GAAP PowerPoint #2

advertisement

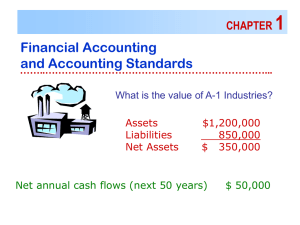

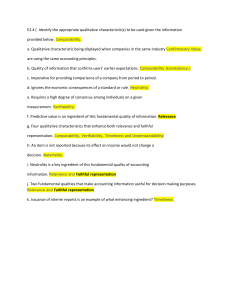

GAAP PowerPoint #2 Cost/Benefit (discussed in PPT #3) Understandability Decision Usefulness Relevance Reliability Verifiability Timeliness Feedback Value Predictive Value Neutrality Representational Faithfulness Comparability and Consistency Materiality (discussed in PPT #3) www.fasb.org To provide useful, understandable information to users of financial statements for decision making For present and potential investors and creditors and other users in making rational investment, credit, and similar decisions To help present and potential investors and creditors and other users to assess the amounts, timing, and uncertainty of prospective cash receipts To inform users about the ◦ economic resources of an enterprise; ◦ the claims to those resources (obligations); ◦ the effects of transactions, events, and ◦ circumstances that cause changes in resources and claims to those resources Decision usefulness ◦ the quality of being useful to decision making Understandability ◦ users must understand the information within the context of the decision being made Relevance Reliability ◦Definition: relating to the matter at hand ◦Capable of making a difference in the decision making of the user Must have predictive or feedback value ◦ Predicts or forecasts for users about the outcome of events of a company ◦ Provides feedback value for users to confirm or correct prior expectations of a company Must be presented in a timely manner ◦ Provides current information to users to help with decision making ◦ Definition: the quality or state of being reliable; and the extent to which an experiment, test, or measuring procedure yields the same results on repeated trials http://www.merriamwebster.com ◦ Information must be verifiable, a faithful representation, & reasonably free of error & bias (neutral) Must be verifiable ◦ Able to be proven; not subject to opinion Must be a faithful representation ◦ Agreement between the accounting numbers and supporting documentation Must be reasonably free from error ◦ No mistakes or inaccuracies should be found in the financial statements Must be reasonably free from bias; should be neutral ◦ Accounting information should not favor any groups or companies but be a true and factual representation of a company’s financial position. Comparability Consistency Definition: The quality of information that enables users to identify similarities in and differences between two sets of economic phenomena. The purpose of comparison is to detect and explain similarities and differences. Accounting information should be comparable across different companies and over different time periods. www.fasb.org ◦ Definition: Conformity from period to period with unchanging policies and procedures. Information about a particular enterprise gains greatly in usefulness if it can be compared with similar information. Consistent use of accounting principles from one accounting period to another enhances the utility of financial statements to users. A quality of the relationship between two accounting numbers www.fasb.org Explain the concept of the FASB’s conceptual framework. (Slide 2) What is the primary objective of financial accounting? Explain relevance and reliability of financial statements. What are the components of relevant information? What are the components of reliable information? Why should financial statements be both comparable and consistent?