its final decision without regard to any of the social, economic, or public policy considerations.” (J.Carter Beese, SEC) “Truth in accounting means telling it like it is, without bias or intent to encourage any particular mode of behavior.” (Dennis Beresford, FASB) Other post-employment benefits (OPEB), stock options, derivatives, etc. Responsibilities of Accountants Detect fraud? Verify that financial reporting rules have been followed (i.e. proper form)? Ensure that the accounting reflects the substance of the economic event? Auditor independence Expectations gap