LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

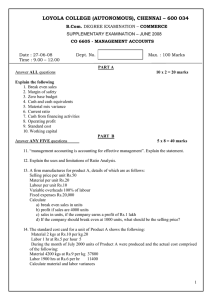

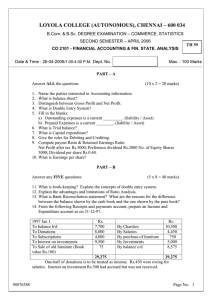

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – CORPORATE SECRETARYSHIP SUPPLEMENTARY EXAMINATION – JUNE 2008 BC 6600 - MANAGEMENT ACCOUNTS Date : 27-06-08 Time : 9.00 – 12.00 Dept. No. Max. : 100 Marks SECTION – A I. Answer all the questions: 10 x 2 = 20 Marks 1. 2. 3. 4. 5. 6. Define Management Accounting. State any four features of Management Accounting. What is meant by ZBB? Give any two limitations of Funds Flow Statement. Give the meaning of Ratio. Opening Stock Rs.29,000; Closing Stock Rs.31,000; Purchases Rs.2,42,000. Calculate Stock Turnover Ratio. 7. Ascertain the Return on shareholders’ Funds from the following data: Equity share capital - Rs.12,00,000 Preference share capital - Rs. 3,00,000 Reserves - Rs. 5,00,000 Profit after tax - Rs.10,00,000 8. Calculate funds from operations from the following P & L Account: Particulars To Expenses paid To Depreciation To Loss on sale of building To Discount To Goodwill To Net Profit Rs. 1,00,000 40,000 Particulars By Gross profit By Gain on sale of machinery 15,500 500 12,000 52,000 2,20,000 Rs. 2,00,000 20,000 2,20,000 9. You are required to prepare a production budget for the half year ending June 2007 from the following information: Product S T Budgeted sales Quantity Units 20,000 50,000 Actual Stock on 31.12.2006 Units 4,000 6,000 Desired stock on 30.6.2007 Units 5,000 10,000 10. A project costs Rs.15,60,000 and yields annually a profit of Rs.2,70,400 after depreciation of 12% p.a. but before tax at 25% Calculate Pay back period. 1 SECTION – B II. Answer any FIVE questions only: 5 x 8 = 40 Marks 11. Bring out the limitations of Ratio Analysis. 12. State the objectives of Budgetary Control. 13. Highlight the advantages of Management Accounting. 14. From the following details, find out (a) Current assets (b) Current liabilities (c) Liquid assets (d) Stock Current ratio – 2.5; Liquid ratio – 1.5; Working Capital – Rs.90,000 15. Prepare a schedule of changes in working capital from the following Balance Sheets: Liabilities Share capital 10%Debentures B/P Out. Exp. Creditors Total 2007 50,000 10,000 18,000 6,000 33,000 2008 50,000 20,000 6,000 9,000 40,000 1,17,000 1,25,000 Assets 2007 2008 Fixed Assets 18,000 28,000 Investments: Non-trading 10,000 10,000 Trading 8,000 9,000 Inventories 12,000 18,000 Debtors 40,000 48,000 Acc. Interest 4,000 6,000 Unexpired Insurance --3,000 Cash at Bank 17,000 2,000 Cash in Hand 8,000 1,000 1,17,000 1,25,000 Total 16. The summarized Balance Sheets of Nandan Ltd., as 31.12.2006 and 31.12.2007 are as follows:Liabilities 2006 2007 Assets 2006 2007 Share capital 4,50,000 4,50,000 Fixed Assets 4,00,000 3,20,000 Gl. Reserve 3,00,000 3,10,000 Investments 50,000 60,000 P&L A/C. 56,000 68,000 Inventories 2,40,000 2,10,000 Creditors 1,68,000 1.34.000 Debtors 2,10,000 4,55,000 Tax provision 75,000 10,000 Cash at Bank 1,49,000 1,97,000 Mortgage Loan ---2,70,000 Total 10,49,000 12,42,000 Total 10,49,000 12,42,000 ADDITIONAL DETAILS 1. Investments costing Rs.8,000 were sold for Rs. 8,500 2. Tax provision made during the year was Rs.9,000 3. During the year part of the fixed assets costing Rs.10,000 was sold for Rs.12,000 and the profit was included in the P&L A/c. You are required to prepare cash flow statement for 2007. 2 17. Draw up a flexible budget for production at 75% and 100% capacity on the basis of the following data for a 50% activity. Per Unit Rs. Materials 100 Labour 50 Variable expenses (direct) 10 Administrative expenses (50% fixed) 40,000 Selling & Distn. Expenses (60% fixed) 50,000 Present production (50% activity) 1,000 units 18. Each of the following projects requires a cash outlay of Rs.10,000. You are required to suggest the project to be accepted if the standard pay-back period is 5 years. Cash inflows Year Project X Rs. Project Y Rs. Project Z Rs. 1 2 3 4 5 2,500 2,500 2,500 2,500 2,500 4,000 3,000 2,000 1,000 --- 1,000 2,000 3,000 4,000 --- SECTION – C III. Answer any TWO questions only: 2 x 20 = 40 Marks 19.From the following Balance Sheets made out (i) statement of changes in working capital (ii) Funds flow statement. Balance Sheets of Beta Ltd. Liabilities Eq. Share Capital 8% Redeemable Pref. Share Capital Capital reserve General reserve P&L A/c Proposed Dividend S. Creditors Bills Payable Exp. Outstanding Pro. For Tax Total 2006 3,00,000 2007 4,00,000 1,50,000 10,000 30,000 30,000 42,000 25,000 20,000 30,000 40,000 6,77,000 1,00,000 20,000 50,000 48,000 50,000 47,000 16,000 36,000 50,000 8,17,000 Assets Goodwill Land & Buildings Plant Investments Debtors Stock Bills Receivable Cash in hand Cash at bank Preliminary Expenses 2006 1,00,000 2,00,000 80,000 20,000 1,40,000 77,000 20,000 15,000 10,000 15,000 2007 80,000 1,70,000 2,00,000 30,000 1,70,000 1,09,000 30,000 10,000 8,000 10,000 Total 6,77,000 8,17,000 1. A piece of land has been sold out in 2007 and the profit on sale has been credited to capital reserve. 3 2. A machine has been sold for Rs.10,000. The written down value of the machine was Rs.12,000. Depreciation of Rs.10,000 is charged on plant account in 2007 3. Rs.3,000 by way of dividend on investments is received . It includes Rs.1,000 from preacquisition profit which has been credited to investment account. 4. An interim dividend of Rs.20,000 has been paid in 2007 20.The following ratios and other data relate to the financial statement of James Co. Ltd. for the year ending 31st December 2007: Working capital ratio (current ratio) Acid test ratio Working capital Fixed assets to shareholders equity Inventory turnover (based on closing stock) Gross profit ratio Earnings per share Debt collection period No. of shares issued Earnings for the year on share capital 1.75 1.27 Rs.33,000 0.625 4 times 40% Re. 0.50 73 days 20,000 25% The company has no prepaid expenses, deferred charges, intangible assets or long-term liabilities. You are required to draft the company’s Balance Sheet and the Profit and Loss Account. 21. A newly started company wishes to prepare cash budget from January. Prepare a cash budget for the 6 months from the following estimated revenue and expenses. Months January February March April May June Total Sales Materials Wages Production Overhead Rs. Rs. Rs. Rs. 20,000 22,000 24,000 26,000 28,000 30,000 20,000 14,000 14,000 12,000 12,000 16,000 4,000 4,400 4,600 4,600 4,800 4,800 3,200 3,300 3,300 3,400 3,500 3,600 Selling & Distribution Overhead Rs. 800 900 800 900 900 1,000 Cash balance on 1st January was Rs.10,000. A new machine is to be installed at Rs.30,000 on credit, to be repaid by two equal installments in March and April. Sales commission at 5% on total sales is to be paid within the month following actual sales. Rs.10,000 being the amount of 2nd call may be received in March. Share premium amounting to Rs.2,000 is also obtained with 2nd call. Period of credit allowed by suppliers – 2 months Period of credit allowed to customers – 1 month Delay in payment of overheads – 1 month Delay in payment of wages – ½ month Assume cash sales to be 50% of the total sales -x-x-x-x-x-x-x4