/~usji/Institute/Newsletter/sept98.doc

advertisement

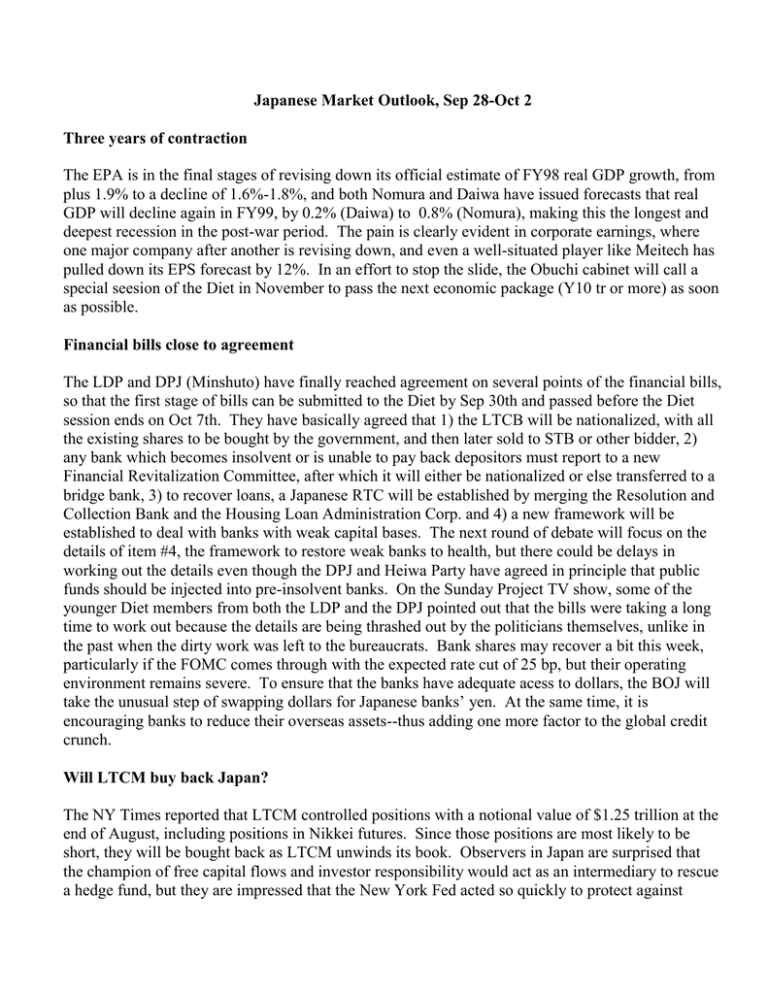

Japanese Market Outlook, Sep 28-Oct 2 Three years of contraction The EPA is in the final stages of revising down its official estimate of FY98 real GDP growth, from plus 1.9% to a decline of 1.6%-1.8%, and both Nomura and Daiwa have issued forecasts that real GDP will decline again in FY99, by 0.2% (Daiwa) to 0.8% (Nomura), making this the longest and deepest recession in the post-war period. The pain is clearly evident in corporate earnings, where one major company after another is revising down, and even a well-situated player like Meitech has pulled down its EPS forecast by 12%. In an effort to stop the slide, the Obuchi cabinet will call a special seesion of the Diet in November to pass the next economic package (Y10 tr or more) as soon as possible. Financial bills close to agreement The LDP and DPJ (Minshuto) have finally reached agreement on several points of the financial bills, so that the first stage of bills can be submitted to the Diet by Sep 30th and passed before the Diet session ends on Oct 7th. They have basically agreed that 1) the LTCB will be nationalized, with all the existing shares to be bought by the government, and then later sold to STB or other bidder, 2) any bank which becomes insolvent or is unable to pay back depositors must report to a new Financial Revitalization Committee, after which it will either be nationalized or else transferred to a bridge bank, 3) to recover loans, a Japanese RTC will be established by merging the Resolution and Collection Bank and the Housing Loan Administration Corp. and 4) a new framework will be established to deal with banks with weak capital bases. The next round of debate will focus on the details of item #4, the framework to restore weak banks to health, but there could be delays in working out the details even though the DPJ and Heiwa Party have agreed in principle that public funds should be injected into pre-insolvent banks. On the Sunday Project TV show, some of the younger Diet members from both the LDP and the DPJ pointed out that the bills were taking a long time to work out because the details are being thrashed out by the politicians themselves, unlike in the past when the dirty work was left to the bureaucrats. Bank shares may recover a bit this week, particularly if the FOMC comes through with the expected rate cut of 25 bp, but their operating environment remains severe. To ensure that the banks have adequate acess to dollars, the BOJ will take the unusual step of swapping dollars for Japanese banks’ yen. At the same time, it is encouraging banks to reduce their overseas assets--thus adding one more factor to the global credit crunch. Will LTCM buy back Japan? The NY Times reported that LTCM controlled positions with a notional value of $1.25 trillion at the end of August, including positions in Nikkei futures. Since those positions are most likely to be short, they will be bought back as LTCM unwinds its book. Observers in Japan are surprised that the champion of free capital flows and investor responsibility would act as an intermediary to rescue a hedge fund, but they are impressed that the New York Fed acted so quickly to protect against systemic risk. This may be just another sign that the pendulum has swung as far as it is going to in the direction of free-market capitalism, and that w e are moving into an era of somewhat more regulation. This may confuse the Japanese, who will feel justified that they have always been reluctant to follow the US in free-ranging capitalism, but it still leaves them the problem of finding a new paradigm for their economy. High-tech blues Sharp has become the latest high-tech company to revise down, and it would follow Hitachi into the red if it marked its Y43 bn unrealized loss on bank shares to market rather than keeping them on the books at cost. Like the IC makers, it will cut capex by Y27 bn from its initial plan, leading to a 34% decline to Y115 bn. NEC is being banned by government agencies for 1-3 months because of the role one of its directors played in arranging kick-backs and Amakudari posts with the Defense Agency. Another problem is brewing since it has just been discovered that some air-defense secrets were smuggled out of the country through NEC and nearly sold In the Philippines in 1990. Meanwhile, in a move that could keep DRAM prices subdued for an even longer time, the CMP Electronic Buyer News reports that Intel may take a small stake in Micron Technology, to ensure itself a stable supply of DRAMs and prevent shortages. Valuation loses mount Although Sharp is avoiding valuation losses on the view that its bank shares are likely to recover after this temporary downturn, many other companies are being compelled to post at least some of their losses. DKB has just sold Y100 bn worth of properties to unlisted real estate firms, and will use the Y50 bn in profit to offset valuation losses. Valuation losses are now expected to lead to a 1H RP loss of Y25 bn at Nissan and Y20 bn at Nippon Steel. For non-financial firms overall, Daiwa estimates that valuation losses at a Nikkei level of 13,915 (on Aug 28th) amount to Y2.9 tr, vs anticipated aggregate RP of Y9.8 tr. EP stocks shine Electric power stocks, which fell to a ten-year relative low in Jul 97, have since then outperformed TOPIX by almost 60% as their Y25 semi-annual dividends become more attractive with every week’s further decline in bond yields. On Tuesday, the government is expected to complete its first ever successful auction of 10-year bonds with a coupon of less than 1%. Although these stocks are regarded as safe havens, we note that Chubu EP has indicated it may agree to Sakura Bank’s request that it buy Y10 bn worth of new shares along with Toyota and Mitsui group companies. That would significantly increase Chubu’s exposure to Sakura: at present its 7.541 mn shs of Sakura are worth only Y1.59 bn. TEPCO has also been asked to buy new Sakura shares, but has not yet indicated its intent. Toyota’s recent investments The November issue of “Kinyu Business” examines the motivations for Toyota’s equity investments announced this year in Kokusai Securities, Daihatsu, Sakura Bank and Chiyoda F&M. Before WWII, the Toyoda family had owned Yutaka Securities and Hachiyo Securities, both forerunners of Kokusai. The 2% stake that Toyota bought last March came from LTCB. A tradition in the Toyoda family holds that the eldest son in each generation of descendents from Toyoda Sakichi (the founder of Toyota Auto Loom) should set up a new business; his son Kiichiro started making buses and trucks, his grandson Shoichiro started the mass production of cars and it may be that his greatgrandson Akio (41) may take the Toyota group into investment banking. Akio, now the Vice President of NUMMI, worked at A.G. Becker investment bank for five years after graudating from Keio in 1979. Thus the increased stakes that Toyota has taken in Kokusai and Chiyoda may suggest plans to expand the group’s financial businesses. Regarding the new investment in Sakura Bank, it was initially suggested that Toyota was returning the favor for Mitsui Bank’s Y188 mn loan that rescued Toyota back in 1949, but the obligation was fully repaid back in 1961 when Kiichiro had to step aside as president to make way for a man from Mitsui Bank (Mr Nakagawa). That bitter exerience is the main reason that the parent company has no bank debt today. Rather, the main reason that Toyota is planning to increase its stake in Sakura by as much as Y150 bn is to put the government in its favor for future consideration in two main areas: China and electric vehicles. Toyota has not had particularly smooth relations with China over the years, but Daihatsu has. But even a 51.2% stake in Daihatsu may not be enough to ensure smooth running for Toyota in China, so it may need the good offices of the Japanese government in the future. Furthermore, the commcercialization of electric vehicles (EV) by 2003 could cost over Y1 tr, but the burden could be eased by favorable tax treatment, and government help may be needed for exports and overseas production as well. Thus, by doing its part to recapitalize Sakura Bank so that the government may not have to, Toyota may be creating goodwill in the government which could be returned in the future. Investor concern about all these new equity investments may be one reason that Toyota’s share price is 20.4% below its July high, but it has still outperformed Honda (-26.8% from summer peak) and Nissan (-22.6%) in the current downturn. ___________________