4 Mitigating risks to the UK financial system

advertisement

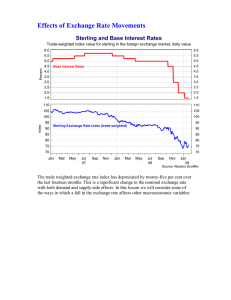

Section 4: Mitigating risks to the UK financial system Chart 4.1 Illustrative example of potential changes to Basel II minimum capital requirements over the economic cycle(a) (a) This chart contrasts the volatility of Basel II minimum capital requirements for a fixed portfolio, relative to Basel I. The chart is not intended to make any statement about the level of aggregate Basel II capital requirements relative to Basel I at any stage in the economic cycle. Chart 4.2 Major UK banks’ sterling stock liquidity requirement relative to total assets(a)(b) Source: FSA regulatory returns. (a) Data exclude Nationwide and Banco Santander. (b) The sterling stock liquidity requirement shown above is calculated as net sterling wholesale liabilities, and 5% of sterling retail deposits, maturing over the next five days. Under the sterling stock liquidity regime (SLR), banks can offset up to 50% of this five-day net wholesale outflow with discounted holdings of other banks’ sterling certificates of deposit. The rest of the sterling stock liquidity requirement must be met with holdings of Bank of England eligible assets. Table 4.A Market Wide Exercise 2006: issues for follow-up Workstream Questions addressed Cash What arrangements can be made to make cash distribution more resilient to a pandemic? Retail Can improvements be made to co-ordination between high street banks to enhance the availability of branch networks and ATMs to consumers during a pandemic Wholesale Do the various concerns raised by firms about reliance on home working undermine its potential role in a pandemic? Infrastructure What are the impacts of disruption or closure of exchanges or infrastructure providers? Regulatory forbearance In what areas, and when, would firms be seeking regulatory forbearance during a pandemic? Source: Market Wide Exercise 2006 Report, available at www.fsc.gov.uk/section.asp?catid=468. Table 4.B Summary assessment of the main wholesale UK payment systems against Core Principles(a) Source: Payment Systems Oversight Report 2006, Bank of England. (a) The Core Principles for Systemically Important Payment Systems, designed by the G10 Committee on Payment and Settlement Systems, provide a set of minimum standards for risk management in systemically important payment systems. See www.bis.org/publ/cpss43.pdf for a description of the Core Principles. (b) The LCH.Clearnet Ltd Protected Payments System (PPS) enables settlement of obligations between LCH.Clearnet Ltd and its members in twelve currencies. The assessment shown above relates to the main three currencies settled, namely sterling, euro and US dollar. One exception to the assessment shown above is that the Bank continues to assess the UK PPS’s arrangements for US dollar settlement partly to observe Core Principle VI, and for the US PPS’s arrangements for US dollar settlement broadly to observe Core Principle VI. Table 4.C Some recent testing involving the UK Tripartite Authorities(a) (a) Tests involving only one of the authorities are not listed in the table. (b) Testing of phone lines, back-up sites etc. (c) Financial crisis management. (d) www.ecb.int/press/pr/date/2003/html/pr030310_3.en.html. (e) Business continuity planning. (f) www.ecb.int/press/pr/date/2005/html/pr050518_1.en.html.