“On Trade-Off and the Impossibility”

advertisement

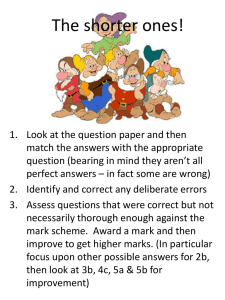

On Trade-off and the Impossibility The “Trilemma” of Exchange Rate Management and Autonomous Monetary Policy under CAC 1 The trilemma CAC ERM 2 Some Definitions Fiscal Deficit = Total Expenditure – Total Receipts = [Revenue Expenditure +Capital Expenditure] = [interest payments +subsidies + defence expenditure + Capital Expenditure] – Total Receipts Primary Deficit = Fiscal Deficit – interest payments = [subsidies + defence expenditure + Capital Expenditure] – Total Receipts 3 CAC Capital Imports ER Appreciation Reserve Accumulation Rise in Mo Rise in M3 Rise in prices OMO Interest payment s Rise in FD Cut in subsidies Cut in PD Cut in public invest 4 ment • Forex Inflows and Monetary Sterilization in India (Rs. Crore) Source: GOI, Economic Survey 2007-08 5 . Priority sector lending as percentage of NBCs Financial public Year sector banks FY2001 43.7 private banks foreign banks 36.7 33.5 FY2002 43.1 40.9 34.0 FY2003 42.5 44.4 33.9 FY2004 44.0 47.4 34.8 Source: Basic statistical returns, RBI, various issues. 6 Loans to SSI sector in priority sector (in %) Source: Basic statistical returns, RBI, various issues. 7 Composition of gross banking credit of SCBs (FY2001-FY2004) FY2001 FY2002 FY2003 FY2004 Gross Bank credit Food procurement Non-food Priority Industry-Large Wholesale trade Others of which Housing Consumer durables NBFCs Individuals against shares Real estate Personal 8.5 91.5 32.9 34.7 3.8 20.1 3.4 1.2 1.7 0.4 0.4 3.9 10.1 89.9 32.7 32.1 3.8 21.3 4.2 1.3 1.8 0.3 0.5 4.4 7.4 92.6 31.6 35.1 3.4 22.5 5.5 1.1 2.1 0.3 0.9 4.2 4.7 95.3 34.5 32.3 3.3 25.2 6.8 1.1 2.2 0.3 0.7 4.6 Advances against fixed deposits Tourism 4.3 0.2 4.0 0.3 3.4 0.4 3.4 0.4 Source: RBI Report on Trends & Progress of Banking in India, various issues. Note: Only the important items have been listed under others. Source: RBI Report on Trends & Progress of Banking in India, various issues. 8 Retail portfolio of banks 2004-05 Amount outstanding (Rs bn) Housing loan 894.49 Consumer durables 62.56 Creditcard receivables 61.67 Other-personal loans 871.7 Total 1890.41 % to total 22.0 Total Loans and advances 8590.92 As % to retail 47.3 3.3 Impaired credit % 1.9 6.6 Net NPA as a % of net advances 1.4 4.0 3.3 6.3 2.4 46.1 100.0 2.6 2.5 1.6 1.6 Source: RBI Report on trends and progress, of Banks 2004 9 Profitability of loans (%) % of avera ge assets Yield Intere st cost* Lendi ng sprea d Mort Car Two- Perso Topgages loans wheel nal tier er Corpo rate 8.0 9.5 18.0 15.0 6.0 3.5 3.5 3.5 3.5 3.5 Credit SME card 24.0 3.5 9.5 3.5 4.5 20.5 6.0 6.0 14.5 11.5 2.5 Source: As discussed with banks. * The interest rate on cash balances with RBI is 3.5%. 10 On Profit ranges: Number of industrial units as at end of March 2005 Profit range (percentages) Above 1000 Between 100990 Between 50-99 Industry Services 1 6 4 38 7 257 12 311 Between 0-9 1625 549 Between (-).01 to (-) 20 Less than (-) 20 499 176 363 324 Total no of firms 2513 1659 Between 10-49 Source: CMIE, Prowess Online data 11 Corporate Investments (Rs Crores) 2002-3 Total 2003-4 2004-5 50200 73510 83841 12463 22053 25836 (24.82) (30.0) (30.81) and 12928 15344 19560 debenture (25.75) (20.87) (23.32) 21942 30490 29053 (43.02) (41.47) (34.65) investments Securities of financial institutions Shares s* of subsidiaries Industrial securities *Debentures include privately placed debentures with financial institutions. Figures in brackets indicate percentages. Source: Reserve Bank of India Bulletin September 2006 12 Selected Financial Ratios of Public Limited Companies (percentages) 2004-05 . Sales range Quick assets* to Gross fixed asset Net current liabilities formation fixed assets to to total net assets total use of funds Rs 50-100 crores 51.9 43.2 40.0 Rs 100-500 crores 53.4 44.1 42.2 Rs500-1000 58.5 41.3 42.2 50.4 38.0 40.8 crores > Rs 1000 crores *Quick assets comprise of (a) sundry debtors (b) book value of quoted investments and (c) cash and bank balances Source: Reserve Bank of India Bulletin September 2006 13 7 Fiscal deficit,Primary Deficit and Interest Payments: As Percenrage of GDP 6 5 4 3 Fiscal Deficit 2 Primamry Deficit interest 1 0 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 -1 14 Components of Expenditure under Primary Deficit as Percentages of GDP 4.5 4 3.5 3 2.5 subsidies 2 defence 1.5 capital expenditure 1 0.5 0 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 15