Input Prices: Long Term Trends and Short Run Realities (

advertisement

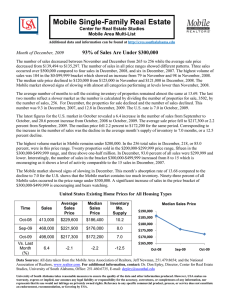

Input Prices: Long Term Trends and Short Term Realities Paul D. Mitchell Agricultural and Applied Economics University of Wisconsin-Madison UWEX and WPVGA Annual Growers Conference February 3, 2009 Stevens Point, WI Goal Today Overview of Input and Output Prices Where they are now (short-term) Where they are going (long-term) Fertilizer prices are still high Fertilizer Jan 2007a Jan 2008a Feb 2008b Aug 2008c Nov 2008a Feb 2009a Urea 410 505 500 815 --- 585 Anhydrous 515 775 715 1095 1160 985 32% N Solution 270 405 405 535 560 395 Ammonium Sulfate 210 240 325 510 500 300 DAP 335 580 625 1185 1150 795 Potash 255 420 515 820 820 795 aLandmark Coop bFrontier FS Coop cInformal Survey Average 1200 1000 Prcie ($/ton) 800 600 Urea Anhydrous 32% N/UAN 400 200 0 Jan-07 Apr-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 1200 1000 Price ($/ton) 800 600 400 200 0 Jan-07 Apr-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Ammonium Sulfate DAP Potash Higher than last year, but not as high as this summer Fertilizer Jan 2008 Summer Max Feb 2009 %D from 2008 %D from Max Urea 505 935 585 16% -37% Anhydrous 775 1235 985 27% -20% 32% N Solution 405 535 395 -2% -26% Ammonium Sulfate 240 539 300 25% -44% DAP 580 1244 795 37% -36% Potash 420 930 795 89% -15% 1385 988 10-34-0 -29% Price Indexes USDA NASS publishes monthly price indexes for many ag outputs and inputs http://usda.mannlib.cornell.edu/MannUsda /viewDocumentInfo.do?documentID=1002 National average price for the many items in a category, weighted by sales volumes Many categories not reported here Normalized so 1990-1992 Average = 100 700 Price Index (1992 = 100) 600 500 400 N P&K 300 200 100 Fertilizer Prices 0 Jan-06 Apr-06 Jul-06 Oct-06 Feb-07 May-07 Aug-07 Dec-07 Mar-08 Jun-08 Sep-08 Jan-09 700 650 Price Index (1992 = 100) 600 550 500 N P&K 450 400 350 300 250 200 Jan-08 Feb-08 Mar-08 Apr-08 Jun-08 Jul-08 Aug-08 Oct-08 Nov-08 Dec-08 Feb-09 Short-Term Fertilizer Prices Don’t expect prices to go much lower Companies believe they are priced about right for world demand and grain markets Supply going to be the issue Pre-purchased/contracted are in good shape Poor fall application window, lots of waiting Warehouses full, no slack in system Companies not holding excesses anymore Decide what you want and get it ordered asap If waiting to buy, could be serious trouble 200 180 Price Index (1992 = 100) 160 140 120 Herbicides Insecticides Fungicides 100 80 60 40 20 Chemical Prices 0 Jan-06 Apr-06 Jul-06 Oct-06 Feb-07 May-07 Aug-07 Dec-07 Mar-08 Jun-08 Sep-08 Jan-09 180 Price Index (1992 = 100) 170 160 150 Herbicides Insecticides Fungicides 140 130 120 110 100 Jan-08 Feb-08 Mar-08 Apr-08 Jun-08 Jul-08 Aug-08 Oct-08 Nov-08 Dec-08 Feb-09 Short-Term Chemical Prices Chemicals higher than last year (~15%) Fairly flat since summer Supply also going to be the issue Pre-purchased/contracted are in good shape Lots of waiting by farmers, companies not overstocking or over producing If acres shift to soybeans, shortages will occur If wait too long, get “shotgun” of chemicals, not your specific needs, and cost more Decide what you want and get it ordered asap 500 450 Price Index (1992 = 100) 400 350 300 Diesel LP 250 200 150 100 50 Fuel Prices 0 Jan-06 Apr-06 Jul-06 Oct-06 Feb-07 May-07 Aug-07 Dec-07 Mar-08 Jun-08 Sep-08 Jan-09 500 Price Index (1992 = 100) 450 400 350 Diesel LP 300 250 200 150 100 Jan-08 Feb-08 Mar-08 Apr-08 Jun-08 Jul-08 Aug-08 Oct-08 Nov-08 Dec-08 Feb-09 Short-Term Energy Prices Diesel: Prices about same as 2 years ago LP: Prices lower than have been for awhile Jan 2009: 30% lower than in Jan 2008 Jan 2009: 4% lower than in Jan 2007 Jan 2009: 49% lower than in Jan 2008 Jan 2009: 20% lower than in Jan 2007 Both may have lower to go Long-Term Input Prices Depends on interrelated factors World demand for meat/grain Energy prices Exchange rates All three depend significantly on how bad the global meltdown is/becomes and how long it lasts Global Input Demand China, India, Brazil: major drivers of increased demand that increased prices, but demand slowed now with meltdown Export driven economies hit hard Less money for meat/grain demand Farmers have less access to credit than in US Exchange rates further increasing input prices and prices of imported meat/grain Energy and Exchange Rates Energy Prices: Transportation and N Prices Driven by global demand, so how bad will the global meltdown be and when will it end? New natural gas plants around world on line, U.S. seen as place to soak up excess supply Expect some downward pressure on N prices Exchange rates: dollar strengthening, so increase costs of inputs and imports for other nations Long Term: What to Expect from Suppliers Shift in willingness to hold excess supply More formality in pre-pricing/contracting Will expect growers to be very specific on needs in advance and take what order Plan ahead & place your orders, don’t wait and expect them to have what you want Want to push some of the input price risk on to farmers Land Rents Landlords may be playing catch up With input and output price uncertainty, margin risk larger than before Flexible Cash Leases more popular FSA changed the rules, so don’t need to share govt. payments as in years past Check with FSA to be sure your lease qualifies as not needing to share payments Flexible Cash Leases Act. Yld Act. Price Formula: Base rent Base Yld Base Price Set max rent and/or min rent to share upside and/or downside risk Examples: Google “Flexible Cash Lease” Contact me, I’ve sent links/examples If must use fixed rent, set final rate in Mar/Apr or ask to renegotiate then Input and output prices more clear by then Credit: Another Input Banks are getting tighter on credit Anecdotes only, no data Farmers going to bank to ask for operating credit to buy inputs “Sell 80 acres and come back in” “Won't lend you the money if you pay that rental rate” Talk to your banker!!! What’s Going on with Output Prices? Grain prices have decreased and become more volatile Ethanol/biodiesel prices falling as crude oil and diesel prices decline Dollar stronger, so export demand declined Livestock prices falling, so less grain demand World demand uncertainty increased with the financial crisis/recession USDA Monthly Average Prices Received by Farmers 14.00 12.00 Price ($/bu) 10.00 8.00 Wheat Corn Soybeans 6.00 4.00 2.00 0.00 Jan-07 Apr-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 CBOT Contract Peak Price* Current Decrease Dec. Corn June 7.99 4.16 -48% Nov. Soybeans July 16.37 9.25 -43% March 12.75 6.33 -50% Dec. Wheat Source: *Darrel Good (U of IL) Grain Prices Soybean futures prices fell less and have been climbing relative to corn and wheat Will there be a significant acreage shift to soybeans in 2009? Acreage shift to soybeans will affect short term fertilizer and chemical input availability and prices to some extent What about Potatoes and Vegetables? 250 Prcie Index (1992 = 100) 200 150 Vegetables Potatoes 100 50 0 Jan-06 Apr-06 Jul-06 Oct-06 Feb-07 May-07 Aug-07 Dec-07 Mar-08 Jun-08 Sep-08 Jan-09 USDA-NASS national monthly price index for prices received by farmers Same Data Regression Fit 250 Price Index (1992=100) 200 150 Vegetables Potatoes Veg Fit 100 50 0 Jan-06 Apr-06 Jul-06 Oct-06 Feb-07 May-07 Aug-07 Dec-07 Mar-08 Jun-08 Sep-08 Jan-09 Average annual increase over the last 3 years Vegetables = 5.4%, Potatoes = 13.8%, > Inflation Pot Fit USDA-AMS weekly average prices received at terminal markets for Central Wisconsin fresh potatoes 30 Price ($/50 lbs) 25 20 Norkotah 70s 15 Norkotah 5x10lbs Round Red Bs 10 5 0 7/28/2007 11/5/2007 2/13/2008 5/23/2008 8/31/2008 12/9/2008 Fresh Potato Prices Round Red B’s have followed the “standard” post-harvest trend Russets: Have not seen the post-harvest price increase that had last year When will they bottom out? Retail demand for fresh potatoes falling with lower consumer income Summary: Short Term Input prices are about where they are going to be in short term Availability the big issue now, not price Some farmers are not going to get what they want when they want it Don’t wait, or you may be one of these Soybean acres will have important effect on chemical and fertilizer availability Rents: flex cash leases or renegotiate Stay in communication with your banker Summary: Long Term It all depends on how bad it gets around the world and when it ends Expect changes from suppliers: less willing to carry stock and more pre-planning on your part My opinion: We will have a few years of lower input prices, but eventually the global economy will start to roll again Input and output prices will increase again Use the next few years to prepare Increase energy and input use efficiency Questions? Paul D. Mitchell UW-Madison Ag & Applied Economics Office: (608) 265-6514 Cell: (608) 320-1162 Email: pdmitchell@wisc.edu Extension Web Page: www.aae.wisc.edu/mitchell/extension.htm