The shorter ones!

advertisement

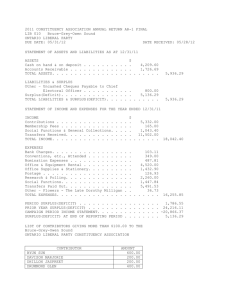

The shorter ones! 1. Look at the question paper and then match the answers with the appropriate question (bearing in mind they aren’t all perfect answers – in fact some are wrong) 2. Identify and correct any deliberate errors 3. Assess questions that were correct but not necessarily thorough enough against the mark scheme. Award a mark and then improve to get higher marks. (In particular focus upon other possible answers for 2b, then look at 3b, 4c, 5a & 5b for improvement) This refers to firms and consumers within a country’s economy trading/exchanging goods & services in return for money with firms and consumers from economies of foreign countries. Quotas to restrict the import of goods in to a country Export subsidies to discourage exporting This is the total output of a country’s entire economy, divided by the population count to arrive at an output per head figure. This provides a truer comparison of economic progress between countries of different sizes Inflation – If aggregate demand increases, and demand already utilises most of aggregate supply, then rapid economic growth will lead to a sharp rise in price levels in the short term. Increase in income inequality – because inflation that occurs suddenly and is not planned for will result in a redistribution of wealth that may not be viewed as good for the longer term health of the economy. Consumer expenditure went up, because prices got cheaper due to a fall in inflation and there was less poverty and less unemployment There will be a positive relationship between changes in consumer expenditure and investment. More consumer expenditure will boost the animal spirits of businesses and encourage them to invest. Prices fell by 0.8% in comparison to the previous year Argentina had a surplus of $1.3 billion, from a deficit of $1.7 USA had a budget surplus of $13.7 up from a surplus of $2.4 No, it isn’t possible The tax cut will have caused inflation by creating an increase in aggregate demand A budget deficit is when a government spends more than it collects in tax. A cut in tax rates can commonly be associated with a budget deficit as taxes like VAT and income tax are a significant source of government income. A fall in such income would appear to increase the likelihood of a budget deficit as the government will collect less in taxes.