RMI 4472 Surplus Line Insurance Operations MASTER SYLLABUS

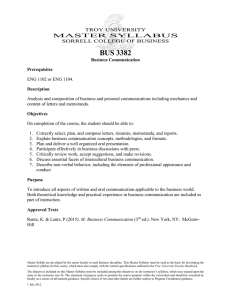

TROY UNIVERSITY

MASTER SYLLABUS

SORRELL COLLEGE OF BUSINESS

RMI 4472

Surplus Line Insurance Operations

Prerequisites

RMI 3335

Vision Statement

The Sorrell College of Business will be a recognized and respected leader for quality and flexibility in the delivery of business education that prepares graduates to succeed in the global business environment.

Mission Statement

The Sorrell College of Business supports the Troy University mission by preparing our diverse student body to become ethical professionals equipped to compete in the global business environment. To achieve this, our faculty, staff, and administration will:

1) Provide quality education in global business through our undergraduate and graduate programs, delivered around the world through face-to-face and online environments, to traditional, non-traditional, military, and international students;

2) Contribute to the development and application of knowledge focused on applied business, learning, and pedagogical research;

3) Provide service to the University, business and professional organizations, and our communities through individual involvement, business outreach, and our centers for research.

Description

Master Syllabi are developed by the senior faculty in each business discipline. This Master Syllabus must be used as the basis for developing the instructor syllabus for this course, which must also comply with the content specifications outlined in the Troy University Faculty Handbook .

The objectives included on this Master Syllabus must be included among the objectives on the instructor’s syllabus, which may expand upon the same as the instructor sees fit. The statement of purpose seeks to position the course properly within the curriculum and should be consulted by faculty as a source of advisement guidance. Specific choice of text and other details are further subject to Program Coordinator guidance.

1 August 2005

Master Syllabus: RMI 4472

A study of the excess and surplus lines insurance markets as well as the reinsurance sector of the insurance industry. The course covers the formation and classification of these companies, their distribution systems, their regulation, their accounting procedures, and a comparison of these companies to admitted insurers.

Objectives

On completion of the course, the student should be able to:

1.

Understand the calculation of the expense ratio, loss ratio, success ratio, retention ratio and the combined ratio as they relate to insurance.

2.

Discuss the development of surplus lines regulation and provide reasons for having regulation.

3.

Identify the functions performed by insurance producers, underwriters and intermediaries within the surplus lines market.

4.

Identify the goals of rate regulation.

5.

Differentiate between types of insurance, including treaty, facultative, pro rate, and excess of loss.

6.

Describe the elements of an insurer’s balance sheet and income statement, and calculate the above mentioned ratios.

Purpose

This course is designed to provide the student with an understanding of the differences between operations of insurers serving the surplus lines market and the operations of insurers serving the admitted market. In addition, the course prepares students to take the

ASLI 163 exam.

Approved Texts

Myhr, Ann E. and Hoopes, Doris. ASLI 163 Surplus Lines Insurance Operations (current or ISBN: 978-0-89463-306-5). The Institutes. http://www.aicpcu.org/comet/programs/asli/asli.htm#tab2

Supplements

As deemed appropriate.

Troy University Faculty Handbook (2010): Section 3.9.2.8 [extract] — essential elements of the syllabus (somewhat modified for space):

1.

Course title

2.

Course number + section

3.

Term

4.

Instructor

5.

Prerequisites

6.

Office hours

7.

Class days, times

8.

Classroom location

9.

Office location + e-mail address

10.

Office telephone

11.

Course description, objectives

12.

Text(s)

13.

Other materials

14.

Grading methods, criterion weights, make-up policy, mid-term grade reports

15.

Procedure, course requirements

16.

General supports

(computer works,

18.

19.

ADA statement

Electronic device writing center)

17.

Daily assignments, statement

20.

Additional holidays, add/drop

& open dates, dead day, final exam services, statements

21.

Absence policy

22.

Incomplete-work policy

23.

Cheating policy

24.

Specialization requirements

(certification, licensure, teacher competencies)

2