6. ----------------- is a technique of analysis to study... volume variations on a profit

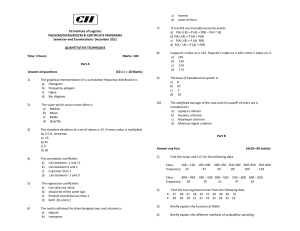

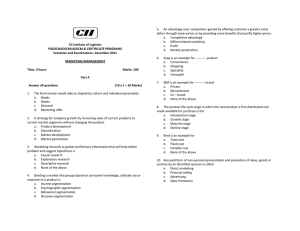

advertisement

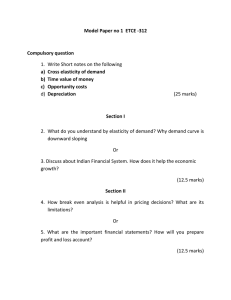

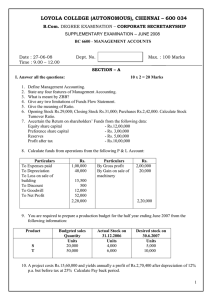

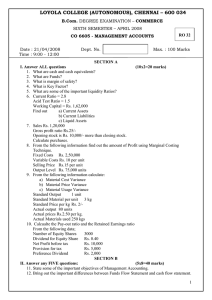

6. ----------------- is a technique of analysis to study the effects of costs and volume variations on a profit a) Net Profit analysis b) Gross Profit analysis c) CVP analysis d) Cost analysis 7. Contribution – Fixed Cost = a) Sales b) Profit c) Loss d) Variable Cost 8. Depreciation is included in the cost, in case of --------------a) PBP method b) ARR method c) PV Index method d) NPV method 9. Which method will not consider the Time value of money? a) Net Present Value method b) Discounted Payback method c) Profitability Index method d) Pay Back Period method CII Institute of Logistics PGDSCM/DSCM/ADSCM & CERTIFICATE PROGRAMS Semester-end Examinations- December 2011 FINANCE & ACCOUNTS FOR LOGISTICIANS Time: 3 hours Marks: 100 Part A Answer all questions 1. 2. 3. 4. 5. (10 x 1 = 10 Marks) Share Holders Fund is otherwise called as ----------------------a) Bank Balance b) Cash Balance c) Net worth d) Retained Earnings Income measurement based on comparison of expenses and revenues of a period is called a) Matching b) Revenue c) Expenses d) Accrual Increase in Bills Receivable results in a) Increase in cash b) Decrease in cash c) No change in cash d) Slight decrease in cash An analysis that explains the difference between the balance of cash shown on the bank statement and the balance of cash showed on the depositors records a) Bank statement b) Bank reconciliation c) Investment analysis d) Passbook Acid Test Ratio is otherwise called as a) Debt Equity ratio b) Net Profit ratio c) Current Ratio d) Quick ratio 10. Increase in Assets is --------------------a) Application of funds b) Sources of funds c) No Change in funds d) None of above Part B Answer any four (4x15= 60 marks) 1. Who are the users of Financial Statement? Discuss their usage briefly. 2. What is Working Capital? How it is related to the Liquidity Position of a Company? 3. What is Budgetary Control? Explain in detail. 4. What is Depreciation? How it helps the management while calculating the Tax? 5. From the following information, find out i. ii. iii. Current Assets, Quick Current Liabilities, Stock, iv. v. a) b) c) d) e) f) g) 6. Fixed Assets and Share Capital. Working Capital Reserves and Surplus Bank Overdraft Current ratio Liquid ratio Fixed Assets to Proprietors funds Long Term Liabilities 1,50,000 Rs.1,00,000 Rs.60,000 1.75 1.15 0.75 Nil 0.909 0.826 0.75 0.683 ************************************* P/V ratio Profit when sale are Rs.20,000 New Break Even point if selling price is reduced by 20% Fixed expenses Rs.4,000 Break-Even Sales Rs.10,000 Part C Case study (3*10=30 marks) Please read the problem and answer the questions given below: Mukesh Engineers propose to purchase a Machinery for Rs.1,00,000. There are two alternatives available in the market A & B. The expected rate of return is 10%. Year Machine – A Machine – B 1 15,000 10,000 2 20,000 25,000 3 25,000 25,000 4 30,000 30,000 5 50,000 50,000 Calculate 1. 2. 3. P.V.F at 10% 0.621 -------------------------------------------------------------------------------------------- From the following data calculate: i. ii. iii. ------------------------------------------------------------------------------------------------Year 1 2 3 4 5 Pay Back Period Net Present Value Profitability Index As a Manager choose the right machinery, which is suitable for your industry by using the above tools and write your decision.