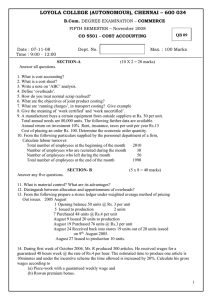

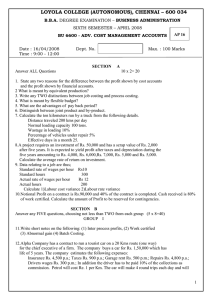

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

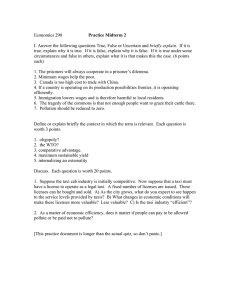

advertisement

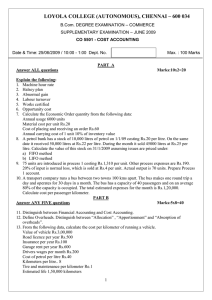

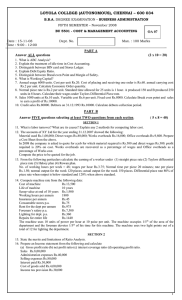

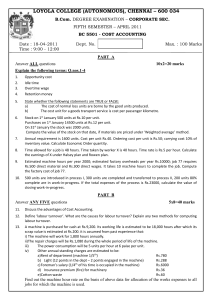

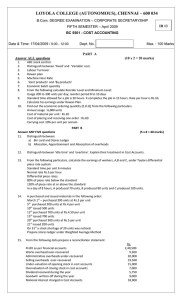

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – CORPORATE SECRETARYSHIP SUPPLEMENTARY EXAMINATION – JUNE 2008 BC 5501 - COST ACCOUNTING Date : 28-06-08 Time : 9.00 – 12.00 Dept. No. Max. : 100 Marks PART A Answer ALL questions 10 x 2 = 20 marks Explain the following: 1. Cost unit 2. ABC Analysis 3. Bin Card 4. Equivalent units 5. Opportunity cost 6. Machine Hour rate 7. Rowan plan 8. Two expenses not included in Cost Accounts. 9. Allocation and apportionment of overheads. 10. Works certified and uncertified PART B Answer ANY FIVE questions 5 x 8 = 40 marks 11. What are ‘idle time’ and ‘overtime costs’? Explain their treatment in Cost Accounts. 12. What is Labour Turnover? State the reasons and cost associated with Labour Turnover. 13. Mr. S owns a fleet of taxis and the following information is available from the records maintained by him: Number of taxis 10 Cost of each taxi Rs.54,600 Salary of manager Rs. 700 p.m. Salary of accountant Rs. 500 p.m Salary of cleaner Rs. 200 p.m. Salary of mechanics Rs. 400 p.m. Garage rent Rs. 600 p.m. Insurance premium 5 % p.a. Annual tax Rs. 900 per taxi Driver’s salary Rs. 350 p.m. per taxi Annual repairs Rs. 1,000 per taxi Total life of a taxi is about 2,00,000 kms. A taxi runs, in all, 3,000 kms. in a month and 30% of this distance has to be run without any passenger. Petrol consumption is one litre for every 10 kms. @ Rs.4.41 per litre. Oil and other sundries are Rs.10.50 per 100 kms. Calculate the cost of running a taxi per km. 1 14. Calculate the earnings of workers A and B under Straight Piece Rate System and Taylors Differential Piece Rate System from the following particulars: Normal rate per hour Re.1.80 Standard time per unit 20 secs Differentials to be applied : 80% of piece rate below standard 120% of piece rate at or above standard. Worker A produces 1300 units per day and Worker B produces 1500 units per day. 15. A) Calculate Economic Order Quantity from the following: Annual requirement 600 units Ordering cost per order Rs.12 Carrying cost 20% Price per unit Rs.20 B) From the following data calculate: Re-order level Minimum level Maximum level Average stock Re-ordered quantity 300 units Usage 25 to 75 units per week Re-order period 4 to 6 weeks 16. Calculate the machine hour rate from the following Cost of machine Rs.19200 Estimated scrap value Rs.1200 Repairs and maintenance Rs.150 per month Standing charges allocated to the machine per month Rs.50 Effective working life of machine 10000 hrs. Running time per month 166 hours Power used by the machine 5 units per hour at 19 paise per unit 17. The accounts of a machine manufacturing company disclosed the following data for the year ending 31st December 2007: (Rs.) Material used 1,50,000 Direct wages 1,20,000 Factory overheads 30,000 Administration overheads 15,000 Selling overheads 24,000 Prepare a Cost sheet for the machines. In the year 2008, the company is required to quote for a machine which will require Rs.1250 in materials and Rs.750 as wages, so that it will earn a profit of 20% on selling price. Factory overheads are recovered as a percentage of Direct wages and Administration and Selling overheads as a percentage of Works cost. Calculate the price to be quoted for the machine. 2 18. The following transactions took place in the month of December 2007 in respect of material X: Dec.1 purchased 200 units at Rs.2 per unit. 10th purchased 300 units at Rs.2.4 per units 15th issued 250 units 18th purchased 250 units at Rs.2.6 per unit 24th purchased 150 units at Rs.2.5 per unit 30th issued 200 units Prepare the Stores Ledger, pricing the issues under Weighted Average Method. PART C Answer ANY TWO questions 2 x 20 = 40 marks 19. The following figures relate to R Ltd. for the year ending 31st March 2007: Financial A/cs (Rs.) Cost A/cs (Rs.) Opening Stock: Raw material 6000 5000 Work in progress 7000 6500 Finished stock 5000 4500 Closing Stock: Raw material 4000 4300 Work in progress 3000 3700 Finished stock 5900 6200 Purchases 40000 40000 Direct wages 20000 20000 Factory overheads 20000 21000 Administration overheads 3000 2300 Selling overheads 4000 4500 Loss on sale of assets 1000 Interest and dividend received 1600 Sales 110000 Calculate the profit in Financial A/cs and Cost A/cs and prepare a statement reconciling the two profits. 20. The product of a manufacturing concern passes through two processes A and B and then to finished stock. It is ascertained that in each process normally 5% of the total weight is lost and 10% is scrap which from Processes A and B realizes Rs.80 per ton and Rs.200 per ton respectively. The following are the figures relating to both the processes: Materials in tons Cost of materials per ton in rupees Wages in rupees Manufacturing expenses in rupees Output in tons Process A 1,000 125 28,000 8,000 830 Process B 70 200 10,000 5,250 780 Prepare Process Cost Accounts, Normal Loss Account, Abnormal Loss Account and Abnormal Gain Account. 3 21. M.Ltd, has 3 production depts.. A, B and C and 2 service dept., X and Y. following particulars are available for the month of March 2005. Rent Rs. 15000, Taxes Rs. 5000, Electricity Rs.2400, Indirect wages Rs. 6000, Power Rs. 6000, Depreciation on machinery Rs. 40000, Canteen expenses Rs. 30000, Welfare expenses Rs. 10000. The following further details are available: Total A B C X Y Floor space(Sq mts.) 5000 1000 1250 1500 1000 250 Light points (nos) 240 40 60 80 40 20 Direct wages (Rs.) 40000 12000 8000 12000 6000 2000 HP of machines (nos.) 150 60 30 50 10 Cost of machines (Rs.) 200000 48000 65000 80000 4000 4000 Working hours 2335 1510 1525 The expenses of the service dept. are to be allocated to the production depts.. as follows: A B C X Y X 20% 30% 40% 10% Y 40% 20% 30% 10% Calculate the overhead absorption rate per hour for each of the three production depts. What should be the price to be quoted for a job which would require Rs. 1000 material, Rs.500 in wages and the job is handled by the three production depts. as follows: Dept A. 4 hrs., Dept.B 8 hrs and Dept C. 2 hrs. A profit of 20% on total cost is expected. @@@@@@ 4